In the dispatch dated June 12, Prime Minister Pham Minh Chinh assessed that there are still cases where businesses, stores, and retail households have not fully complied with regulations on the use of electronic invoices generated from cash registers. In addition, the habit of paying without cash and getting invoices when purchasing goods among consumers is still not popular.

Therefore, the Prime Minister requested the Chairmen of the Provincial People's Committees to coordinate with the Ministry of Finance to manage taxes for business households and individuals, and deploy electronic invoices generated from cash registers. Local agencies shall coordinate with the tax sector to review, identify, and classify business establishments eligible to apply electronic invoices generated from cash registers.

They must have timely support solutions for information technology infrastructure, research solutions to support initial installation costs in cases where electronic invoices are deployed from cash registers but do not meet the requirements for information technology infrastructure.

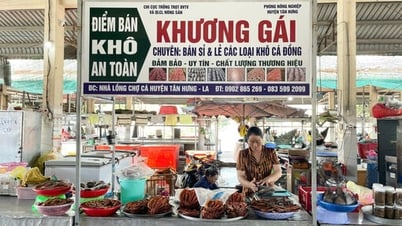

From June 1, about 37,000 households with annual revenue of over 1 billion VND in some industries (food and beverage, hotels, retail, passenger transport, etc.) must use electronic invoices via cash registers connected to tax authorities. However, a number of business owners are still used to using pocket calculators and handwriting, many of whom are old and not familiar with technology. In addition, the initial investment cost (computers, software) is up to tens of millions of VND, which is a barrier for small businesses.

Currently, 110 enterprises providing electronic invoice solutions meet the criteria of tax authorities, including units such as FPT, Viettel, CMC, iPOS, KiotViet...

Also in the telegram, the head of the Government requested the tax authority to immediately work with businesses and providers of electronic invoice software solutions generated from cash registers to find solutions to provide free software and reduce invoice costs. This is to provide substantial and effective support for small, micro and household businesses, contributing to the effective implementation of regulations on electronic invoices.

Along with that, tax authorities must increase connectivity, information and data exchange for tax management, especially with businesses, households and individuals doing direct retail business to users, e-commerce, petrol and oil, and digital platform business. This helps ensure correct, sufficient and timely collection to the state budget.

The tax sector must monitor the use of electronic invoices, especially in the creation of electronic invoices generated from cash registers, and resolutely handle violations of tax and invoice laws. The Prime Minister noted that the tax sector should focus on tax management based on taxpayers' cash flow through information exchange, ensuring data protection.

In addition, they also need to increase propaganda and organize the use of electronic invoices, helping people, businesses, households, and individual traders clearly understand the benefits, responsibilities, and effectiveness of using this type of invoice.

According to the General Statistics Office (Ministry of Finance), by the end of 2024, the country will have 3.6 million tax-managed business households, contributing VND25,953 billion to the budget. Of these, nearly 2 million households pay lump-sum tax, paying an average of VND700,000 per month.

According to the roadmap, Vietnam will eliminate lump-sum tax for business households by 2026 at the latest, as required in Resolution 68 of the Politburo.

VN (according to VnExpress)Source: https://baohaiduong.vn/nghien-cuu-ho-tro-ho-kinh-doanh-dung-hoa-don-tu-may-tinh-tien-413989.html

Comment (0)