Overview of the workshop related to special consumption tax on products harmful to health on the morning of September 20 - Photo: N.NHIÊN

On September 20, the Ministry of Health held a workshop on the necessity of increasing special consumption tax on goods harmful to health to achieve the goal of reducing the rate of use of alcohol, beer, cigarettes, and sugary drinks for the benefit of public health in Hanoi.

Impact of taxes on unhealthy products

In the draft revised Law on Special Consumption Tax, which is being consulted, a number of goods that are harmful to health are added, specifically shredded tobacco, pipe tobacco and other forms of drugs; soft drinks according to Vietnamese Standards (TCVN), with sugar content over 5g/100ml...

Sharing at the workshop, Ms. Dinh Thi Thu Thuy, Deputy Director of the Legal Department (Ministry of Health ), affirmed that applying special consumption tax to products harmful to health is important and necessary to protect people's health. The draft Law on Special Consumption Tax (amended) this time has included these items. This is a good sign, Ms. Thuy commented.

Mr. Nguyen Tuan Lam shared at the workshop - Photo: N.NHIÊN

Sharing at the workshop, Mr. Nguyen Tuan Lam, expert in preventing non-communicable disease risk factors, World Health Organization (WHO) Office in Vietnam, affirmed that three products, tobacco, alcohol and sugary drinks, are causing direct harm to health as well as future consequences.

Smoking is a risk factor for 11 types of cancer and a host of other chronic diseases. In particular, tobacco production and consumption have recently tended to increase rapidly.

"International experience shows that tobacco tax is the main measure to reduce demand. However, this solution is being implemented very poorly in Vietnam. In Southeast Asia, Vietnam is in the top 3 countries with the cheapest tobacco prices, just behind Laos and Cambodia. Thailand is the country with the highest tobacco prices," said Mr. Lam.

Mr. Lam cited the contribution rate of tobacco harm prevention policies in reducing the number of smokers in Thailand, of which 61% is due to taxes, 22% is due to banning advertising and promotions, and the rest is due to health warning measures and other communication.

Meanwhile, in Vietnam, the average price of a pack of cigarettes has remained virtually unchanged for 10 years. The real price of beer and wine has decreased significantly in the past 10 years. Mr. Lam believes that the current tax increase does not affect cigarette smuggling or reduce beer and wine consumption in Vietnam.

Tax increases are needed to change behavior.

Ms. Hoang Thi Thu Huong, Department of Legal Affairs (Ministry of Health), said that the mixed tax calculation method and total tax rate must be large enough to impact changes in consumption levels.

Taxes need to be increased gradually so that cigarette prices keep up with income growth and gradually move towards the optimal tax rate of 70-75% of retail prices as recommended by WHO.

For sugary drinks, the draft proposes a 10% tax rate on the selling price of manufacturing and importing enterprises. According to calculations, this tax rate will only increase the retail price by 5%. Such an increase in retail price is insignificant and not enough to change consumer behavior.

For example, a soft drink product currently priced at VND10,000/bottle after applying special consumption tax has a selling price of VND10,500/bottle.

Mr. Nguyen Tuan Lam also said that WHO recommends that taxes on products harmful to health should be increased regularly, so that the increase is higher than the increase in inflation and income. According to international experience, tax rates have a significant impact in reducing the consumption of products harmful to health.

Regarding sugary drinks, Vietnam should consider applying a sugary drinks tax roadmap to reach a tax rate of 20% of the retail price (ie increasing the manufacturer's selling price by 40%) as recommended by the WHO globally, to reduce health risks for future generations. In the long term, taxing by sugar content or threshold should be considered to encourage sugar-reduced products.

It is expected that the draft will be submitted to the National Assembly for comments in October and approved in May 2025.

Source: https://tuoitre.vn/nguoi-viet-dung-nhieu-san-pham-co-hai-tang-thue-co-the-giam-tieu-thu-20240920113621006.htm

![[Photo] Prime Minister Pham Minh Chinh chairs meeting on railway projects](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/23/1761206277171_dsc-9703-jpg.webp)

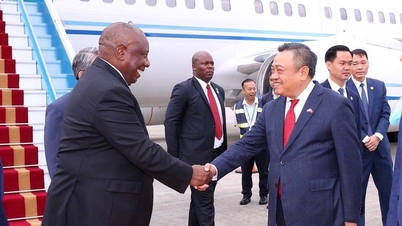

![[Photo] Prime Minister Pham Minh Chinh meets with South African President Matamela Cyril Ramaphosa](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/23/1761226081024_dsc-9845-jpg.webp)

![[Photo] President Luong Cuong holds talks with South African President Matamela Cyril Ramaphosa](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/23/1761221878741_ndo_br_1-8416-jpg.webp)

Comment (0)