Deputy Minister of Finance Nguyen Duc Chi speaks at a press conference - Photo: VGP/HT

Budget collection achieved positive results

On the afternoon of October 3, at the regular press conference for the third quarter of 2025, Deputy Minister of Finance Nguyen Duc Chi informed: The management of state finance and budget has achieved many positive results in recent times. Although the Ministry of Finance must simultaneously carry out the task of merging and streamlining the apparatus according to the direction of the Central Government and ensuring effective budget management, the revenue and expenditure results still have many bright spots.

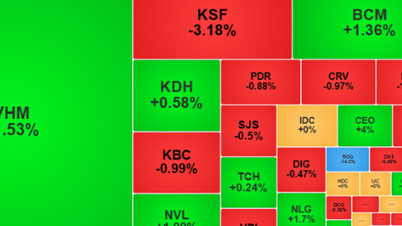

According to the report, the total state budget revenue in September is estimated at 156.7 trillion VND. In the first 9 months, the state budget revenue reached 1,901.6 trillion VND, equal to 96.7% of the estimate, up 28.9% over the same period in 2024. Of which, the central budget revenue reached about 88.5% of the estimate; the local budget revenue reached 105.2% of the estimate.

In terms of expenditure, the State budget balance expenditure in September is estimated at 192.1 trillion VND. In the first 9 months, budget expenditure reached about 1,625.4 trillion VND, equal to 63.1% of the estimate, up 30.6% over the same period. Of which, development investment expenditure reached about 451 trillion VND (57% of the estimate), debt interest payment and regular expenditure both reached about 68.4% of the estimate.

"In the coming time, the Ministry of Finance will focus on resolving bottlenecks and mobilizing all resources, especially in fiscal policy, to contribute to achieving the growth target of over 8%," Deputy Minister Nguyen Duc Chi emphasized.

Institutionalize resolutions, remove difficulties

Immediately after the four important Resolutions (57-NQ/TW, 59-NQ/TW, 66-NQ/TW, 68-NQ/TW) were issued, the Ministry of Finance promptly reviewed, developed and amended a series of legal documents to promptly institutionalize them.

Specifically, the Ministry has submitted and participated in drafting the Law Project to amend and supplement 8 laws in the financial sector, including: Law on Bidding; Law on Investment under the Public-Private Partnership method; Law on Customs; Law on Value Added Tax; Law on Export Tax and Import Tax; Law on Investment; Law on Public Investment; and Law on Management and Use of Public Assets. At the same time, the Ministry is also studying to amend key tax laws such as the Law on Corporate Income Tax, Personal Income Tax and Value Added Tax, in order to add incentives for innovation, promote digital transformation and support the private economic sector.

Regarding the implementation of two-level local government, the Ministry of Finance has issued decisions assigning specific tasks, established hotlines, established a Standing Team and organized two support rounds in 34 localities. These efforts have contributed to removing obstacles and facilitating the process of arranging the grassroots government apparatus.

"The volume of legal documents to be completed in 2025 is huge. The Ministry of Finance hopes for the support of the press in propaganda and reflection so that policies reach people and businesses as soon as possible and most effectively," Deputy Minister Nguyen Duc Chi emphasized.

Mr. Mai Son - Deputy Director of the Tax Department - reports the results of the Tax sector - Photo: VGP/HT

At the press conference, Mr. Mai Son - Deputy Director of the Tax Department said: 2025 is a special year when the Central Executive Committee and the Government have many drastic directions on socio-economic development. The budget collection results reaching over 96% of the estimate is a clear demonstration of the companionship of businesses and people.

The Tax sector has implemented administrative procedure reforms, promoted digital transformation and focused on cultivating new revenue sources. Many previously difficult revenue sources such as revenue from business households and cross-border e-commerce have seen positive changes.

Regarding land, an important revenue source that has not met its budget for many years, there has been an improvement in 2025 thanks to strong direction from all levels. Land revenue not only offsets the budget but also promotes the progress of infrastructure projects, thereby supporting production and business.

Notably, the Tax sector is implementing its own action program to modernize tax management in the private economic sector, including business households. The goal is that by January 1, 2026, all business households after conversion will fully and effectively implement legal policies.

In the past 9 months, in addition to the 44,000 business households that had previously implemented the program, more than 98,000 households have converted and over 2,000 households have turned into enterprises. The households have basically agreed, thanks to the timely support and propaganda from the tax authorities.

In parallel, the Tax sector focuses on building general management software, enhancing data connectivity, and coordinating with tax agents and accountants to support the implementation of transparent and fair policies. Tax Department leaders also regularly participate in seminars and workshops to directly answer questions and resolve problems for business households.

The Government is very concerned about the financial and budgetary tasks. Most recently, Prime Minister Pham Minh Chinh signed Official Dispatch No. 184/CD-TTg dated October 2, 2025, sent to ministries, branches and localities, requesting to strengthen the management and operation of the State budget in the last months of the year. In particular, the Government leaders requested ministries, branches and localities to strengthen the management and operation of the State budget in the last months of the year. Set the target of State budget revenue in 2025 to increase by at least 25% compared to the estimate. Request to save expenditures and improve the efficiency of budget use.

Solutions include: Reforming administrative procedures; improving the investment environment; combating tax losses (especially in digital business, transfer pricing, tax evasion); expanding electronic invoices; tightening regular expenditures; accelerating disbursement of public investment capital; handling surplus public assets. The Ministry of Finance is assigned to preside over the coordination of fiscal policy management, revenue and expenditure management, control of deficits, public debt, etc.

Mr. Minh

Source: https://baochinhphu.vn/thu-ngan-sach-9-thang-co-ket-qua-tich-cuc-con-du-dia-but-pha-quy-cuoi-nam-102251003200125328.htm

Comment (0)