(Dan Tri) - The conditions for withdrawing social insurance (SI) one time in 2025 remain unchanged compared to 2024, although the Social Insurance Law 2024 takes effect from July 1, 2025.

Before July 1st

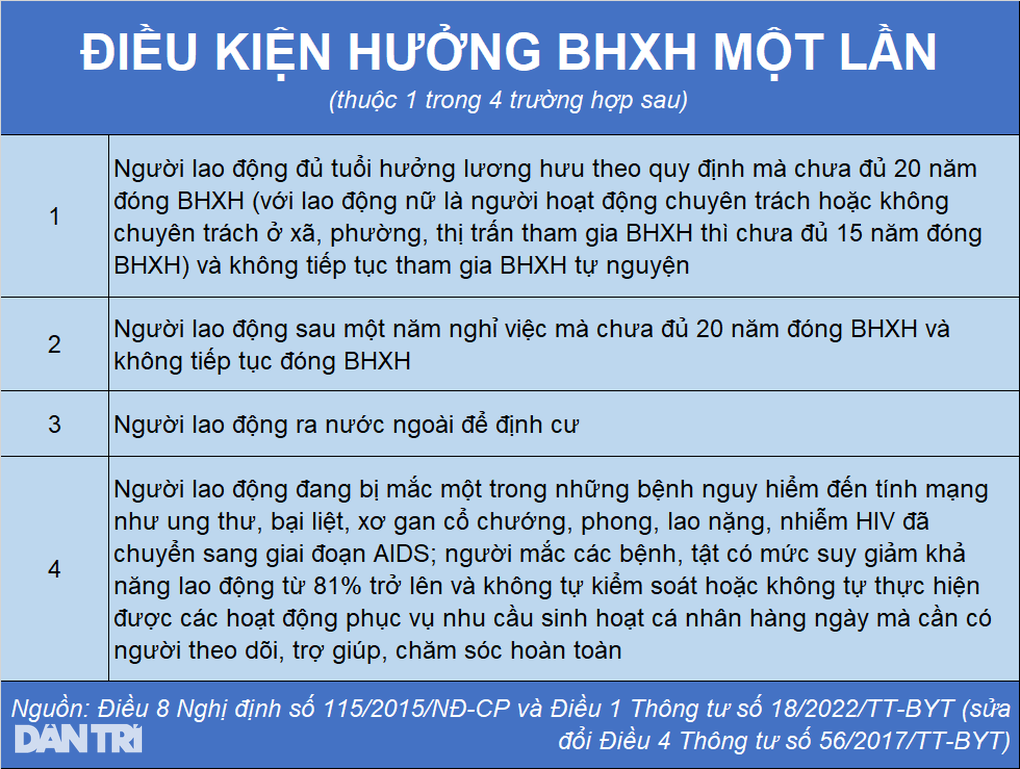

Before July 1, the social insurance regime was applied according to the provisions of the Social Insurance Law 2014. Accordingly, the conditions for employees to withdraw social insurance at one time were stipulated in Article 60 of the Social Insurance Law 2014, then supplemented in Resolution 93/2015/QH13.

On November 11, 2015, the Government issued Decree No. 115/2015/ND-CP detailing a number of articles of the Law on Social Insurance on compulsory social insurance, including provisions that more clearly define cases in which one-time withdrawal of social insurance is allowed.

Specifically, Clause 1, Article 8 of Decree No. 115/2015/ND-CP stipulates 4 cases of one-time withdrawal of social insurance for employees who are Vietnamese citizens participating in compulsory social insurance and those working abroad under contract.

Firstly, employees who are old enough to receive pension according to regulations but have not paid social insurance for 20 years; female employees who are full-time or part-time workers in communes, wards or towns when they retire but have not paid social insurance for 15 years and do not continue to participate in voluntary social insurance.

Second, employees who quit their jobs after one year without having paid social insurance for 20 years and do not continue to pay social insurance.

Third, workers go abroad to settle down.

Fourth, the worker is suffering from one of the life-threatening diseases such as cancer, paralysis, cirrhosis, leprosy, severe tuberculosis, HIV infection that has progressed to AIDS and other diseases as prescribed by the Ministry of Health .

Conditions for receiving one-time social insurance benefits before July 1 (Graphic: Tung Nguyen).

From July 1st onwards

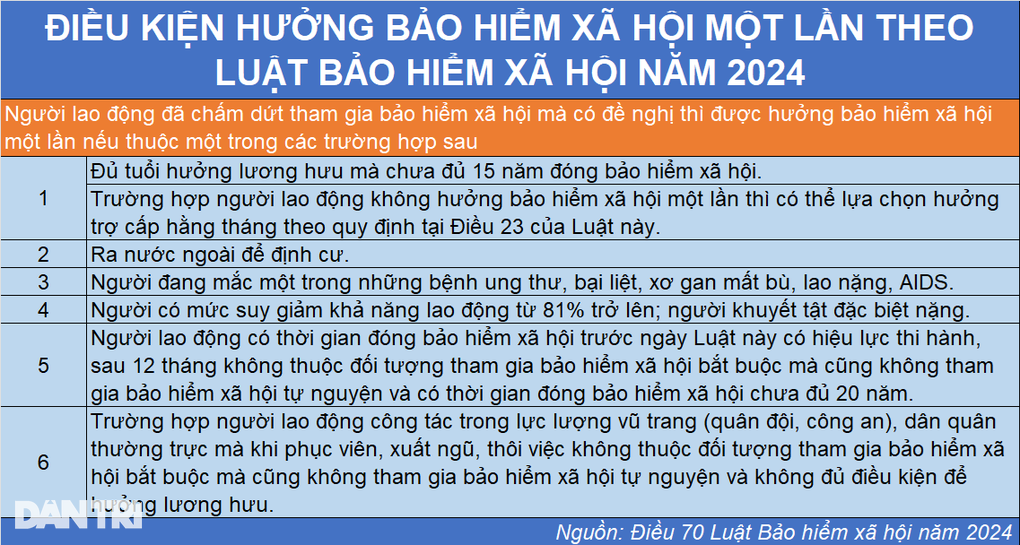

From July 1, when the Social Insurance Law 2024 takes effect, those who participated in social insurance before July 1 will still be entitled to receive one-time social insurance benefits upon request in 6 prescribed cases, no different from the conditions for receiving one-time social insurance benefits before July 1.

Firstly, the employee is old enough to receive pension but has not paid social insurance for 15 years. In case the employee does not receive a lump sum social insurance payment, he/she can choose to receive monthly benefits.

Second, workers go abroad to settle down.

Third, the worker is suffering from one of the following diseases: cancer, paralysis, decompensated cirrhosis, severe tuberculosis, AIDS.

Fourth, workers with a working capacity reduction of 81% or more; people with especially severe disabilities.

Fifth, employees who have paid social insurance before the effective date of this Law (July 1, 2025), after 12 months are not subject to compulsory social insurance but also do not participate in voluntary social insurance and have paid social insurance for less than 20 years.

Sixth, employees working in the army, police, or militia who, upon demobilization, discharge, or termination of employment, are not subject to compulsory social insurance, nor do they participate in voluntary social insurance, and are not eligible for pension.

Conditions for receiving one-time social insurance benefits from July 1 onwards (Graphic: Tung Nguyen).

As for employees who start participating in social insurance from July 1 onwards, they are still entitled to receive one-time social insurance payment upon request in 5 cases, except for the 5th case.

However, in 2025, no employee will fall into the 5th case, so the conditions for withdrawing social insurance at one time in 2025 will remain almost unchanged compared to 2024.

Source: https://dantri.com.vn/an-sinh/ai-duoc-rut-bao-hiem-xa-hoi-mot-lan-trong-nam-2025-20250124141246908.htm

![[Photo] Prime Minister Pham Minh Chinh launched a peak emulation campaign to achieve achievements in celebration of the 14th National Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/5/8869ec5cdbc740f58fbf2ae73f065076)

![[Photo] Prime Minister Pham Minh Chinh chairs the Government's online conference with localities](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/5/264793cfb4404c63a701d235ff43e1bd)

![[Video] Jelly Mooncakes: New Colors for the Mid-Autumn Festival](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/10/5/abb1d390ee7f452b9110fca494ba0d77)

![[Video] Traditional moon cakes attract customers](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/10/5/0a98992e8c92419fa9ea507de23e365d)

![[VIDEO] Summary of Petrovietnam's 50th Anniversary Ceremony](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/10/4/abe133bdb8114793a16d4fe3e5bd0f12)

![[VIDEO] GENERAL SECRETARY TO LAM AWARDS PETROVIETNAM 8 GOLDEN WORDS: "PIONEER - EXCELLENT - SUSTAINABLE - GLOBAL"](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/7/23/c2fdb48863e846cfa9fb8e6ea9cf44e7)

Comment (0)