Domestic gold price today 5/29/2025

At the time of survey at 4:30 a.m. on May 29, 2025, domestic gold prices continued to decrease sharply compared to yesterday. Specifically:

DOJI Group listed the price of SJC gold bars at 116.2-118.7 million VND/tael (buy - sell), an increase of 400 thousand VND/tael in both buying and selling directions compared to yesterday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 116.2-118.7 million VND/tael (buy - sell), an increase of 700 thousand VND/tael in both buying and selling directions compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 117.5-118.7 million VND/tael for buying and selling. Compared to yesterday, the gold price increased by 1.5 million VND/tael for buying and 700 thousand VND/tael for selling compared to yesterday.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by businesses at 116.2-118.7 million VND/tael (buy - sell), the price increased by 700 thousand VND/tael in both buying and selling directions compared to yesterday.

SJC gold price at Phu Quy is traded by businesses at 115.7-118.7 million VND/tael (buy - sell), gold price increased 400 thousand VND/tael in both buying and selling directions compared to yesterday.

As of 4:30 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 111.5-114 million VND/tael (buy - sell); the price increased by 200,000 VND/tael in the buying direction - unchanged in the selling direction compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 113.8-116.8 million VND/tael (buy - sell); an increase of 300 thousand VND/tael in both buying and selling directions compared to yesterday.

The latest gold price list today, May 29, 2025 is as follows:

| Gold price today | May 29, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 116.2 | 118.7 | +700 | +700 |

| DOJI Group | 116.2 | 118.7 | +400 | +400 |

| Red Eyelashes | 117.5 | 118.7 | +1500 | +700 |

| PNJ | 116.2 | 118.7 | +400 | +400 |

| Vietinbank Gold | 118.7 | +700 | ||

| Bao Tin Minh Chau | 116.2 | 118.7 | +700 | +700 |

| Phu Quy | 115.7 | 118.7 | +400 | +400 |

| 1. DOJI - Updated: May 29, 2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Domestic gold price | Buy | Sell |

| AVPL/SJC HN | 116,200 ▲400K | 118,700 ▲400K |

| AVPL/SJC HCM | 116,200 ▲400K | 118,700 ▲400K |

| AVPL/SJC DN | 116,200 ▲400K | 118,700 ▲400K |

| Raw material 9999 - HN | 107,500 ▲200K | 111,500 |

| Raw material 999 - HN | 107,400 ▲200K | 111,400 |

| 2. PNJ - Updated: May 29, 2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 111,300 | 114,400 |

| HCMC - SJC | 116,200 ▲400K | 118,700 ▲400K |

| Hanoi - PNJ | 111,300 | 114,400 |

| Hanoi - SJC | 116,200 ▲400K | 118,700 ▲400K |

| Da Nang - PNJ | 111,300 | 114,400 |

| Da Nang - SJC | 116,200 ▲400K | 118,700 ▲400K |

| Western Region - PNJ | 111,300 | 114,400 |

| Western Region - SJC | 116,200 ▲400K | 118,700 ▲400K |

| Jewelry gold price - PNJ | 111,300 | 114,400 |

| Jewelry gold price - SJC | 116,200 ▲400K | 118,700 ▲400K |

| Jewelry gold price - Southeast | PNJ | 111,300 |

| Jewelry gold price - SJC | 116,200 ▲400K | 118,700 ▲400K |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 111,300 |

| Jewelry gold price - Kim Bao Gold 999.9 | 111,300 | 114,400 |

| Jewelry gold price - Phuc Loc Tai Gold 999.9 | 111,300 | 114,400 |

| Jewelry gold price - Jewelry gold 999.9 | 111,300 | 113,800 |

| Jewelry gold price - Jewelry gold 999 | 111,190 | 113,690 |

| Jewelry gold price - Jewelry gold 9920 | 110,490 | 112,990 |

| Jewelry gold price - Jewelry gold 99 | 110,260 | 112,760 |

| Jewelry gold price - 750 gold (18K) | 78,000 | 85,500 |

| Jewelry gold price - 585 gold (14K) | 59,220 | 66,720 |

| Jewelry gold price - 416 gold (10K) | 39,990 | 47,490 |

| Jewelry gold price - 916 gold (22K) | 101,840 | 104,340 |

| Jewelry gold price - 610 gold (14.6K) | 62,070 | 69,570 |

| Jewelry gold price - 650 gold (15.6K) | 66,620 | 74,120 |

| Jewelry gold price - 680 gold (16.3K) | 70,030 | 77,530 |

| Jewelry gold price - 375 gold (9K) | 35,330 | 42,830 |

| Jewelry gold price - 333 gold (8K) | 30,200 | 37,700 |

| 3. SJC - Updated: 5/29/2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 116,200 ▲700K | 118,700 ▲700K |

| SJC gold 5 chi | 116,200 ▲700K | 118,720 ▲700K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 116,200 ▲700K | 118,730 ▲700K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 111,300 ▲300K | 114,000 |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 111,300 ▲300K | 114,100 |

| Jewelry 99.99% | 111,300 ▲300K | 113,400 |

| Jewelry 99% | 107,777 | 112,277 |

| Jewelry 68% | 70,769 | 77,269 |

| Jewelry 41.7% | 40,942 | 47,442 |

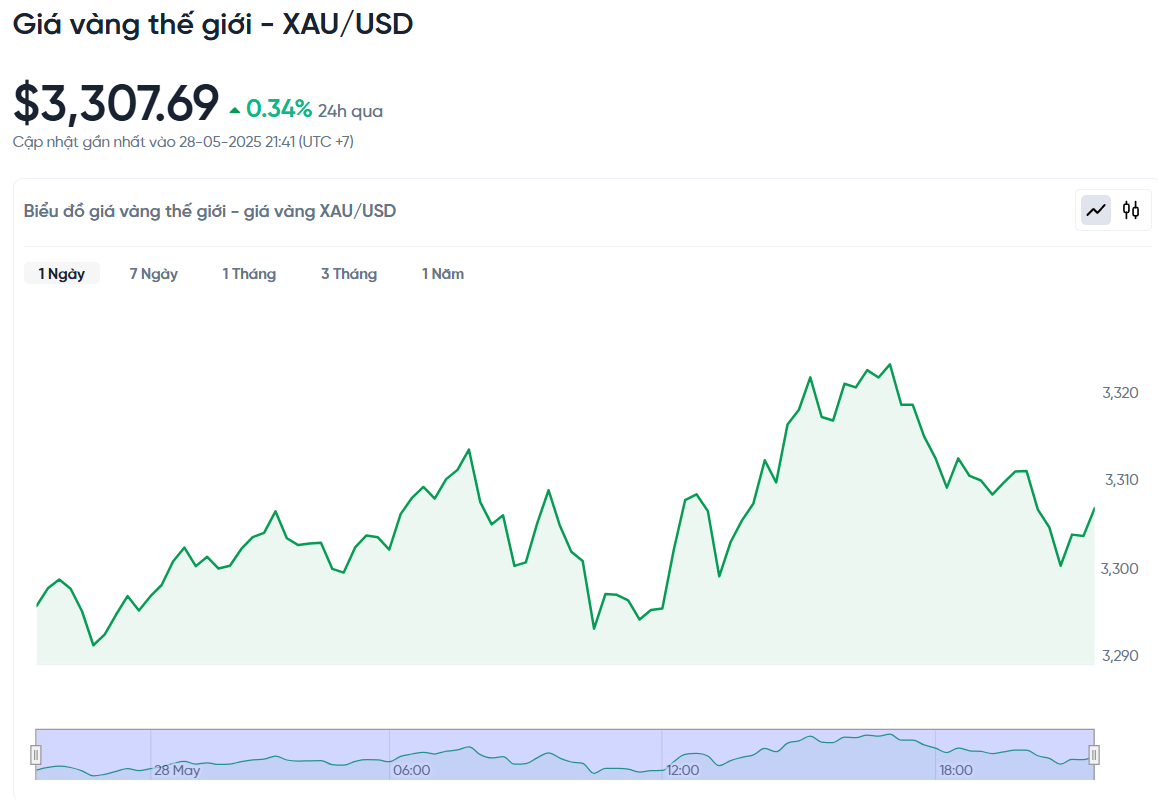

World gold price today May 29, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:30 a.m. today, Vietnam time, was at 3,307.69 USD/ounce. Today's gold price increased by 11.12 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,140 VND/USD), the world gold price is about 108.13 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 10.57 million VND/tael higher than the international gold price.

World gold prices rose again after falling in the previous session. Many investors took advantage of buying gold after the low price this morning, helping the market recover slightly. Specifically, spot gold prices increased by 0.34% to above 3,300 USD/ounce. US gold futures also increased by 0.3%, trading at 3,310.6 USD/ounce. Yesterday, gold prices fell to a low of 3,285.19 USD/ounce.

Investors are still closely monitoring the minutes of the latest policy meeting of the US Federal Reserve (Fed), scheduled to be released later in the day. This is a factor that could strongly affect gold prices in the short term.

Jim Wyckoff, senior analyst at Kitco Metals, said that gold prices have been volatile lately, with no clear trend and often reacting to new information each day. In the short term, he said, gold prices may have reached a temporary peak.

The minutes of the Fed meeting are being closely watched because they will provide officials with an update on their views on inflation. The meeting comes amid concerns about global trade tensions, especially after President Trump announced a series of new import tariffs in April. Those tariffs were later eased or postponed.

Gold prices have risen about 26% since the beginning of the year and hit a record high in April. Goldman Sachs recently recommended that investors should hold a larger-than-usual portion of their long-term portfolios in gold, citing rising risks to U.S. financial credibility, a stressed Fed and strong central bank demand for gold.

Markets are also focusing on a slew of upcoming U.S. economic data, including Thursday's GDP report and Friday's PCE consumer spending, a closely watched inflation gauge for the Fed. Speeches from Fed officials in the coming days will also be of particular interest to the market.

Another sign that gold demand remains strong: in April, gold imports from the US to Switzerland surged to their highest level since at least 2012. This came after the US removed the precious metal from its list of import tariffs.

In other precious metals, silver edged down 0.3% to $33.20 an ounce. Platinum rose 0.8% to $1,088.65, while palladium fell 0.6% to $972.36.

Gold Price Forecast

Technically, the trend for June gold futures remains slightly bullish. If the bulls want to maintain this momentum, they need to push the price above $3,400, a key resistance level. Conversely, a drop below the May low ($3,123.30) could signal a reversal.

Although gold prices have slightly decreased in recent sessions, many experts still believe that the upward trend will soon return. The reason is that geopolitical risks and trade tensions between the US and major partners such as Japan, the EU, and China can flare up at any time, especially under President Donald Trump.

Uncertainty in US policy has kept investors cautious, while maintaining demand for safe-haven assets such as gold. Technical factors and fundamentals in the market are still tilted in favor of gold. According to previous forecasts from Citi and UBS, gold prices could reach $3,500/ounce this year. And in fact, this target was achieved last April.

However, investors are currently pausing to monitor new developments in both US-EU trade policy, tensions with China, as well as global hotspots such as Ukraine and the Middle East. The situation of negotiations between the US and Iran as well as Mr. Trump's role as mediator in the Russia-Ukraine conflict have not shown clear progress.

Another notable development is that China continues to increase its gold imports despite high prices. Figures from the Hong Kong Census and Statistics Department show that in April, China imported a net of more than 43 tons of gold, nearly nine times higher than the previous month and the highest level since March 2024.

Bank of America Securities expert Francisco Blanch said that the current correction in gold prices is due to the easing of geopolitical risks. However, he still maintains a positive view on the outlook for gold and silver prices in the second half of 2025.

Mr. Blanch emphasized that after the gold price reached $3,500/ounce as predicted, the market is now entering a correction period that will last for several months. But in the long term, gold still has many opportunities to increase sharply, possibly even surpassing the $4,000/ounce mark by the end of 2025 or into 2026.

According to Mr. Tim Waterer, analyst at KCM Trade, if gold price maintains the support zone around 3,250–3,280 USD/ounce, the possibility of increasing back to 3,400 USD is completely possible, especially if the risk-averse sentiment in the market returns in the near future.

Source: https://baonghean.vn/gia-vang-hom-nay-29-5-2025-gia-vang-trong-nuoc-va-the-gioi-tang-tro-lai-nguoi-dan-do-xo-mua-vang-vang-sau-muc-gia-thap-sang-qua-10298435.html

![[Video] Forecast of benchmark scores of mid-ranking universities to drop sharply](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/7/18/be12c225d0724c00a7e25facc6637cb9)

![[Infographic] In 2025, 47 products will achieve national OCOP](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/7/16/5d672398b0744db3ab920e05db8e5b7d)

Comment (0)