Investors are advised to take profits.

VCBS Securities Company commented that during the March 30 session, VN-Index recorded green but profit-taking pressure appeared when the index entered the area above 1,060 points. The huge pressure caused the increase to narrow significantly in the afternoon session.

After a series of consecutive sessions of increase, demand has shown signs of slowing down due to short-term profit-taking by investors. After the ATO session, strong active buying power, starting from the group of stocks VIC, VHM and VRE along with some other bank stocks, had a positive impact on the stock market on March 30 and caused the green color to spread.

The most notable stock market session on March 30 was still the real estate group with stocks such as VHM, VRE and NVL, while other industry groups recorded mixed increases and decreases.

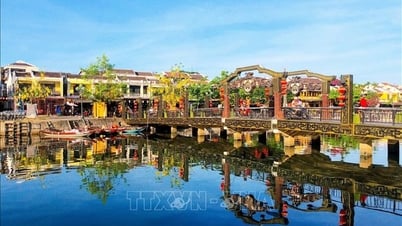

In the stock market session on March 30, although the VN-Index still increased, investors were advised to take profits. Illustrative photo

The liquidity of the stock market session on March 30 also reached a fairly high level compared to the average of previous sessions with the transaction value on HSX reaching more than 11,000 billion VND, but was more concentrated in the afternoon session when the index began to turn around and narrow the increase during the session, showing that the 1,060 point area is still a psychological resistance zone in the short term.

Foreign investors continued to net sell more than yesterday's session, with liquidity reaching 418 billion, focusing on selling STB, SSI, DGW, VPB and VND.

At the end of the session, VN-Index increased by 3.11 points, equivalent to 0.29% to 1,059.44 points. Similarly, HNX Index closed at 205.95 points, up 0.36 points.

According to VCBS, with the current developments, VN-Index will likely continue to fluctuate in the coming sessions and if demand does not increase convincingly to help the index overcome resistance, the probability of MACD forming 2 negative divergence peaks will be higher and increase the risk of reversal.

“We recommend that investors limit buying more stocks that have recorded large increases in recent sessions, and proactively realize partial profits and can wait to buy back when the general market fluctuates and corrects downwards during the session,” VCBS advised investors.

World stocks up

Asia- Pacific markets traded mixed on Thursday, with Australia's benchmark index hitting a two-week high as concerns over recent banking turmoil in the US and Europe eased.

In Australia, the S&P/ASX 200 closed 1.02% higher at 7,122.3, led by mining and banking stocks. Top gainers were BHP and Río Tinto, up 2.4% and 1.8%, respectively, as well as the "Big Four" banks, which posted gains of between 0.93% and 2.3%.

The “Big Four” banks include the Commonwealth Bank of Australia, National Australia Bank, ANZ Group and Westpac Banking Corporation.

Japan's Nikkei 225 index fell 0.36% to close at 27,782.93, while the Topix index saw a larger loss of 0.61% to end at 1,983.32. South Korea's Kospi rose 0.38% to 2,453.16, while the Kosdaq index rose 0.77% to 850.48.

The Hang Seng Index rose 0.37%, while the Hang Seng Tech Index also rose 0.16%. In mainland China, the Shanghai Composite rose 0.65% to end at 3,261.25, while the Shenzhen Component also closed 0.62% higher at 11,651.83.

European stock markets were higher on Thursday morning, continuing the positive momentum from the previous three sessions as concerns about the banking sector eased.

The pan-European Stoxx 600 rose 0.84% in mid-morning trade, with most sectors in the green.

Retail stocks led the way, rising 2.9%, with H&M the biggest gainer. At mid-morning, shares of the Swedish retailer were up 11.8%, leading the Stoxx 60.

The company reported an operating profit of 725 million crowns ($69.73 million), up from 458 million crowns the year before and above a forecast loss of 1.10 billion crowns in a Refinitiv poll.

Tech stocks rose 1.4% as risk assets returned to favor, while bank stocks rose 1.7% as the sector looked to weather recent volatility.

UBS shares rose 1.7%. The stock ended Wednesday up 3.7% after the bank announced Sergio Ermotti would return to the role of group CEO effective April 5, following its recent acquisition of Credit Suisse.

Source

![[Photo] National Assembly Chairman attends the seminar "Building and operating an international financial center and recommendations for Vietnam"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/7/28/76393436936e457db31ec84433289f72)

Comment (0)