After a 3.3% increase in the previous week, the week from May 19-23, the VN-Index increased by 1.4% to 1,314.5 points. Many good news have brought the $200 billion stock exchange - Ho Chi Minh City Stock Exchange (HoSE) to increase strongly, overcoming the fear of "Sell in May". However, risks still lie ahead.

Signals from the US and the breakthrough of billionaire Pham Nhat Vuong

After falling back to the support zone of 1,290-1,300 points in the second session, the VN-Index showed a positive recovery trend in the two mid-week sessions.

According to Mr. Dinh Quang Hinh, Head of Market Strategy Department, VnDirect Securities Analysis Division, the recovery momentum is led by positive signals in trade negotiations between Vietnam and the US.

At the end of the second round of negotiations, Vietnam and the United States made some positive progress, identifying groups of issues that have been agreed upon and groups of issues that need to be further discussed to reach an agreement in the coming time. The two sides also pointed out the contents that need to be further negotiated in the third round of negotiations, taking place in early June.

At the same time, The Trump Organization officially broke ground on a $1.5 billion project in Hung Yen . These moves have raised expectations that Vietnam could reach a more favorable reciprocal tax trade agreement within the next 45 days.

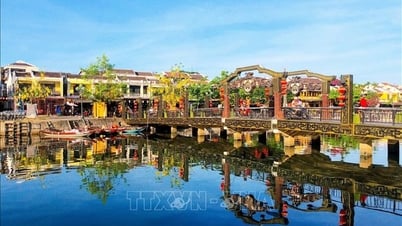

Vietnam's stock market increased sharply in May. Photo: VNN

In addition, the market was also supported by the increase of Vingroup stocks after a series of positive news including: Prime Minister Pham Minh Chinh requested relevant agencies to study the proposal to build Vinspeed's high-speed railway; the Tu Lien bridge project was officially started to help improve the infrastructure connecting the Vin Global Gate Co Loa project with the inner city. Vin businesses also announced many new investment projects.

Previously, VPL shares of Vinpearl JSC were listed on HoSE on May 13, with 3 consecutive ceiling price sessions (including the first listing session increasing by 20%) and are currently at 100,000 VND/share, with a capitalization of more than 176,600 billion VND (about 6.8 billion USD), ranking in the top 7 on HoSE.

The increase only cooled down in the last two sessions of the week when profit-taking pressure returned at the resistance zone of 1,320-1,340 points. At the end of the week, the VN-Index increased a total of 1.4% to 1,314.5 points.

Forecast for week 26-30/5 and outlook for 2025

The Vietnamese stock market recorded another week of positive growth, but is expected to face profit-taking pressure in the week of May 26-30, when the VN-Index approaches a strong resistance zone.

Mr. Dinh Quang Hinh said that the resistance zone of 1,320-1,340 is still a big challenge as this is the peak zone since the beginning of the year. The market is entering a period of "blank area" of supporting information after the first quarter business results reporting season and the 2025 shareholders' meeting.

With the Vietnam-US trade negotiation round taking place in early June, VN-Index may move sideways in the 1,290-1,340 range to absorb profit-taking supply, waiting for new signals.

After a strong increase, short-term investors tend to be more cautious, limiting disbursement into stocks that have increased rapidly, causing cash flow to slow down.

In the last trading session of the week, May 23, although closing in green, the increase was not significant, besides, liquidity also decreased significantly. The matched volume decreased by nearly 43% compared to the previous session and was 19.2% lower than the average of 20 sessions.

According to CSI Securities, the narrow increase in points with low liquidity shows that the momentum for the increase is not much, plus the VN-Index is at the peak of 2025, so the possibility of a further breakout is unlikely. Increasing profit-taking pressure is also inevitable.

According to CSI, VN-Index may need more time to accumulate or adjust to the balance zone to accumulate momentum for the next increase.

Looking at the weekly chart, the VN-Index's uptrend is still dominant with 3 consecutive weeks of increase. However, investors are waiting for a strong breakout signal of the VN-Index (surpassing the 2025 peak - 1,343 points with explosive liquidity exceeding the 20-session average) to confirm the major trend before returning to a new buying position.

In case of VN-Index correction, the 1,250 point mark is considered a strong and safe support level for new net buying positions.

In the medium and long term, VnDirect experts expect that breakthrough policies on promoting the private economic sector from Resolution 68 and the newly issued Resolution 198 will promote extensive reforms, helping to significantly improve the business environment in Vietnam. This will be a great driving force for the Vietnamese stock market in the medium and long term.

Vietnamnet.vn

Source: https://vietnamnet.vn/tin-hieu-moi-tu-dam-phan-thue-quan-viet-my-san-200-ty-usd-dien-bien-ra-sao-2404589.html

![[Photo] National Assembly Chairman attends the seminar "Building and operating an international financial center and recommendations for Vietnam"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/7/28/76393436936e457db31ec84433289f72)

Comment (0)