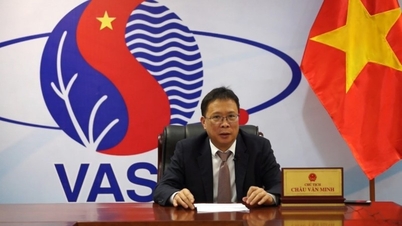

Director of the Tax Department Mai Xuan Thanh - Photo: Tax Department

Strengthening tax management in gold trading

On the afternoon of November 25, Director of the Tax Department Mai Xuan Thanh chaired a meeting to deploy three topics to combat tax losses: inspecting gold trading enterprises, inspecting enterprises with many years of losses, and inspecting tax refunds. The meeting was attended by leaders of the Departments and affiliated units.

Regarding the topic of inspecting gold trading enterprises, the representative of the Inspection Board said that the inspection process recorded many signs of risks such as buying and selling gold through individuals without issuing invoices, authorization in violation of regulations, and declared revenue not matching reality. The Inspection Board recommended that localities inspect according to the list of enterprises that have identified risks, and at the same time inspect all enterprises, households and individuals trading in gold, silver and precious stones in the area.

The inspection content focuses on compliance with tax laws, the use of invoices and documents, ensuring timely detection and handling of violations without affecting the production recovery process in disaster-affected areas. Local Tax Departments are required to allocate sufficient resources and fully implement the requirements in Official Dispatch 221/CT-KTr dated November 11, 2025.

According to the report, the number of enterprises declaring losses for many years accounts for a large proportion, especially in the group of small and medium enterprises. Some cases show signs of abnormality: no revenue is generated but continuous losses are declared; expenses do not serve production and business; provisioning is incorrect; related-party transactions do not comply with the principle of independent comparison.

Through inspections of high-risk enterprises, the tax authorities initially discovered many violations. The Inspection Board recommended continuing to assess risks and directing localities to include the group of enterprises with long-term losses in the 2026 inspection plan. The tax authorities were also asked to review the database, complete the selection criteria, strengthen risk analysis and summarize violations to learn from experience.

Inspection forces will continue to receive professional training to improve their ability to detect fraud in long-term loss-making business models. At the same time, propaganda work will be enhanced to help taxpayers understand policies and improve compliance.

Regarding the topic of combating value-added tax (VAT) refund fraud, the Inspection Board said that the Tax Department has directed localities to focus on post-refund inspections, especially for high-risk items such as phones, non-ferrous metals, used cooking oil and valuable documents. Many localities have discovered violations such as using "virtual" headquarters, having no actual business activities, making payments without going through banks, issuing invoices at the wrong time, and exporting goods with unusual signs of origin.

The Inspection Committee proposed to continue requiring localities to urgently complete tax refund inspections in the last two months of the year, while strengthening the fight against invoice fraud and tightening management from input to output.

In his directive speech, Director Mai Xuan Thanh requested heads of units to concentrate maximum resources to complete three key topics in the remaining time of the year. In localities affected by natural disasters, tax authorities must both support affected businesses and households and proactively isolate damaged areas and assess the level of recovery.

Mr. Thanh emphasized the need for tax authorities at all levels to strengthen coordination between the Tax sector, the Police and relevant units to handle signs of fraud and tax evasion; at the same time, promote the application of digital data, risk analysis and AI solutions to improve monitoring efficiency.

"It is necessary to continue to promote communication and support taxpayers to improve compliance with the law. Effective completion of the three topics will contribute to preventing budget losses, creating a transparent business environment and strengthening the trust of people and businesses," Director Mai Xuan Thanh stated.

Mr. Minh

Source: https://baochinhphu.vn/trien-khai-manh-3-chuyen-de-trong-diem-chong-gian-lan-thue-102251125190937428.htm

Comment (0)