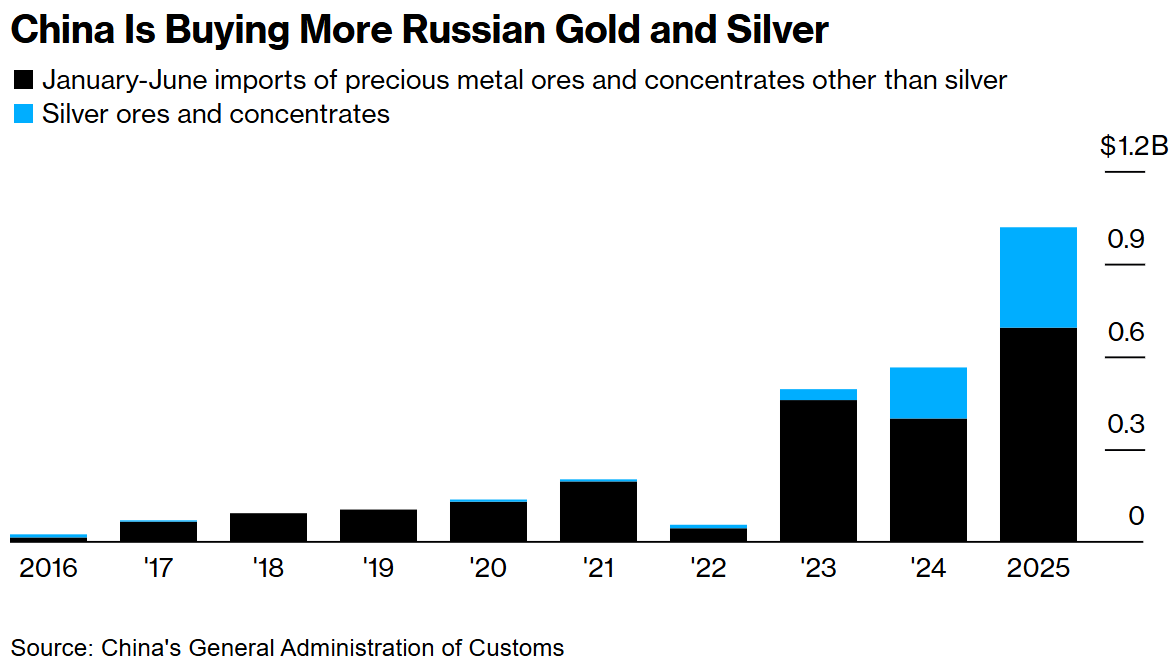

In the first half of 2025, the value of Russia's precious metal exports to China nearly doubled year-on-year. According to data from Trade Data Monitor and the General Administration of Customs of China, China's imports of precious metal ores and concentrates from Russia, including gold and silver, increased by 80% to $1 billion year-on-year.

The gains were largely driven by a surge in gold prices, which have risen about 28% this year amid geopolitical risks, escalating trade tensions, and strong net buying from central banks and ETFs.

Russia is now the world's second-largest gold producer, behind only China, with output of more than 300 tonnes a year. The Russian Central Bank was once one of the world's largest government buyers of gold. However, Russia's net purchases have declined since the conflict with Ukraine.

Russian gold miners are feeding growing domestic retail demand. Russian consumer demand for gold hit a record last year as they rushed to buy the precious metal to protect the value of their savings. Russian consumers bought 75.6 tonnes of gold in 2024, accounting for about 25% of the country’s annual production.

In contrast, the People's Bank of China has maintained its position as one of the top central banks buying gold in recent years.

Although the volume of Russian gold exports to China has increased, much of the difference in value is due to the meteoric rise in spot gold prices, which have increased by nearly 43% over the past 12 months.

MMC Norilsk Nickel PJSC, one of the world’s top producers of palladium and platinum, has boosted exports to China. Prices of the two metals have risen 38% and 59%, respectively, this year.

Silver reigns supreme

In September 2024, the Russian government announced plans to spend 51 billion rubles ($535.5 million) over the next three years to increase its precious metals reserves. While gold is already an important asset in its foreign exchange reserves, Russia is looking to expand its holdings to include silver and platinum group metals (PGMs).

According to Tim Treadgold, silver prices are benefiting from significant but unannounced net buying by the Russian Central Bank. Since the start of 2025, silver prices have risen 30.6%, surpassing gold’s 27.5% gain over the same period, as Russia announced in late September 2024 that it plans to add silver to its State Reserve Fund.

Signs that investors have paused buying gold, which has more than doubled since 2022, were initially driven by net central bank buying followed by private investor participation, Treadgold said.

Russia's BRICS partners, including China, India and Brazil, may also share a strategy of accumulating precious metals to escape dependence on the US dollar in international trade.

While gold accumulation is part of the BRICS financial strategy, with gold prices currently hovering near historic highs, silver is emerging as a viable alternative, allowing BRICS members to continue their plans to break away from USD dominance.

Other factors supporting silver's investment appeal include strong industrial demand, mainly from the green energy and electronics sectors, along with silver's use in jewelry.

"The biggest factor impacting the silver market is investment demand. The metal is increasingly seen as an alternative to gold," Treadgold said.

Source: https://vietnamnet.vn/trung-quoc-tang-toc-gom-vang-bac-tu-nga-cuoc-dua-thay-doi-tai-chinh-toan-cau-2425829.html

![[Photo] Cutting hills to make way for people to travel on route 14E that suffered landslides](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/08/1762599969318_ndo_br_thiet-ke-chua-co-ten-2025-11-08t154639923-png.webp)

![[Video] Hue Monuments reopen to welcome visitors](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/11/05/1762301089171_dung01-05-43-09still013-jpg.webp)

Comment (0)