The Vietnamese stock market has maintained a streak of 9 consecutive sessions of increase, surpassing many short-term resistance levels. A series of stock groups in the securities, banking, insurance, real estate, etc. have increased very strongly. Many stocks have increased in price by 50%-70%, even doubling in a short period of time.

Many investors who sold their stocks early, waiting for the market to correct, had to buy them back because they did not want to stay out of the market. Or new investors who wanted to invest in stocks but were afraid of "catching the peak" because the price was too high.

Many new people want to invest in stocks but are afraid of "catching the top" because the price is too high.

Experts say there is still room for growth.

Speaking to reporters, Mr. Tran Quoc Toan, Director of Branch 2 - Headquarters of Mirae Asset Securities Company (MAS), commented that it is very difficult to determine the short-term peak of the market at this time. The reason is that the macro context is favorable, listed companies' profits are growing strongly and investors' confidence is increasing.

Although the VN-Index has surpassed its historical peak at the end of 2021, the entire market valuation is currently at a P/E of 14.5 times - lower than the 5-year average and below the 18-time mark of 2021. "This shows that there is still room for growth when listed companies' profits, especially in the banking and real estate groups, improve; combined with expectations of expanding the P/E ratio," said Mr. Toan.

He said the current growth rate is “higher and faster” than previous increases, causing fear of corrections to increase. Profit-taking pressure may appear suddenly, similar to 2021 when the market had 5 corrections of over 5%, of which 2 fell by more than 10%. “Investors always have to manage risks,” he said.

Profits of listed enterprises in the second quarter of 2025

Sharing the view that the market still has room, Mr. Phan Dung Khanh, Investment Consulting Director of Maybank Securities Company, said that VN-Index may have many new peaks in the coming time. He observed that many investors “lost goods” and are waiting to buy back when the market corrects.

According to Mr. Khanh, to avoid "buying at the top" when the market falls, investors should reduce the proportion of stocks if they are using high margin or holding a large amount. Those who have few stocks can wait for adjustments or buy at a small ratio. "However, it is necessary to distinguish between short-term and long-term peaks. If it is short-term, reduce the proportion and lower the margin; if it is medium-term or long-term, you can buy when the market adjusts. For those who are holding cash, they can hold stocks," he said.

To overcome the “invisible fear”, investors should look at the attractive valuation factor, the prospect of Vietnam being upgraded to a market class and the strong increase in corporate profits, Mr. Toan said. Short-term adjustments, he said, are an inevitable part of the bull market, taking place to transfer expectations between groups of investors.

Should buy on corrections

However, risks still exist. Some experts warn that margin debt has reached a record high of about VND330 trillion. “If investors do not manage well, the risk of burning their accounts is real,” said a financial expert.

According to Mr. Toan, the corrections will be an opportunity to increase the proportion and help those who missed the beat to return to the market. “Choosing good stocks and strict risk management will help make investments more effective. Three notable industries are banking, securities and construction materials,” he recommended.

From a more positive perspective, Mr. Hoang Anh Tuan, Director of Customer Relations at MBS Securities Company, forecasts that the VN-Index could reach 2,000–2,150 points by the end of this year or early 2026. He explains that with a strong increase, the index could increase 2–2.5 times compared to the bottom.

“If we take this year’s bottom at around 1,100 points, the mark above 2,000 is feasible. It sounds high, but with a double-digit GDP growth cycle in the next 5 years, this is not too shocking,” said Mr. Tuan.

VN-Index is at a historical peak but the market's P/E valuation is still lower than in 2021

Source: https://nld.com.vn/chung-khoan-tang-phi-ma-dau-tu-the-nao-de-khong-du-dinh-196250815085652485.htm

![[Photo] Panorama of the 2025 Community Action Awards Final Round](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/15/1763206932975_chi-7868-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh meets with representatives of outstanding teachers](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/15/1763215934276_dsc-0578-jpg.webp)

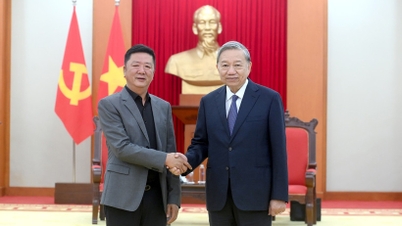

![[Photo] General Secretary To Lam receives Vice President of Luxshare-ICT Group (China)](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/15/1763211137119_a1-bnd-7809-8939-jpg.webp)

Comment (0)