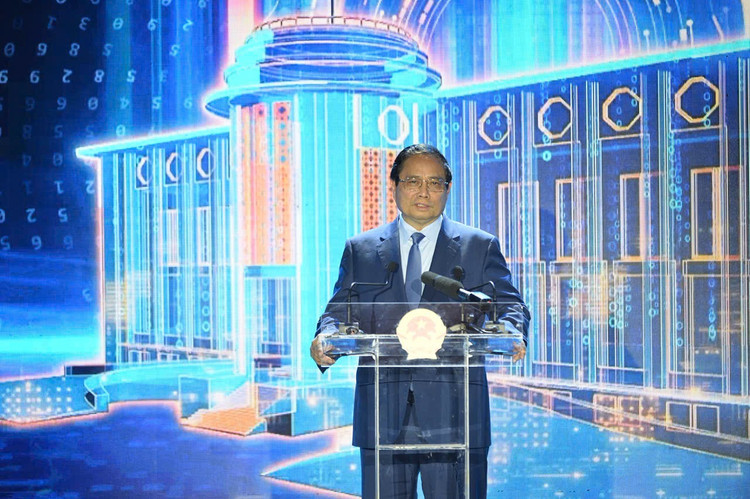

The event was attended by Prime Minister Pham Minh Chinh - Politburo member, Head of the Government's Steering Committee on science and technology development, innovation, digital transformation and Project 06; Mr. Le Hoai Trung - Secretary of the Party Central Committee, Chief of the Party Central Committee Office; Mr. Phan Van Mai - Member of the Party Central Committee, Member of the National Assembly Standing Committee, Chairman of the National Assembly's Economic and Financial Committee.

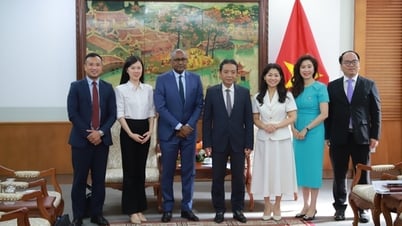

On the Banking side, there was the participation of Governor Nguyen Thi Hong - Member of the Party Central Committee, Head of the Steering Committee for Digital Transformation of the Banking Sector, along with Deputy Governors, representatives of credit institutions, commercial banks and technology enterprises...

Convergence of vision - Towards a people-centric financial ecosystem

Speaking at the event, Prime Minister Pham Minh Chinh acknowledged the innovative thinking and drastic actions of the entire industry in the digital transformation process, which is a solid foundation for the banking industry to continue promoting its role as the "blood vessel" of the digital economy , a smart, safe and people-centered digital ecosystem.

The Prime Minister emphasized that the most important goal of digital transformation in the banking sector is to effectively connect banks with each other, banks with the State, banks with people and social partners. This is the foundation to contribute to the development of digital government, digital society, digital citizens, and at the same time plays an important role in stabilizing the macro economy and ensuring sustainable social security. According to the Prime Minister, the next goal to be achieved is to bring practical benefits to people and businesses, help reduce operating costs for the banking system and prevent corruption and waste through transparency of financial transactions.

The head of the Government requires that the digital transformation process must adhere to the guidelines, act decisively, improve real efficiency, and avoid formality. At the same time, the banking industry needs to seize opportunities in a timely manner, take the lead in new technologies, pioneer in the application of science and technology, and take the lead in innovation, thereby creating diverse financial products and safe and convenient services.

The Prime Minister affirmed that all policies and actions must put the interests of the people at the center, considering people not only as beneficiaries but also as active participants in the digital transformation process, accompanying and contributing to building a modern financial system.

In particular, the Prime Minister pointed out the specific tasks that the entire banking industry needs to carry out in the coming time, which are to accelerate, make breakthroughs and reach the finish line earlier than the set roadmap. Specifically, promoting investment in digital infrastructure, promoting digital transformation for both people and businesses; Issuing practical priority policies for the disadvantaged, ensuring that everyone has the opportunity to access digital banking services; Focusing on developing high-quality digital human resources, capable of mastering new technologies. And most importantly, ensuring the safety and security of the financial and banking information system, protecting national interests and the rights of the people.

At the event, SBV Governor Nguyen Thi Hong emphasized that the Digital Transformation of the Banking Industry 2025 event with the theme "Smart Digital Ecosystem in the New Era" is an important annual event, demonstrating the high political determination and strong commitment of the entire industry in implementing Resolution 57-NQ/TW on breakthroughs in science, technology, innovation and national digital transformation and the National Digital Transformation Program to 2025, with a vision to 2030. SBV Governor Nguyen Thi Hong also pointed out the strategic directions of the industry in the coming period. Accordingly, the SBV will continue to create favorable conditions in terms of mechanisms and policies for credit institutions to accelerate the digital transformation process, develop safe and convenient digital banking products and services, contributing to promoting non-cash payments and improving access to financial services for all classes of people.

The Governor also announced that in order to implement Resolution 57-NQ/TW and the direction of the Government and the Prime Minister, in the spirit of accompanying other sectors and fields in implementing Resolution 57-NQ/TW, the State Bank has developed and directed commercial banks to implement a credit program of VND 500,000 billion for enterprises investing in infrastructure and digital technology to implement key and important national projects in the fields of transportation, electricity and digital technology according to the list announced by ministries and sectors. To date, 21 commercial banks have prepared a resource of VND 500,000 billion for lending under the Program with preferential lending interest rates in VND, at least 1% lower per year compared to the average medium and long-term lending interest rates applied by the lending bank itself in each period. In order for banks to be able to soon implement this Credit Program, the State Bank will closely coordinate with ministries and branches to guide, support and create conditions for commercial banks to organize implementation within their authority.

At the conference, representatives of banks and credit institutions shared their practical experiences in the process of implementing digital transformation, and proposed many solutions to improve efficiency in the coming time. Opinions were unanimous that digital transformation is not simply about investing in technology but must be associated with innovation in leadership thinking, improving the quality of human resources and comprehensively adjusting operating processes.

Several large commercial banks have presented typical models such as deploying new generation Core Banking, expanding multi-channel digital banking, enhancing the integration of Big Data and artificial intelligence (AI) to improve the ability to analyze customer behavior and personalize products and services.

In particular, delegates emphasized the urgent need to train high-quality technology human resources, increase investment in cybersecurity, and promote digital financial education and communication so that people, especially in rural and remote areas, can easily access and use safe digital banking services.

Practical sharing from credit institutions not only contributes to enriching the picture of digital transformation in the banking industry but also affirms the spirit of companionship, cooperation and sharing of the entire industry, towards a modern financial ecosystem, where technology serves people effectively and humanely.

Towards a smart and humane digital financial ecosystem

In the overall picture of digital transformation in the banking industry, the Vietnam Bank for Agriculture and Rural Development (Agribank) has shown its pioneering role with impressive efforts and results. At the event, Agribank's technology booth attracted special attention from delegates with advanced technology applications and smart transaction counter models, bringing new and convenient experiences to customers.

In particular, the presentation of Deputy General Director Hoang Minh Ngoc at the conference with the topic "Social security payment via bank account/card" received high appreciation from experts and industry leaders. Agribank has shown steady progress in applying digital technology to improve the efficiency and transparency of social security programs. The impressive figures announced by Agribank have demonstrated its great efforts and contributions to the community: the bank has issued 12 million cards, opened 9 million accounts in rural and mountainous areas, made payments to 500,000 beneficiaries and disbursed 210,000 billion VND through the insurance channel.

These results not only demonstrate strong investment in technology but also demonstrate Agribank's deep social responsibility in accompanying the Government in implementing social security policies. Agribank also demonstrates its long-term commitment to continuing to promote digital transformation, aiming at the goal of deep integration with the national electronic identification system (VNeID), moving towards a paperless payment model, contributing to the humanization of financial services, especially for people in remote areas, who still have many difficulties in accessing traditional banking services.

The Digital Transformation of Banking Industry 2025 event has ended with important milestones, demonstrating the determination and efforts of the entire industry in creating a smart, safe and convenient digital financial ecosystem. The spirit of initiative, creativity and close cooperation between banks and technology enterprises are key factors to realize this goal.

The Digital Transformation of Banking Industry 2025 event is not only a place for organizations to share experiences and introduce technology solutions, but also a strong affirmation of the vision and determination of the Vietnamese banking industry in seizing opportunities from the 4.0 industrial revolution, towards a comprehensive digital future, effectively serving the country's sustainable development.

Source: https://khoahocdoisong.vn/chuyen-doi-so-nganh-ngan-hang-2025-kien-tao-he-sinh-thai-post1544723.html

Comment (0)