|

| The workshop "Eliminating lump-sum tax: What do business households need to prepare?" was jointly organized by the Vietnam Tax Consultants Association (VTCA), MISA Joint Stock Company and Vietnam Prosperity Joint Stock Commercial Bank (VPBank). (Photo: baodautu.vn) |

Opportunities in challenges

According to Resolution 198/2025/QH15 on a number of special mechanisms and policies for private economic development, from January 1, 2026, business households and individual businesses will no longer apply the tax contract method, but instead pay taxes according to the Law on Tax Administration, and at the same time stop paying business license fees. The turning point from "contracting" to "transparent declaration" originates from the orientation of developing the private economy.

Sharing at the workshop "Eliminating lump-sum tax: What do business households need to prepare?", citing Resolution 68-NQ/TW on private economic development, Ms. Nguyen Thi Thu Ha - former Director of the Department of Propaganda - Taxpayer Support (Tax Department) emphasized that the private economy is the most important driving force of the national economy. In the private sector, from large, medium and small enterprises to business households and individuals, each group has its own role. Business households, no matter how small, still play an important role in creating jobs and promoting the local economy.

"The general direction is to promote the development of the business system, while encouraging business households to gradually transform into enterprises. However, this process needs a roadmap suitable to the level, habits and actual conditions of business households. Transforming into enterprises will help expand scale, increase connectivity, access more business opportunities and bring greater value to both business households and the economy. At the same time, the role of business households is still very important, especially in solving employment and promoting local economic development," said Ms. Ha.

According to the roadmap, Vietnam aims to have 2 million businesses by 2030 and 3 million by 2045. To achieve these numbers, business households need to calculate the appropriate direction right now. Switching to tax declaration is considered a necessary stepping stone, helping households get used to transparency, creating a basis for gradually transforming into businesses in the future.

According to Mr. Nguyen Quang Khai - Deputy Director of Misa Retail Solutions, this is both a challenge and a great opportunity. The challenge is that households have to change their habits, invest in tools and time for transparent declaration. However, the opportunity is much more important. When businesses are transparent, they will have easier access to credit, easier cooperation with partners, deeper participation in the supply chain and affirm their reputation in the market.

From the perspective of a credit institution, Mr. Ngo Binh Nguyen - Director of the business household segment, Vietnam Prosperity Joint Stock Commercial Bank ( VPBank ) also shared the reason for having a long time accompanying units providing software solutions to support sales and tax transparency.

Tax payment and complete tax declaration are input data for credit institutions like VPBank to make decisions on unsecured loans and unsecured loans. With the transparent declaration option, within 6 months to 1 year, the representative of this bank said that business households and individuals will easily access loan capital.

"When Decree 68/2025/ND-CP was issued with a general spirit of supporting and promoting the private economy, I think that Vietnam is following a very common trend in the world as well as in Asia and Southeast Asia. Looking at many neighboring countries, the type of business household or "household banking" is no longer mentioned much, but instead has transformed into a private enterprise or "Sole Proprietorship" in English," Mr. Nguyen also added.

Adapting in Transition

|

| Ms. Nguyen Thi Thu Ha - former Director of the Department of Propaganda and Taxpayer Support. (Photo: baodautu.vn) |

In practice, many businesses such as restaurants, garment processing, seafood... often lack input invoices due to long-standing habits. Ms. Nguyen Thi Thu Ha also emphasized that Decree 70/2025/ND-CP amending and supplementing Decree 123/2020/ND-CP also stipulates on invoices and documents requiring businesses with revenue of 1 billion VND/year to use electronic invoices connected to cash registers from June 1, 2025. This is a premise for millions of businesses across the country to gradually abandon the lump-sum tax payment method.

“Anyone doing business needs to know clearly the output, input, profit and loss. If you only monitor based on feelings, it will be difficult to expand or develop sustainably. Applying electronic invoices from cash registers is not only to comply with the law but also helps households manage their sales, costs and business efficiency systematically and transparently instead of monitoring based on feelings and without a clear system,” Ms. Ha emphasized.

According to Decree 70/2025/ND-CP, from now until January 1, 2026, the transition period allows retail invoices for end-consumers (B2C) to not be required to record buyer information. However, invoices for sales to other businesses or households (B2B) must have full information. Otherwise, the invoice will be invalid. This means that households must gradually get into the habit of issuing full invoices when selling goods, and always request invoices when purchasing goods to legitimize costs.

For goods and raw materials without input invoices, households can prioritize importing goods from suppliers with documents, and at the same time, inventory and gradually process goods of unknown origin in the remaining time. By January 1, 2026, all inventories must be reflected at actual value and valid documents.

The abolition of lump-sum tax from 2026 is an important turning point, marking the transition from the model of “simple but opaque management” to “transparent, modern management”. According to Ms. Ha, this transition period in the last months of 2025 is a golden opportunity for business households to practice, adjust, change habits, and gradually adapt.

According to Investment Newspaper

https://baodautu.vn/chuyen-doi-tu-thue-khoan-sang-ke-khai-co-hoi-vang-o-giai-doan-chuyen-tiep-d372383.html?gidzl=ZdQXGxHrdK-FOA9CjcsVJOvZeqsiQvaTnJFpJAqupKZ4PVLAgsR3Jfuyh1ocOyOGo3xvHcOCEmuqi7wQJm

Source: https://thoidai.com.vn/chuyen-doi-tu-thue-khoan-sang-ke-khai-co-hoi-vang-o-giai-doan-chuyen-tiep-215881.html

![[Photo] Prime Minister Pham Minh Chinh chairs meeting on railway projects](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/23/1761206277171_dsc-9703-jpg.webp)

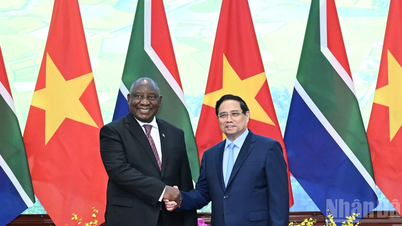

![[Photo] Prime Minister Pham Minh Chinh meets with South African President Matamela Cyril Ramaphosa](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/23/1761226081024_dsc-9845-jpg.webp)

![[Photo] President Luong Cuong holds talks with South African President Matamela Cyril Ramaphosa](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/23/1761221878741_ndo_br_1-8416-jpg.webp)

Comment (0)