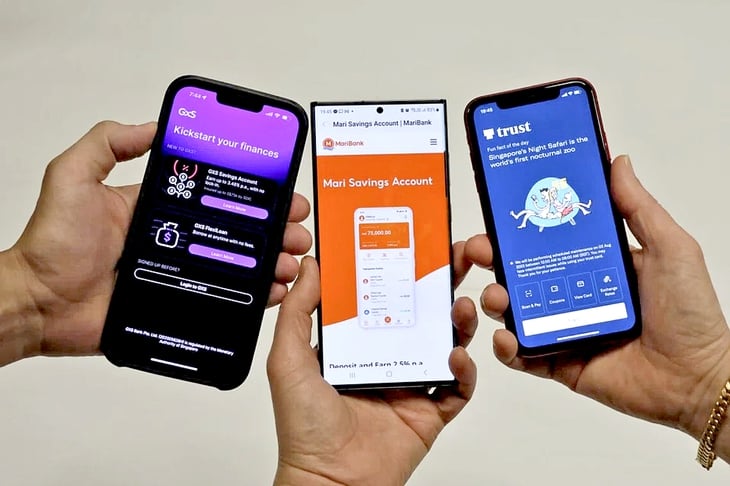

Although fraud complaints at digital banks are still few, they are on the rise - Photo: Lianhe Zaobao/Straits Times

The Financial Industry Dispute Resolution Centre (Fidrec) said that by the end of August 2025, it had recorded 94 complaints about fraud and scams - a sharp increase compared to 42 complaints in the whole of 2024.

The complaints were filed against five digital banks operating in Singapore, including Trust Bank, GXS Bank, MariBank (serving retail customers) and Anext Bank and Green Link Digital Bank (serving small and medium enterprises).

Worrying trend

Although the number of digital banking fraud cases is still small compared to the total number of industry complaints, the growth rate is alarming: from 2.1% of total complaints in 2023, increasing to 4.8% in 2024 and jumping to 8.7% by August 31, 2025.

In particular, scams and fraud account for 84% of all complaints against digital banks alone – much higher than service standards (11%) and policy (5%) issues.

According to Fidrec, the two most common forms of fraud are credential hijacking and impersonation fraud.

In the first form, criminals use phishing attacks and malware to steal information, then access accounts and withdraw money. In the case of impersonation fraud, criminals pose as government officials, banks or relatives to convince victims to transfer money.

Professor Jan Ondrus, currently working at Essec Business School, said that because digital banks operate entirely online, fraudsters have more opportunities to deceive customers through fake messages or impersonation.

However, Mr. Christophe Barel from FS-ISAC - the Cyber Security Cooperation Organization for Banks, argued that all banks are vulnerable to fraud because most transactions are now done online.

Experts agree that the vast majority of successful scams are due to the human element, with scammers exploiting the stress or fatigue of their victims. In addition, the popularity of AI and Deepfake is making scams increasingly sophisticated and difficult to detect.

According to Fidrec, the two most common forms of fraud are credential hijacking and impersonation fraud - Illustration: Blog.vincss.net

Strengthen multi-layered defense

Faced with the dire situation, Singapore's banking industry has been working closely with regulators and telecommunications companies to step up defenses.

Measures include setting up regulations that clearly define the roles and responsibilities of banks, telecoms and consumers for compensation; and promulgating a Fraud Protection Act that allows police to restrict banking transactions if fraud is suspected.

In particular, banks are allowed to delay processing money transfers if the account has a balance of $50,000 or more and the total amount transferred within 24 hours exceeds half of the account balance.

In addition to industry-wide measures, digital banks also leverage modern infrastructure to monitor for unusual activity in real-time.

MariBank's system triggers a warning to educate users before a suspicious transaction is completed. GXS Bank uses suggestive questions like "Do you know the recipient?" to force customers to pause and think again, in order to disrupt the scammer's attack. Customers are also allowed to freeze a portion of their funds, preventing them from being easily transferred out.

Experts say modern infrastructure is an advantage for digital banks to quickly deploy new countermeasures. The fight against this fraud requires close cooperation between banks, regulators and high vigilance from consumers.

Identifying and preventing digital banking scams

To protect themselves, users need to be alert for the following signs: text messages or emails asking for urgent login information; calls from "bank employees" or "government agencies" demanding immediate money transfers; strange links or requests to download applications of unknown origin.

Experts recommend: never share OTP codes or passwords over the phone; always double-check the bank's website and email address; pause and re-verify when there are unusual transaction requests; enable two-factor authentication and transaction notifications via SMS.

If in doubt, contact the bank directly via the official hotline, not via a phone number provided by a stranger. Use the account freezing feature or transfer limit if supported by the bank.

Source: https://tuoitre.vn/lam-sao-ke-gian-lay-duoc-tien-trong-tai-khoan-ngan-hang-so-cua-ban-2025111809493374.htm

![[Photo] President Luong Cuong receives President of the Senate of the Czech Republic Milos Vystrcil](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F11%2F20%2F1763629737266_ndo_br_1-jpg.webp&w=3840&q=75)

![[Photo] Lam Dong: Panoramic view of Lien Khuong waterfall rolling like never before](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F11%2F20%2F1763633331783_lk7-jpg.webp&w=3840&q=75)

![[Photo] National Assembly Chairman Tran Thanh Man holds talks with South Korean National Assembly Chairman Woo Won Shik](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F11%2F20%2F1763629724919_hq-5175-jpg.webp&w=3840&q=75)

Comment (0)