The Bank for Agriculture and Rural Development (Agribank) - Lao Cai II Branch is one of the banks attracting a large proportion of residential deposits in the province, reaching more than VND 5,000 billion by the end of June 2025, an increase of 4.2% compared to the beginning of 2025.

Mr. Nguyen Dinh Hieu, Deputy Director of Agribank Lao Cai II Branch, said: To attract residential deposits, the branch has stepped up communication and assigned staff to approach each residential area to mobilize idle money. In addition, the branch has coordinated with local authorities, departments, branches, and organizations to approach households in areas related to projects that need site clearance and resettlement, closely following the progress of compensation payments to mobilize capital. The branch has also implemented good customer care and information security policies.

Military Commercial Joint Stock Bank (MB Bank) - Lao Cai Branch also applies many policies to mobilize residential deposits such as stable interest rates, customer information security, customer care for savings deposits (such as congratulations, birthday gifts, opening prize programs, digital transformation to improve quality and online savings features).

According to Mr. Tran Trung Kien, Deputy Director of MB Bank Lao Cai Branch, financial indicators by the end of the first period of the assessment year all increased compared to the same period in 2024, in which the deposit scale increased to reach 2,500 billion VND (an increase of 400 billion VND compared to the beginning of 2025).

Traditional savings interest rates are not high but still attract people's deposits due to their safety and need to preserve capital. Current savings interest rates are uneven, depending on each product, term, as well as the size of the bank. Larger banks have more abundant liquidity, while smaller banks with liquidity pressure will have different interest rates. In general, current savings interest rates tend to be stable at a basic level, but medium and long-term interest rates tend to increase higher than short-term interest rates.

Currently, people often invest in some main channels such as savings, stocks, gold and foreign currency, however, savings are still prioritized because of their safety and low risk. With the gold and foreign currency channels, the gold price is currently at a record high, fluctuating strongly according to international factors, so many investors are hesitant. Meanwhile, investing in foreign currency is still limited by foreign exchange market management policies and exchange rate risks. These channels are more suitable for risk prevention than long-term profitable investment.

According to experts, when major investment markets show signs of instability, people tend to prioritize capital safety over expected profits. In this context, banks are still a safe and transparent place to keep assets. In addition, many people consider savings as a temporary channel, waiting for other investment opportunities with higher profit potential to appear.

To mobilize deposits from the population, banks and credit institutions develop deposit products with many flexible and convenient forms, applying modern technology.

Deposits are in the nature of people's savings and accumulation, so there needs to be appropriate policies to both create conditions to attract this source of capital and meet the practical needs of the people, while ensuring the effective use of this source of capital for socio-economic development, through the process of savings, accumulation and investment to expand and grow effectively.

Source: https://baolaocai.vn/tien-gui-dan-cu-tang-phan-anh-niem-tin-cua-nguoi-dan-doi-voi-he-thong-ngan-hang-post404009.html

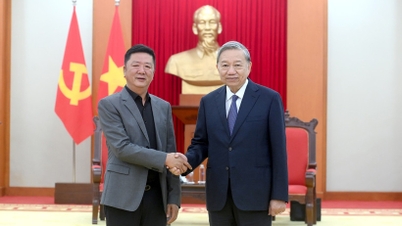

![[Photo] General Secretary To Lam receives Vice President of Luxshare-ICT Group (China)](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/15/1763211137119_a1-bnd-7809-8939-jpg.webp)

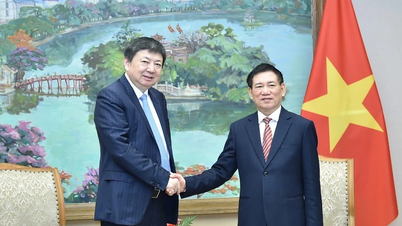

![[Photo] Prime Minister Pham Minh Chinh meets with representatives of outstanding teachers](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/15/1763215934276_dsc-0578-jpg.webp)

![[Photo] Panorama of the 2025 Community Action Awards Final Round](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/15/1763206932975_chi-7868-jpg.webp)

Comment (0)