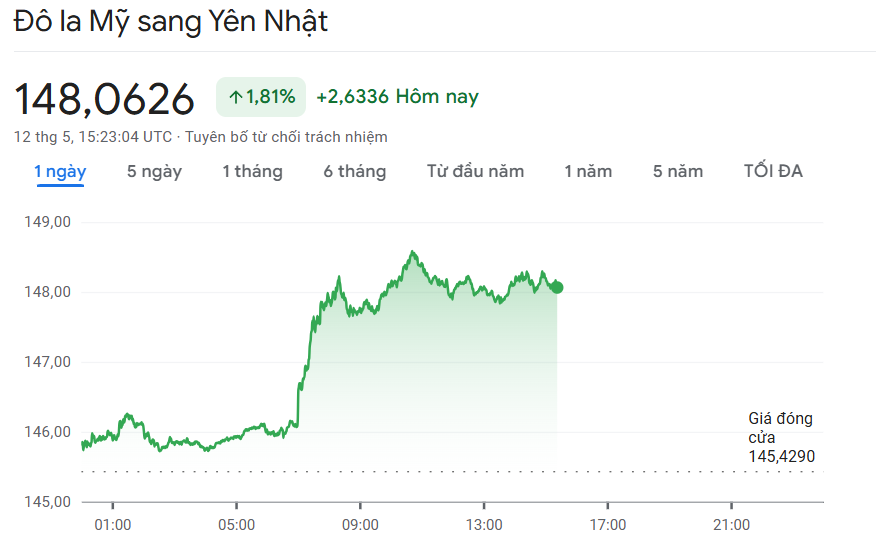

USD/JPY exchange rate today 5/13/2025

The Japanese yen (JPY) continued to weaken on Monday, hitting a one-month low against the US dollar in early European trading on Monday, as optimism surrounding a US-China trade deal weighed on safe-haven assets like the JPY.

At the same time, concerns about Japan's economic growth prospects, amid uncertainties related to US tax policy, also put pressure on the yen.

Positive results from the US-China trade talks have helped ease concerns about a US recession. In addition, the Federal Reserve's pause in its interest rate hike policy earlier this month has further strengthened the US dollar, helping it rise to its highest level since April 10. Thanks to these supportive factors, the USD/JPY exchange rate has surpassed 146.00 and is likely to continue rising.

The joint statement after the talks confirmed that the US would impose a basic tariff of 10% on Chinese goods for an initial 90 days, while China would also suspend its own tariffs on the US. The news boosted optimism in financial markets at the start of the week, with global stock markets rallying sharply, which in turn reduced demand for safe-haven assets such as the yen.

Market sentiment has been soothed as fears of a full-blown trade war that could trigger a US recession have temporarily subsided. In addition, the Fed’s steadfast stance with no plans to cut interest rates in the near future has also contributed to the USD’s rise, with the peak set last Friday.

On the other hand, recent data showed that household spending in Japan increased sharply while real wages fell in March. This raised concerns about deep and widespread inflation in Japan, thereby increasing pressure on the Bank of Japan (BoJ) to consider raising interest rates. However, the uncertainty in international trade has kept the BoJ cautious.

BoJ Governor Kazuo Ueda also acknowledged that achieving the 2% core inflation target would take longer than expected. However, minutes of the March monetary policy meeting released recently showed that the central bank was still ready to raise interest rates if the inflation trend remained stable.

This week, investors are looking forward to inflation data from the US and a speech by Fed Chairman Jerome Powell on Thursday, which could have a strong impact on the USD price trend. Meanwhile, Japan's first-quarter GDP report will be released on Friday and is expected to be a key factor in shaping the USD/JPY pair's movements.

Domestic Japanese Yen exchange rate today May 13, 2025

* The buying and selling rates of Japanese Yen at the State Bank of Vietnam remain unchanged, currently at: 162 VND - 180 VND.

In the "black market", the black market Japanese Yen exchange rate as of 4:30 a.m. on May 13, 2025 was trading around 178.03 VND/JPY.

The buying and selling rates of Japanese Yen at commercial banks are as follows:

| Japanese Yen Exchange Rate | Buy | Sell |

| Vietcombank | 169.55 VND | 180.32 VND |

| Vietinbank | 175.17 VND | 184.87 VND |

| BIDV | 172.18 VND | 180.18 VND |

VIB Bank is buying Japanese Yen cash at the lowest price of 167.74 VND/JPY

VIB Bank is buying Japanese Yen transfers at the lowest price of 169.14 VND/JPY

OCB Bank is buying Japanese Yen cash at the highest price of 179.39 VND/JPY

OCB Bank is buying Japanese Yen transfers at the highest price of 180.89 VND/JPY

VIB Bank is selling Japanese Yen cash at the lowest price of 175.80 VND/JPY

VIB Bank is selling Japanese Yen transfers at the lowest price of 174.80 VND/JPY

SHB Bank is selling Japanese Yen cash at the highest price of 187.85 VND/JPY

OCB Bank is selling Japanese Yen transfers at the highest price of 185.05 VND/JPY

Source: https://baonghean.vn/ty-gia-yen-nhat-hom-nay-13-5-2025-yen-nhat-giam-xuong-muc-thap-nhat-trong-vong-mot-thang-10297136.html

![[Photo] National Assembly Chairman attends the seminar "Building and operating an international financial center and recommendations for Vietnam"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/7/28/76393436936e457db31ec84433289f72)

Comment (0)