VN-Index experienced a full increase on July 25 and officially set a historical peak with a closing price of 1,531.13 points, up 10.11 points (+0.66%) per session and up 2.26% compared to the previous week. During the session, VN-Index increased to a peak of 1,534.5 points, also very close to the highest level recorded in the session on January 6, 2022. Green dominated with 62 stocks hitting the ceiling and 507 stocks increasing in price, while there were only less than 340 stocks decreasing in price and decreasing by the maximum amplitude.

According to Mr. Nguyen Tan Phong, Pinetree Securities Analyst, this is the 5th consecutive week that VN-Index has increased in both points and liquidity. Investor sentiment continues to be excited as businesses have announced their Q2/2025 business results as well as expectations for market upgrade in September. Cash flows have been continuously pouring in and rotating between pillar stocks, banks, securities, and real estate, helping the market maintain its upward momentum despite the fluctuations at the beginning of the week.

Forecasting the upcoming trend, experts from Pinetree Securities said that it is almost certain that VN-Index will surpass all the points ever achieved in trading history next week when there is only a gap of 5 points left. However, experts also emphasized that in the uptrend, there are always deep corrections to shake off. Some uncertain factors were pointed out such as the announcement of business results in the second quarter of 2025 by large enterprises or the official announcement of tariffs by US President Donald Trump on August 1.

At the same time, the current trend of VN-Index depends a lot on Vingroup stocks as well as foreign capital flows. In the worst case, if Vingroup stocks are strongly adjusted next week or foreign capital flows are no longer strong enough to pull the market, it will likely negatively affect VN-Index.

In the past month, VN-Index has increased by more than 12% and is one of the three strongest growing stock indexes in the world , only after the stock exchange indexes in Venezuela and Turkey. In the first three weeks of July alone, the HoSE index has increased by 11.2%. The increase in July is equal to the increase in the first half of the previous year. However, there is a difference in the jump in this July.

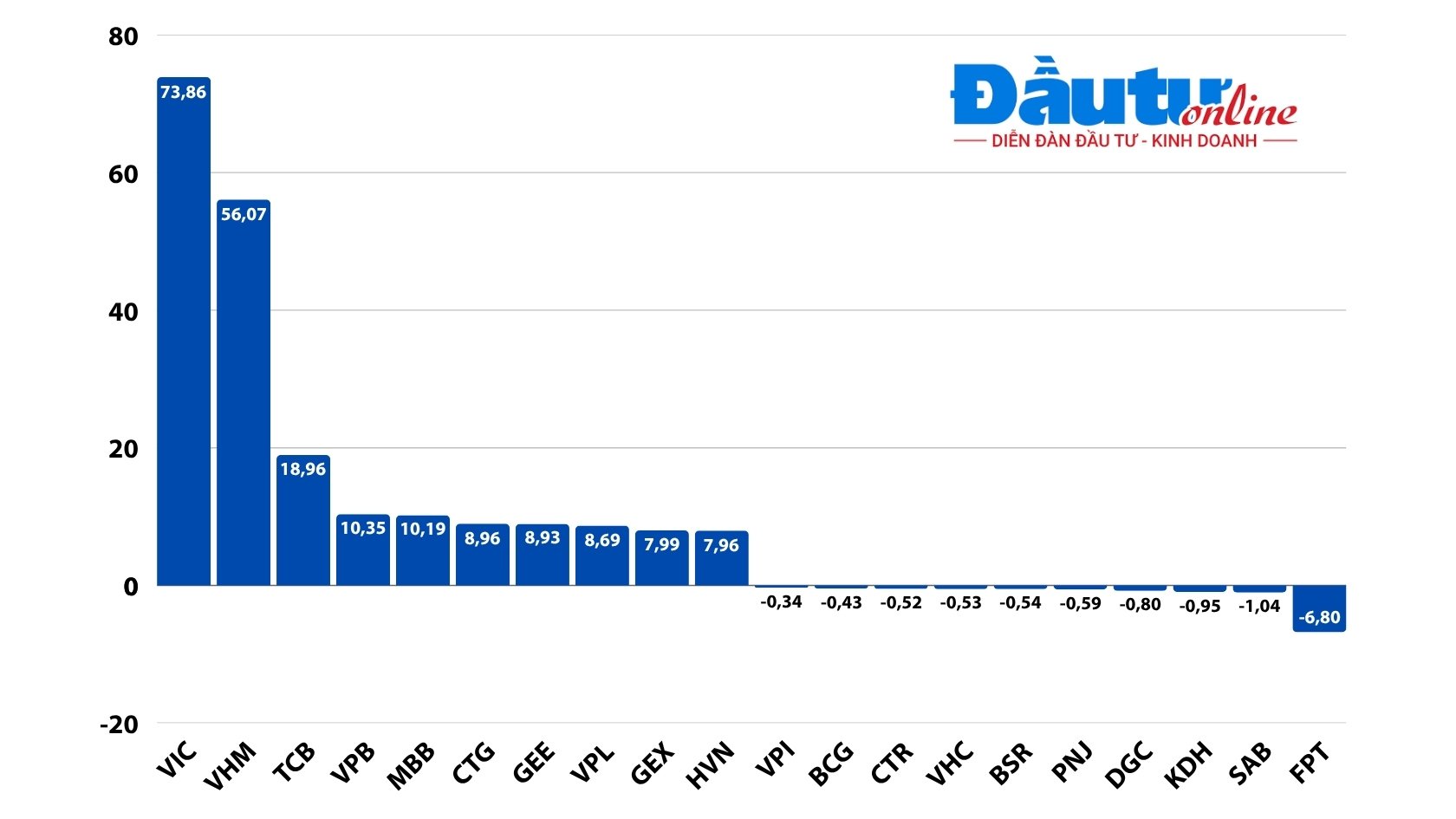

The biggest contributors to the 155-point increase of the VN-Index since the beginning of July are still the stocks of the real estate giants Vingroup and banks, according to the number of points contributed respectively: VIC (+18.6 points), VHM (+16.9 points), VCB (10.6 points), VPB (+10.53 points) and HDB (+5.4 points). However, the total number of points contributed by these Top 5 only corresponds to less than 40% of the increase. Meanwhile, if calculated from the beginning of the year until now, the Top 5 most positively impacted the index contributed 64.2% of the increase.

The increase spread when the cash flow rotated and poured in to promote the increase of many stocks instead of focusing on a few groups , even many stocks increased quite quickly. Like last week, Vietjet Air (VJC) shares officially broke back to surpass 100,000 VND/share and increased by 30% in just one week. This breakthrough also put VJC in the top 10 stocks that had a positive impact on the market.

Similarly, HPG shares have also just started to increase since the beginning of June 2025. Compared to the bottom of the year set in early April when the market fluctuated strongly due to the tax story, HPG shares have increased by nearly 1.5 times (based on the adjusted price after the stock bonus). Since the beginning of the year, Hoa Phat shares have also increased by about 17%.

Since the beginning of the year, the VN-Index has increased by 261 points, equivalent to an increase of 20.8%. Although this is an impressive figure compared to the trading history of previous years, the "heat" of the Vietnamese stock market since the beginning of the year is still far behind many countries such as Venezuela, Portugal, Greece, South Korea, Hungary, Israel...

Vingroup shares with a large capitalization and a stock price 2.8 times higher than at the beginning of the year contributed nearly 74 points to the total increase of 261 points of the general index. On the contrary, FPT shares, one of the stocks with good price increases and attracting a large amount of cash flow from investors in 2024, were the stocks that "held down" the main index. Compared to the end of last year, FPT's capitalization decreased by VND 35,750 billion. FPT's stock price (adjusted after dividend payments and bonus shares) decreased by 13.8%.

|

| Top 10 stocks impacting the Vietnamese stock market from the beginning of 2025. Source: Vietstock Finance |

The top 10 stocks that have positively impacted the VN-Index since the beginning of the year also include the "newbie" Vinpearl. Since its listing in mid-May, the strong increase in the first sessions when sellers were cautious in "selling" helped VPL's stock price surpass the 100,000 VND/share mark at one point . However, with the subsequent adjustment pressure, VPL closed last weekend at 87,600 VND/share, still nearly 23% higher than the reference price on the listing day.

In addition to real estate and banking stocks, the pillars that have helped the VN-Index increase since the beginning of the year include two "home" stocks of Gelex, Gelex Group and GELEX Electricity Joint Stock Company, with contributions of 8.93 points and nearly 8 points, respectively. GEX stock price also had an impressive week of price increase (+26%) to VND53,500/share. The market capitalization scale is now approximately VND48,300 billion. GEE stock also had a steady increase in price in the first 7 months of the year, bringing the stock price up 4.65 times higher than at the end of the year. The market capitalization scale also reached more than VND45,000 billion.

Source: https://baodautu.vn/vn-index-vuot-dinh-lich-su-tru-cot-nao-gop-suc-d341698.html

![[Photo] National Assembly Chairman attends the seminar "Building and operating an international financial center and recommendations for Vietnam"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/7/28/76393436936e457db31ec84433289f72)

Comment (0)