Domestic gold price today June 14, 2025

As of 4:30 a.m. on June 14, 2025, the domestic gold bar price is based on the closing price yesterday, June 13. Specifically:

DOJI Group listed the price of SJC gold bars at 117.5-120 million VND/tael (buy - sell), an increase of 500 thousand VND/tael for buying - an increase of 1 million VND/tael for selling compared to yesterday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 117.5-120 million VND/tael (buy - sell), an increase of 500 thousand VND/tael in buying - an increase of 1 million VND/tael in selling compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 118.3-119.8 million VND/tael for buying and selling. Compared to yesterday, the gold price increased by 800 thousand VND/tael for both buying and selling.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by businesses at 117.5-120 million VND/tael (buy - sell), the price increased by 500 thousand VND/tael in the buying direction - increased by 1 million VND/tael in the selling direction compared to yesterday.

SJC gold price at Phu Quy is traded by businesses at 117-120 million VND/tael (buy - sell), gold price increased by 700 thousand VND/tael in buying direction - increased by 1 million VND/tael in selling direction.

As of 4:30 a.m. on June 14, 2025, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 115-117 million VND/tael (buy - sell); the price increased by 1 million VND/tael in both buying and selling directions compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 116-119 million VND/tael (buy - sell); an increase of 1 million VND/tael in both buying and selling directions compared to yesterday.

The latest gold price list today, June 14, 2025 is as follows:

| Gold price today | June 14, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 117.5 | 120 | +500 | +1000 |

| DOJI Group | 117.5 | 120 | +500 | +1000 |

| Red Eyelashes | 118.3 | 119.8 | +800 | +800 |

| PNJ | 117.5 | 120 | +500 | +1000 |

| Bao Tin Minh Chau | 117.7 | 120.2 | +700 | +1200 |

| Phu Quy | 117 | 120 | +700 | +1000 |

| 1. DOJI - Updated: June 14, 2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Domestic gold price | Buy | Sell |

| AVPL/SJC HN | 117,500 ▲500K | 120,000 ▲1000K |

| AVPL/SJC HCM | 117,500 ▲500K | 120,000 ▲1000K |

| AVPL/SJC DN | 117,500 ▲500K | 120,000 ▲1000K |

| Raw material 9999 - HN | 109,500 ▲1000K | 114,000 ▲1000K |

| Raw material 999 - HN | 109,400 ▲1000K | 113,900 ▲1000K |

| 2. PNJ - Updated: June 14, 2025 04:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 113,500 ▲900K | 116,200 ▲1000K |

| HCMC - SJC | 117,500 ▲500K | 120,000 ▲1000K |

| Hanoi - PNJ | 113,500 ▲900K | 116,200 ▲1000K |

| Hanoi - SJC | 117,500 ▲500K | 120,000 ▲1000K |

| Da Nang - PNJ | 113,500 ▲900K | 116,200 ▲1000K |

| Da Nang - SJC | 117,500 ▲500K | 120,000 ▲1000K |

| Western Region - PNJ | 113,500 ▲900K | 116,200 ▲1000K |

| Western Region - SJC | 117,500 ▲500K | 120,000 ▲1000K |

| Jewelry gold price - PNJ | 113,500 ▲900K | 116,200 ▲1000K |

| Jewelry gold price - SJC | 117,500 ▲500K | 120,000 ▲1000K |

| Jewelry gold price - Southeast | PNJ | 113,500 ▲900K |

| Jewelry gold price - SJC | 117,500 ▲500K | 120,000 ▲1000K |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 113,500 ▲900K |

| Jewelry gold price - Kim Bao Gold 999.9 | 113,500 ▲900K | 116,200 ▲1000K |

| Jewelry gold price - Phuc Loc Tai Gold 999.9 | 113,500 ▲900K | 116,200 ▲1000K |

| Jewelry gold price - Jewelry gold 999.9 | 112,800 ▲800K | 115,300 ▲800K |

| Jewelry gold price - Jewelry gold 999 | 112,690 ▲800K | 115,190 ▲800K |

| Jewelry gold price - Jewelry gold 9920 | 111,980 ▲800K | 114,480 ▲800K |

| Jewelry gold price - Jewelry gold 99 | 111,750 ▲790K | 114,250 ▲790K |

| Jewelry gold price - 750 gold (18K) | 79,130 ▲600K | 86,630 ▲600K |

| Jewelry gold price - 585 gold (14K) | 60,100 ▲470K | 67,600 ▲470K |

| Jewelry gold price - 416 gold (10K) | 40,620 ▲340K | 48,120 ▲340K |

| Jewelry gold price - 916 gold (22K) | 103,220 ▲740K | 105,720 ▲740K |

| Jewelry gold price - 610 gold (14.6K) | 62,980 ▲480K | 70,480 ▲480K |

| Jewelry gold price - 650 gold (15.6K) | 67,600 ▲520K | 75,100 ▲520K |

| Jewelry gold price - 680 gold (16.3K) | 71,050 ▲540K | 78,550 ▲540K |

| Jewelry gold price - 375 gold (9K) | 35,890 ▲300K | 43,390 ▲300K |

| Jewelry gold price - 333 gold (8K) | 30,700 ▲260K | 38,200 ▲260K |

| 3. SJC - Updated: June 14, 2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 117,500 ▲500K | 120,000 ▲1000K |

| SJC gold 5 chi | 117,500 ▲500K | 120,020 ▲1000K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 117,500 ▲500K | 120,030 ▲1000K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 113,500 ▲1000K | 116,000 ▲1000K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 113,500 ▲1000K | 116,100 ▲1000K |

| Jewelry 99.99% | 113,500 ▲1000K | 115,400 ▲1000K |

| Jewelry 99% | 109,757 ▲990K | 114,257 ▲990K |

| Jewelry 68% | 71,729 ▲680K | 78,629 ▲680K |

| Jewelry 41.7% | 41,376 ▲417K | 48,276 ▲417K |

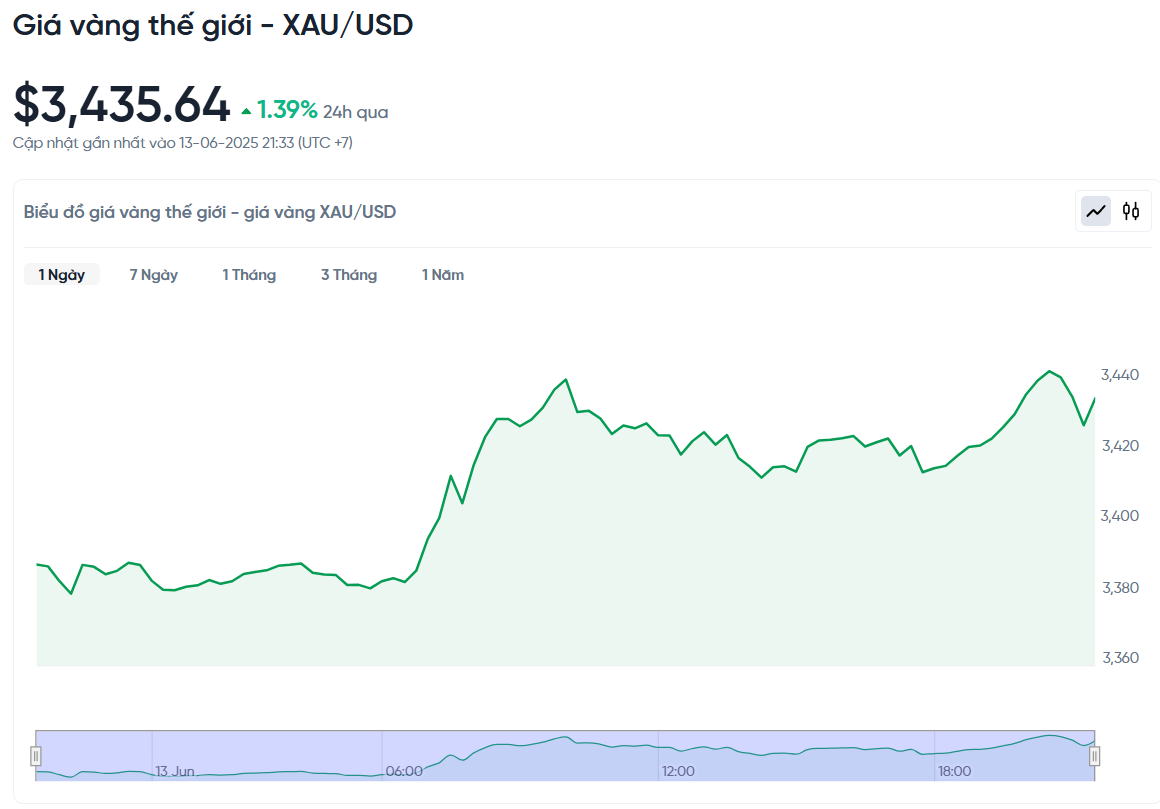

World gold price today June 14, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:30 a.m. on June 14, Vietnam time, was 3,422.03 USD/ounce. Today's gold price increased by 67.62 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,223 VND/USD), the world gold price is about 112.7 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 7.23 million VND/tael higher than the international gold price.

Gold prices surged as investors rushed to buy the metal as a safe haven after Israeli airstrikes on Iran raised concerns about a wider conflict in the Middle East. Spot gold rose 1.2%, approaching its April 2025 record of $3,500.05. For the week, gold prices rose more than 3%.

According to experts, the move to attack Iranian targets has made the market worried about geopolitical risks. Daniel Pavilonis, senior market strategist at RJO Futures, said: "Gold prices will continue to be high as the market anticipates that Iran may retaliate, causing more instability."

Israel has launched a series of airstrikes on Iran, targeting nuclear facilities, missile factories and eliminating military commanders, in what could be a long-term campaign to prevent Tehran from developing nuclear weapons. US President Donald Trump said Iran brought the attack on itself by not complying with US demands to limit its nuclear program.

In addition to geopolitical factors, this week's slightly lower US inflation data also contributed to the gold price increase. This reinforced expectations that the Federal Reserve (Fed) will soon cut interest rates. Gold is considered a safe asset in times of economic uncertainty or geopolitical conflicts, and also benefits from low interest rates.

Meanwhile, in Asian markets like India, demand for physical gold has fallen sharply due to soaring prices. In India, gold prices have crossed the psychologically important threshold of 100,000 rupees, making consumers wary.

Asian and European stocks fell across the board, while US markets are expected to open sharply lower. The US dollar rose against other currencies, while WTI crude oil prices jumped to a five-month high, trading around $74 a barrel. The yield on the 10-year US Treasury note is currently at 4.34%.

Silver edged down 0.3% to $36.24 an ounce, but was still up nearly 1% for the week. Platinum, meanwhile, fell 3.9% to $1,244.91, despite a 6.3% weekly gain. Palladium also fell 0.3%, but was still up 0.7% for the week.

Gold Price Forecast

Technically, gold is in a strong short-term uptrend. The next target for bulls is to push the price above the key resistance level at $3,427.70 per ounce. Meanwhile, bears are hoping to push the price below the support level of $3,250. The immediate resistance levels are currently at $3,467 and $3,477.30, while the immediate support levels are at $3,400 and $3,358.50.

Goldman Sachs predicts that gold prices could reach $3,700 an ounce by the end of 2025 and $4,000 by mid-2026 thanks to strong demand from central banks. Bank of America (BofA) also believes that gold is likely to rise to $4,000 in the next 12 months.

Commerzbank made a rather positive assessment when predicting that gold prices could reach $3,400/ounce by the end of 2024 and continue to increase to $3,600/ounce by the end of 2025. These figures reflect a strong belief in gold's long-term growth potential.

According to Saxo Bank analysis, one of the key factors supporting gold prices is the steady buying demand from global central banks. This trend shows the strong confidence of large institutions in the sustainable value of gold, even when macroeconomic indicators do not clearly show safe-haven demand.

Central banks are actively diversifying their foreign exchange reserves, reducing their dependence on the US dollar and seeking stability in a volatile global economic environment. This strategy contributes to the continued appeal of gold as an important reserve asset.

Wells Fargo stressed that geopolitical factors and economic uncertainty will continue to be the main drivers of gold prices in the near term. The organization forecasts that gold purchases by both private investors and central banks will continue to increase until at least 2026.

In the short term, Wells Fargo expects gold prices to correct slightly to $3,000-$3,200 per ounce by the end of 2024. However, the long-term outlook remains positive as the organization predicts gold prices could reach $3,600 per ounce by the end of 2026, reflecting sustained demand for the precious metal.

Source: https://baonghean.vn/gia-vang-hom-nay-14-6-2025-vang-trong-nuoc-chi-cao-hon-vang-the-gioi-7-trieu-dong-10299583.html

Comment (0)