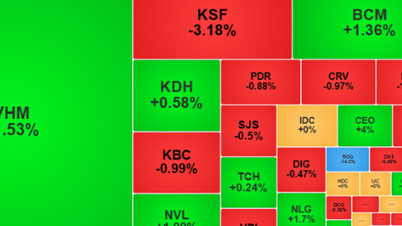

At the end of the trading session on October 8, VN-Index increased by 12.53 points (+0.74%) to 1,697.83 points; HNX-Index increased by 0.47 points (+0.17%) to 273.34 points. The market recorded widespread green with 389 stocks increasing and 285 stocks decreasing. The VN30 basket had 19 stocks increasing, 7 stocks decreasing and 4 stocks remaining unchanged.

Liquidity improved significantly when the HOSE floor recorded more than 1 billion shares matched, equivalent to a value of more than VND 31,300 billion; the HNX floor reached more than 98.2 million shares, worth more than VND 2,300 billion.

The upward momentum was consolidated in the afternoon session, helping the VN-Index surpass the 1,700-point mark at times. VHM, VCB, CTG and VNM contributed more than 8.6 points to the index, while VIC, TCB, LPB andFPT decreased in price, taking away more than 3 points.

The non-essential consumer group led the increase with 1.12%, thanks to MWG (+3.59%), FRT (+2.38%), DGW (+0.49%) and HHS (+4.09%). Real estate and essential consumer goods also increased by 0.92% and 0.78% respectively. On the contrary, information technology was the only group to decrease (-0.96%) due to pressure from FPT, DLG and VEC.

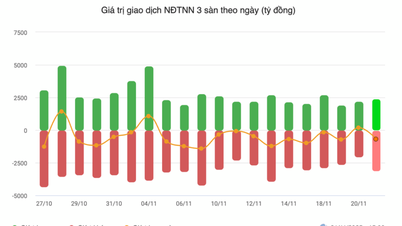

Notably, foreign investors returned to net buying more than VND154 billion on HOSE, focusing on GEX, MWG, HPG and VCB; while on HNX, they net sold VND62 billion, mainly at IDC, CEO, PLC and MST. The reversal of foreign capital to net buying is considered a positive reaction to the news of market upgrade, a factor that could create a new boost for Vietnamese stocks in the near future.

According to the latest announcement, FTSE Russell has decided to upgrade Vietnam from “frontier market” to “secondary emerging market”, effective from September 21, 2026, after a progress review in March 2026.

FTSE Russell noted that Vietnam has fully met the necessary criteria under the national equity classification framework, and recommended further improvements to the accessibility of foreign brokerage firms. The agency highly appreciated Vietnam's efforts in perfecting its trading infrastructure, especially after the Ministry of Finance and the State Securities Commission abolished the pre-trade margin requirement, one of the biggest barriers in the past.

In a report released on the same day, VinaCapital said that the upgrade by FTSE Russell is an important turning point for the Vietnamese stock market, opening up opportunities to attract international capital flows and enhance its regional position. According to the organization's forecast, after the upgrade, the market size could expand to 120% of GDP by 2030, compared to about 75% currently, in line with the Vietnam Stock Market Development Strategy to 2030 (Decision 1726/QD-TTg).

VinaCapital also believes that the upgrade could help the VN-Index revalue, with the possibility of increasing by 15-20% in the next 12-18 months, thanks to expectations of a strong return of foreign capital and corporate profit growth of about 15% per year. In addition to the valuation factor, being recognized as an emerging market will also encourage listed companies to improve governance standards, information transparency and attract more large IPOs.

Analysts say the impact of the upgrade will come in two phases: the first phase is the “anticipatory” capital flow from active funds and the second phase is the passive capital flow from global ETFs when the upgrade decision takes effect. However, Vietnam still needs to continue improving foreign investors’ access to ensure the mid-term review in March 2026 goes smoothly.

In the short term, the VN-Index approaching the 1,700-point mark reflects positive investor sentiment, but experts recommend caution with technical corrections after a strong increase. In the long term, a stable macro foundation, along with the prospect of upgrading and the Government 's support policies, are expected to help the Vietnamese stock market maintain a sustainable growth momentum, affirming its new position on the global financial map.

Source: https://baotintuc.vn/thi-truong-tien-te/khoi-ngoai-quay-lai-mua-rong-vnindex-ap-sat-moc-1700-diem-20251008155903628.htm

![[Photo] Close-up of heavy damage at the school located on the banks of the Ban Thach River](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F11%2F26%2F1764152130492_ndo_bl_img-8188-8805-jpg.webp&w=3840&q=75)

![[Photo] VinUni students' emotions are sublimated with "Homeland in the Heart: The Concert Film"](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F11%2F26%2F1764174931822_10-3878-jpg.webp&w=3840&q=75)

![[Photo] Opening of the 28th Session of the Hanoi People's Council](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/11/26/1764155991133_image.jpeg)

Comment (0)