Survey on October 7, current bank loan interest rates have decreased but not significantly. Loan interest rates are uneven.

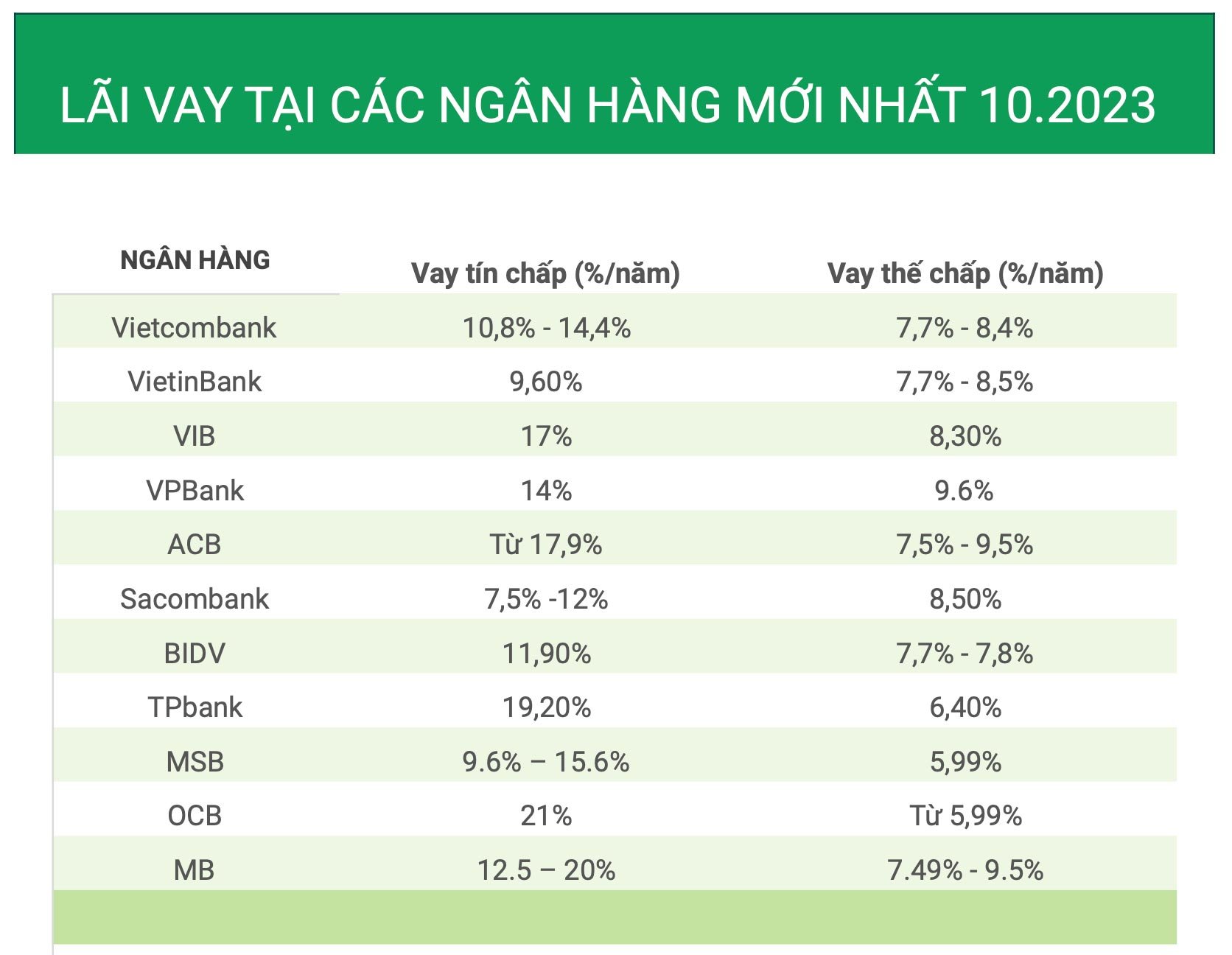

Regarding the latest unsecured interest rates of private banks in early October 2023, they range from 7.5% to 24%/year.

Specifically, Sacombank is lending at an interest rate of 7.5% -12%/year.

In the Big4 group, Vietcombank lends at interest rates from 10.8% - 14.4%/year; BIDV is lending at an interest rate of 11.9%/year.

The highest is HDBank with an interest rate of 24%/year. Next is OCB with an interest rate of 21%/year.

Details in the latest bank loan interest rate comparison table for October 2023:

Mortgage interest rates are lower, according to statistics, interest rates range from 5.99% - 9.19% / year.

Specifically, banks that are offering mortgage loans with low interest rates include: MSB, OCB (5.99%/year).

Mortgage interest rates at BIDV, Vietcombank, Vietinbank are 7.7% - 7.8%/year and 7.7% - 8.4%/year; 7.7% - 8.5%/year respectively.

Banks currently listing loan interest rates above 9%/year are VPBank (9.6%/year); ACB (7.5% - 9.5%/year); MB (7.49% - 9.5%/year).

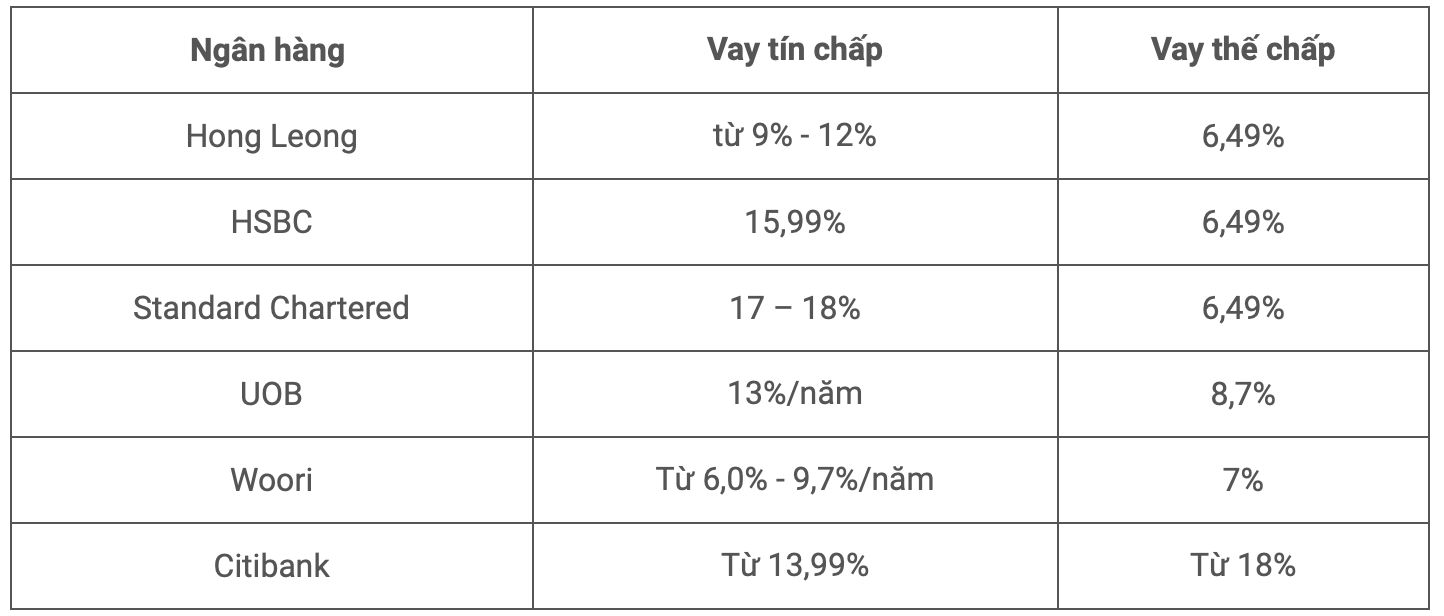

Notably, 100% foreign-owned banks are lending at much lower interest rates than domestic joint-stock commercial banks.

Accordingly, at HSBC, Hong Leong, Standard Chartered are offering mortgage loans with an interest rate of 6.49%/year.

UOB and WooriBank are offering mortgage loans at interest rates of 8.7% and 7% per year, respectively.

Current updated interest rate table for 100% foreign-owned bank loans:

Bank loan interest rates are usually agreed upon in advance between the customer and the bank and may change depending on the market and economic situation.

Normally, bank loan interest rates will be higher than savings interest rates provided by banks. The difference in bank interest rates will depend on the policies and plans of each bank, but must still comply with the regulations of the State Bank of Vietnam on not exceeding the maximum lending interest rate decided by the Governor of the State Bank of Vietnam in each period to meet some capital needs.

The latest loan interest rates listed above are preferential interest rates at banks. After the preferential period, banks will apply different interest rates.

Source

![[Photo] Cutting hills to make way for people to travel on route 14E that suffered landslides](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/08/1762599969318_ndo_br_thiet-ke-chua-co-ten-2025-11-08t154639923-png.webp)

![[Photo] "Ship graveyard" on Xuan Dai Bay](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/08/1762577162805_ndo_br_tb5-jpg.webp)

![[Video] Hue Monuments reopen to welcome visitors](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/11/05/1762301089171_dung01-05-43-09still013-jpg.webp)

Comment (0)