The highest interest rates currently belong to Bac A Bank and Vikki Bank.

Normally, banks classify 24-36 month terms as long-term terms and apply higher interest rates than short-term terms. Although some banks allow savings deposits up to 60 months, most only mobilize up to 36 months for regular deposits.

Many banks currently apply the same interest rate for 18, 24 and 36 month terms, creating flexibility for depositors. However, there are still cases such as Saigonbank and Viet A Bank that maintain a difference between these terms.

The highest interest rates currently belong to Bac A Bank and Vikki Bank, both listed at 6%/year for terms of 18 to 36 months. Following are BVBank (5.95%/year), BaoViet Bank, Viet A Bank and MBV (all 5.9%/year). The next top group includes Saigonbank, VietBank and GPBank with rates from 5.85%/year or higher.

Some major banks such as MB, TPBank, PVCombank are currently listing rates of 5.8%/year. Meanwhile, SCB maintains the lowest rate of only 3.9%/year, much lower than the general level. Vietcombank is currently applying a rate of 4.7%/year, BIDV and Agribank are both at 4.9%/year.

Small banks slightly increase short-term interest rates

As of today, the interest rate table has not recorded any new changes. In May, only 5 banks adjusted their interest rates, including two banks increasing, two banks decreasing and one bank adjusting both directions.

According to data from the State Bank, since the beginning of the year, the average deposit interest rate has only increased by about 0.08 percentage points, mainly thanks to small banks, while large banks have simultaneously reduced their rates according to management guidelines.

Since the beginning of May, only three banks have adjusted their interest rates up, including Techcombank , Bac A Bank and Eximbank. Of these, Eximbank is the latest to raise interest rates for short-term online deposits.

Specifically, the 1-2 month term increased to 4.1%/year, the 3-5 month term increased to 4.3%/year and at the end of the week it was adjusted further to 4.2% and 4.4%/year. However, at the same time, Eximbank reduced the interest rate for the 6-9 month term to 4.9%/year and the 12-15 month term to 5.1%/year.

Techcombank maintains a stable interest rate schedule of 3.25%/year for 1-month term, 3.55%/year for 3-month term and 4.55%/year for 6-month term. This rate is lower than MB – the bank is listing 3.5%/year, 3.8%/year and 4.4%/year respectively for the same terms.

Meanwhile, GPBank has sharply reduced online interest rates for most long terms. The highest rate at this bank is currently 5.85%/year for terms from 12 to 36 months, down 0.1 percentage points compared to before.

MB also reduced interest rates twice in May. Most recently, the bank reduced 0.2 percentage points for terms under 12 months, and 0.1 percentage points for longer terms. Currently, the interest rate for 1-month terms at MB is 3.5%/year, from 12 to 18 months is 4.9%/year and the highest is 5.8%/year applied to terms of 24-60 months.

In general, while some small banks such as Bac A Bank and Eximbank are trying to maintain high interest rates for short terms to attract deposits, medium and large-sized banks are focusing on reducing interest rates to control capital costs, in line with the direction of stabilizing monetary policy from the Government and the State Bank.

Source: https://baonghean.vn/lai-suat-ngan-hang-hom-nay-21-5-2025-ky-han-24-36-thang-cham-moc-6-nam-10297850.html

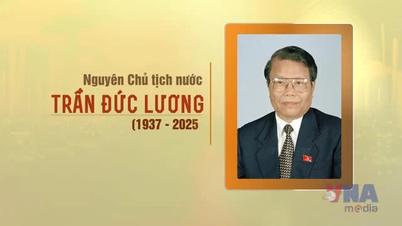

![[Photo] The Central Party Executive Committee delegation visits former President Tran Duc Luong](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/24/ded36b177fe646a1be15fcb33f749b64)

![[Photo] Anh Hoang - Dinh Duc successfully defended the men's doubles championship of the National Table Tennis Championship of Nhan Dan Newspaper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/23/d6ab3bcac02c49928b38c729d795cac6)

![[Photo] Top players gather at the 2025 Nhan Dan Newspaper National Table Tennis Championship](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/23/9ad5f6f4faf146b08335e5c446edb107)

Comment (0)