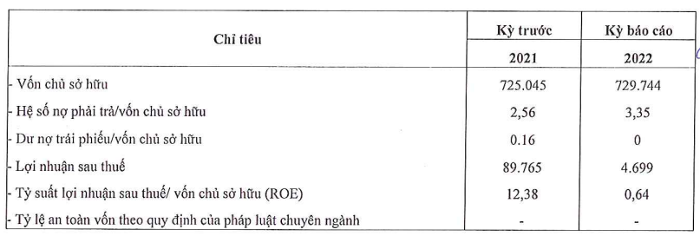

On May 24, Con Cung Investment Joint Stock Company (CCI), the parent company of the Con Cung store chain, sent a document to the Hanoi Stock Exchange (HNX) informing about the company's financial situation in 2022.

According to the report, the company recorded a profit after tax of nearly VND4.7 billion, down nearly 95% compared to the profit of VND89.7 billion in 2021. This caused the return on equity (ROE) to drop to only 0.64%.

Con Cung's equity as of December 31, 2022 reached nearly VND 730 billion, a slight increase compared to the previous year. The debt/equity ratio also increased by 3.35 times, corresponding to a debt value of VND 2,445 billion.

Notably, the bond debt/equity balance of the company operating the Con Cung chain has returned to 0, instead of 0.16 times in 2021. The bond debt balance is 0 because the bonds issued by the company have all matured in 2022.

Con Cung Investment Joint Stock Company was established in September 2015 by Mr. Nguyen Quoc Minh and Luu Anh Tien. This is the parent company of three legal entities: Con Cung Joint Stock Company (Con Cung), Liam Trading Joint Stock Company and Sakura Group Joint Stock Company.

In particular, Con Cung is a retail network of mother and baby care products focusing on directly developing the Con Cung, Toycity and CF (Con Cung Fashion) store chains. The chain currently has 708 stores in many provinces and cities across the country, mainly concentrated in Ho Chi Minh City (207 supermarkets), Dong Nai (61 supermarkets) and Binh Duong (59 supermarkets).

With profits plunging, the return on equity (ROE) will fall to 0.64 times in 2022.

Notably, CCI no longer has outstanding bonds on equity. Previously, in 2021, the company issued VND50 billion in bonds, with an interest rate of 11%/year. These are non-convertible bonds, without collateral and without stock purchase rights.

Source: Con Cung Investment Joint Stock Company

Con Cung Investment Joint Stock Company is the parent company (indirectly owned) of Con Cung Joint Stock Company - the unit that invests, owns, develops and manages the Con Cung chain of stores. The main business areas are market research and public opinion polling, management consulting, information technology services and other computer-related services.

Meanwhile, its subsidiary, Con Cung Joint Stock Company, focuses on developing retail chain systems for pregnant mothers and babies, including Con Cung, Toycity, and CF (CON CUNG FASHION).

Established in 2011, Con Cung quickly became a pioneer retail chain in providing products for mothers and babies in the Vietnamese market.

The loss-making business results occurred while Con Cung had just received a $90 million investment from Quadria Capital fund in early 2022. At the same time, the company launched a new business model, Super Center, with the first store located at Phu Dong Intersection, District 1, Ho Chi Minh City.

According to the information announced by the company, with the newly received capital, Con Cung aims to open 2,000 stores and own 200 - 300 Super Centers by 2025. At present, Con Cung has 800 stores nationwide.

At the beginning of 2022, Con Cung had 800 stores, continuing to aim for the 2,000 store mark by 2025. Con Cung's scale is therefore far surpassing other competitors such as Bibo Mart, Kids Plaza, Shoptretho and Tuti Care.

Source

![[Photo] President Luong Cuong attends the 80th Anniversary of the Traditional Day of the Armed Forces of Military Region 3](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/28/1761635584312_ndo_br_1-jpg.webp)

![[Photo] Party Committees of Central Party agencies summarize the implementation of Resolution No. 18-NQ/TW and the direction of the Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/27/1761545645968_ndo_br_1-jpg.webp)

![[Photo] The 5th Patriotic Emulation Congress of the Central Inspection Commission](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/27/1761566862838_ndo_br_1-1858-jpg.webp)

![[Photo] Draft documents of the 14th Party Congress reach people at the Commune Cultural Post Offices](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/28/1761642182616_du-thao-tai-tinh-hung-yen-4070-5235-jpg.webp)

Comment (0)