Policy Upgrading: From Challenge to Breakthrough

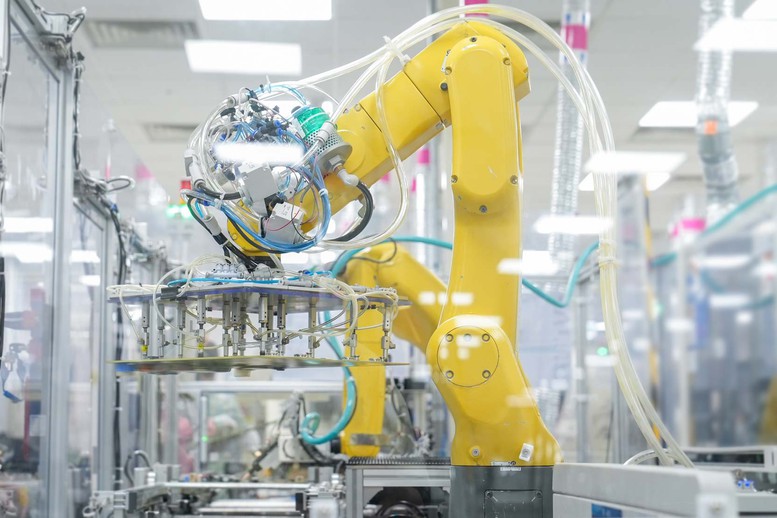

According to analysis, despite attracting more than 400 billion USD of FDI capital since 1988, most of this capital flow is still focused on assembly and processing with low added value. High-tech fields such as semiconductors, artificial intelligence or biotechnology only account for a modest proportion, not meeting the needs of national digital transformation.

The draft revised Law on High Technology aims to overcome these shortcomings by creating a more transparent and stable legal corridor. One of the notable changes is the increase in criteria for defining high-tech enterprises: enterprises must own or receive core technology transfer at the level of "innovation and development" or "mastery and improvement". At the same time, enterprises are classified into two levels, with level 1 for enterprises with domestic investors accounting for more than 30% of capital, enjoying the highest corporate income tax (CIT) incentives - 4-year exemption, 50% reduction for 9 years, 10% tax rate for 15 years. Level 2, applied to most 100% foreign-owned FDI enterprises, is only exempted from tax for 2 years, 50% reduction for 4 years and 15% tax rate.

In addition, the draft proposes to abolish the Certificate of High-Tech Enterprise and switch to a form of self-assessment based on criteria. This is aimed at reducing administrative procedures, but also poses risks to transparency and policy stability. Existing enterprises may encounter difficulties if there are no clear transitional provisions, leading to a gradual loss of incentives even though they still meet the criteria.

Double impact on FDI flows

The law amendment is expected to promote investment in high-tech production and business, contributing to the goal of making science and technology a driving force for economic development. Experts highly appreciate this effort, because high-tech FDI not only brings investment capital but also advanced technology, management knowledge and transfer opportunities to domestic enterprises.

As the experiences of South Korea, Singapore and India have demonstrated: superior incentive policies and a stable environment have helped them attract "giants" such as Samsung, Intel and Google, thereby building a strong domestic supply chain.

Mr. Bui Ngoc Tuan, Deputy General Director of Tax and Legal Advisory Services at Deloitte Vietnam, emphasized: "Policy stability and predictability are key factors in high-tech investment decisions. When the Certificate is only valid for 5 years, it will be difficult for investors to plan long-term strategies, especially for large-scale projects with investment capital of billions of USD and technology application cycles lasting 10-15 years." Mr. Tuan also noted that tightening criteria and reducing incentives could reduce Vietnam's competitiveness compared to neighboring countries.

Associate Professor Dr. Bui Tat Thang, former Director of the Institute for Development Strategy, said that Vietnam still needs to promote FDI attraction, especially in the fields of high technology and clean technology. When tax incentives are no longer the "main weapon", it is necessary to find tools other than taxes, as long as it ensures a more favorable and attractive business environment compared to other partners. He proposed the need to add non-tax support measures, such as land incentives, human resource training or research and development (R&D) support, to compensate for the decrease in tax incentives.

Policy is big enough to attract strategic investors

In order for the revised Law on High Technology to truly become a "magnet" to attract FDI, experts recommend that the Government needs to measure the actual technology absorption capacity of Vietnamese enterprises to build a suitable upgrading mechanism. Only encouraging "receiving transfers" without leading FDI flows will cause resources to be dispersed, reducing opportunities for domestic enterprises to develop.

The proposed solution is to activate all support channels: attracting FDI to create high-quality human resources; encouraging research linkages between the FDI sector - enterprises - domestic universities; promoting technology transfer through co-funding programs; developing innovative industrial clusters and funds to support domestic enterprises in receiving technology.

"The major weakness of the Vietnamese business sector is its obscure role in the global value chain," said Mr. Dau Anh Tuan, Deputy General Secretary of the Vietnam Federation of Commerce and Industry . He proposed promoting programs to connect supply and demand, provide technical support, and share production standards so that domestic enterprises can meet supplier standards, while also forming innovative industrial parks where large and small, domestic and foreign enterprises can cooperate to develop technology.

"The State needs to play the role of 'intermediary promoter' to create sustainable, effective and mutually beneficial links between economic sectors," he emphasized.

Nguyen Duc

Source: https://baochinhphu.vn/sua-luat-cong-nghe-cao-lam-sao-tang-co-hoi-giam-thach-thuc-trong-thu-hut-fdi-chien-luoc-102251030122910708.htm

![[Photo] Prime Minister Pham Minh Chinh attends the 5th National Press Awards Ceremony on preventing and combating corruption, waste and negativity](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/31/1761881588160_dsc-8359-jpg.webp)

![[Photo] Da Nang: Water gradually recedes, local authorities take advantage of the cleanup](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/31/1761897188943_ndo_tr_2-jpg.webp)

Comment (0)