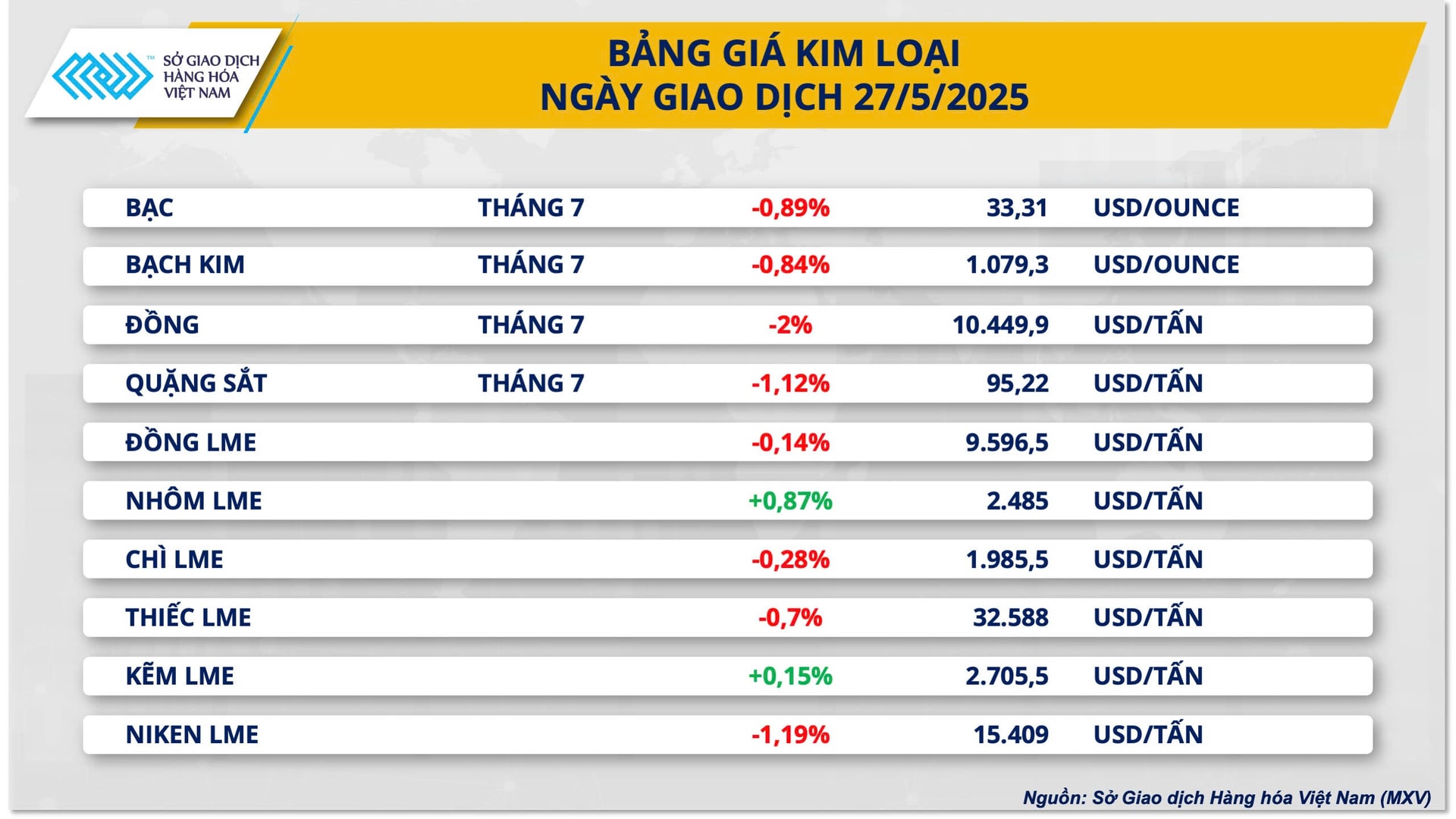

In the metal market , according to MXV, the metal market was quiet yesterday. For the precious metal group, the price of silver continued to lose 0.89 % at the end of the session, falling to 33.31 USD/ounce. Meanwhile, the price of platinum also decreased by 0.84% to 1,079.3 USD/ounce.

In yesterday's trading session, the more optimistic market sentiment due to the cooling of trade tensions between the US and the European Union (EU) weakened the demand for safe havens, causing money to flow out of the precious metals group. The US dollar index thus rose again, reaching 99.52 points. The stronger USD makes metals priced in the greenback less attractive to international investors, thereby promoting selling pressure in the market.

Thus, according to MXV, on the one hand, the demand for safe-haven assets has decreased, and on the other hand, the increased strength of the USD has caused silver prices to adjust in the short term. Currently, investors are quite cautious ahead of the June policy meeting of the US Federal Reserve (Fed).

In the base metals group, COMEX copper prices reversed sharply and fell 2% to $10,449/ton, while iron ore recorded its fourth consecutive decline, losing another 1.12% to $95.22/ton.

COMEX copper prices are also struggling amid signs of slowing demand in China. According to consultancy Everbright Futures, the copper market is entering a seasonal low point, a time when construction activity slows down due to hot and rainy weather, leading to a drop in demand for copper and iron ore.

In addition, demand for iron ore continues to be under pressure as many countries step up protection measures for the domestic steel industry, while supply shows signs of a slight increase. According to Mysteel data, total iron ore exports from Australia and Brazil in the week of May 19-25 reached 27.3 million tons, up 0.9% compared to the previous week, with Australia alone increasing by 7.8% in export volume.

On the other hand, the decline in industrial metal prices was somewhat restrained by positive business results in April from large industrial enterprises in China, with profits increasing 3% in April thanks to support policies from Beijing.

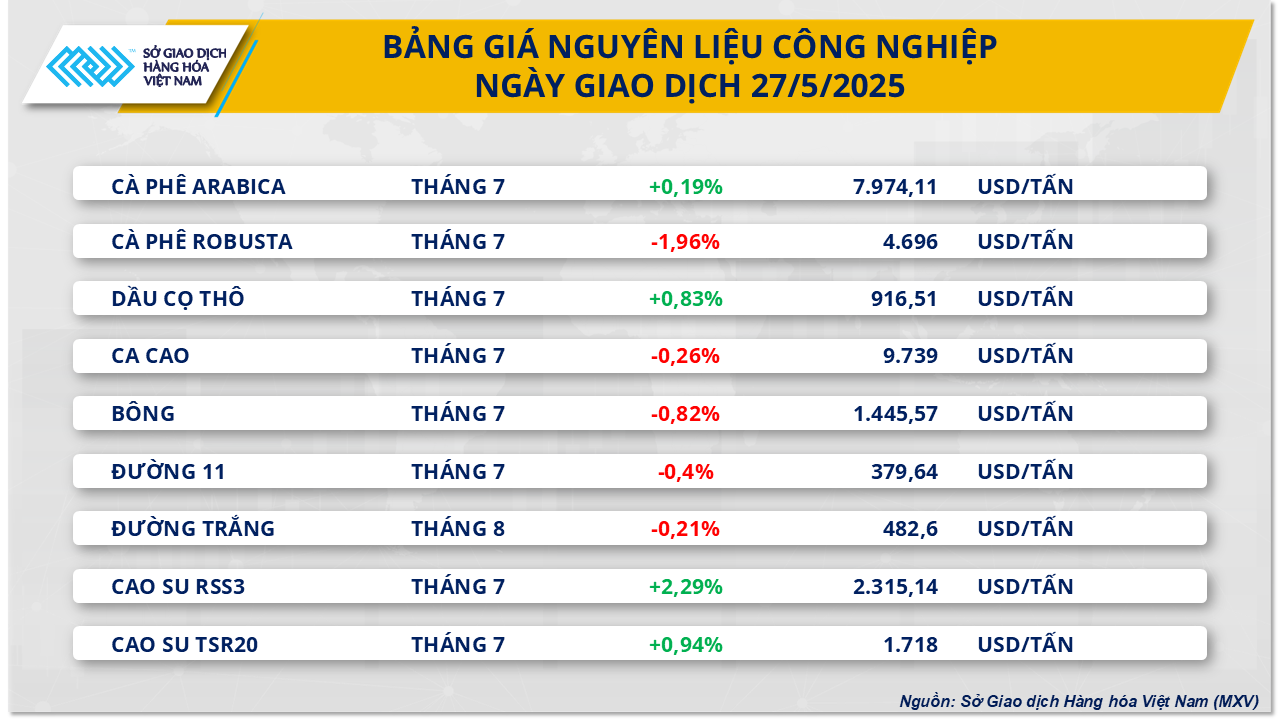

Regarding the industrial raw materials group , according to MXV , at the end of yesterday's trading session, the MXV-Index of industrial raw materials recorded a slight decrease. Notably, the prices of the two coffee products were clearly differentiated. Specifically, the Arabica coffee contract for July delivery on the ICE US exchange increased slightly by 0.19% to 7,974 USD/ton. In contrast, the Robusta coffee contract for July delivery on the ICE EU exchange decreased sharply by 1.96% to 4,696 USD/ton - the lowest level in the past 7 weeks.

The latest forecasts from Conab and USDA both show strong growth prospects for Robusta coffee supply in the world's two largest producing countries, Brazil and Vietnam, which has had a direct impact on Robusta coffee prices recently. According to Conab, Brazil's Robusta coffee output in the 2025-2026 crop year is expected to surge 27.9% year-on-year to a record 18.7 million 60-kg bags. Meanwhile, USDA also forecasts that Vietnam's Robusta output in the 2025-2026 crop year will reach 30 million 60-kg bags, up 7.1% year-on-year.

Brazil's Robusta coffee production segment has expanded its export market share significantly, targeting international consumer markets. Data shows that Brazil's Robusta exports have grown impressively over the years, from 1.47 million bags in the 2022-23 crop year to 8.24 million bags in the 2023-24 crop year. However, in the first 10 months of the current crop year (July 2024 to June 2025), Robusta exports reached 5.89 million bags, down 9.98% compared to the same period last year, mainly due to the impact of the El Niño phenomenon causing prolonged hot and dry weather, affecting the flowering and fruiting stages in the main growing areas.

However, with ample supplies forecast for the coming crop year thanks to favorable weather conditions and high yields in Espírito Santo and Bahia, Brazil’s Robusta exports are expected to recover strongly.

Source: https://baodaknong.vn/thi-truong-hang-hoa-28-5-sac-do-bao-phu-tren-bang-gia-253849.html

![[Photo] Vietnamese and Hungarian leaders attend the opening of the exhibition by photographer Bozoky Dezso](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/29/94d8ceca5db14af3bf31285551ae4bb3)

![[Photo] Prime Minister Pham Minh Chinh receives leaders of Excelerate Energy Group](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/29/c1fbe073230443d0a5aae0bc264d07fe)

![[Photo] Prime Minister Pham Minh Chinh meets with Hungarian President Sulyok Tamas](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/29/dbcaa73e92ea4448a03fe1d0de6d68e8)

Comment (0)