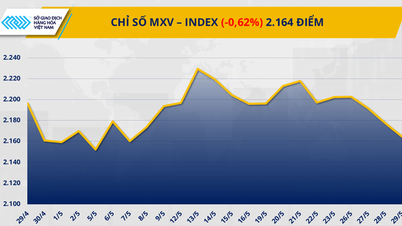

The Vietnam Commodity Exchange (MXV) said that at closing, the MXV-Index decreased slightly by 0.2% to 2,213 points.

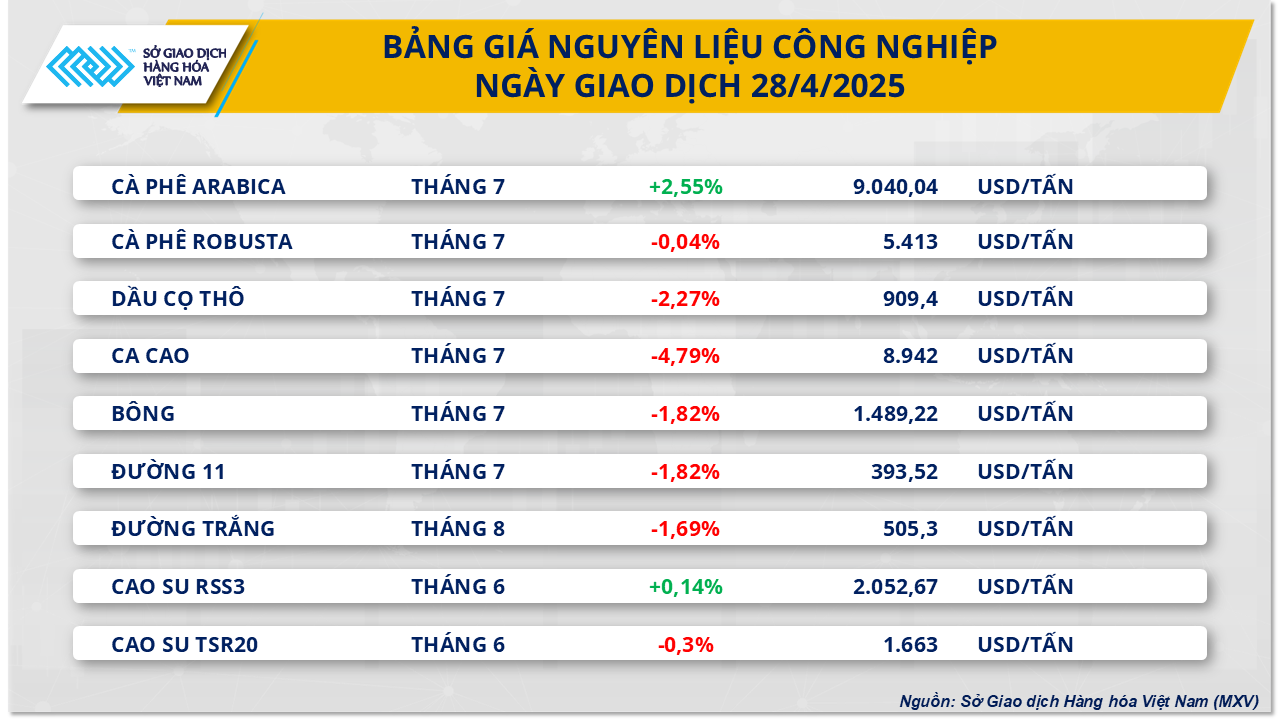

The market for industrial raw materials has mixed fluctuations. Source: MXV

Arabica coffee prices on the New York Stock Exchange continued to increase, recording an increase of 2.55% to 9,040 USD/ton. This is the 5th consecutive increase, of which 4 sessions increased by over 2%, bringing Arabica prices to the highest level in 2 and a half months.

In contrast, Robusta coffee prices on the London floor remained almost unchanged, staying at $5,413/ton, reflecting the market's short-term tug-of-war.

Arabica coffee prices have recovered strongly recently, not only due to tight global supply, but also affected by the instability of financial markets.

Notably, the recent continuous weakening of the USD has caused the USD/BRL exchange rate to drop sharply, thereby supporting the upward momentum of Arabica on the New York Stock Exchange.

On the other hand, cocoa prices on the New York floor fell sharply by 4.79% at the end of the session on April 28.

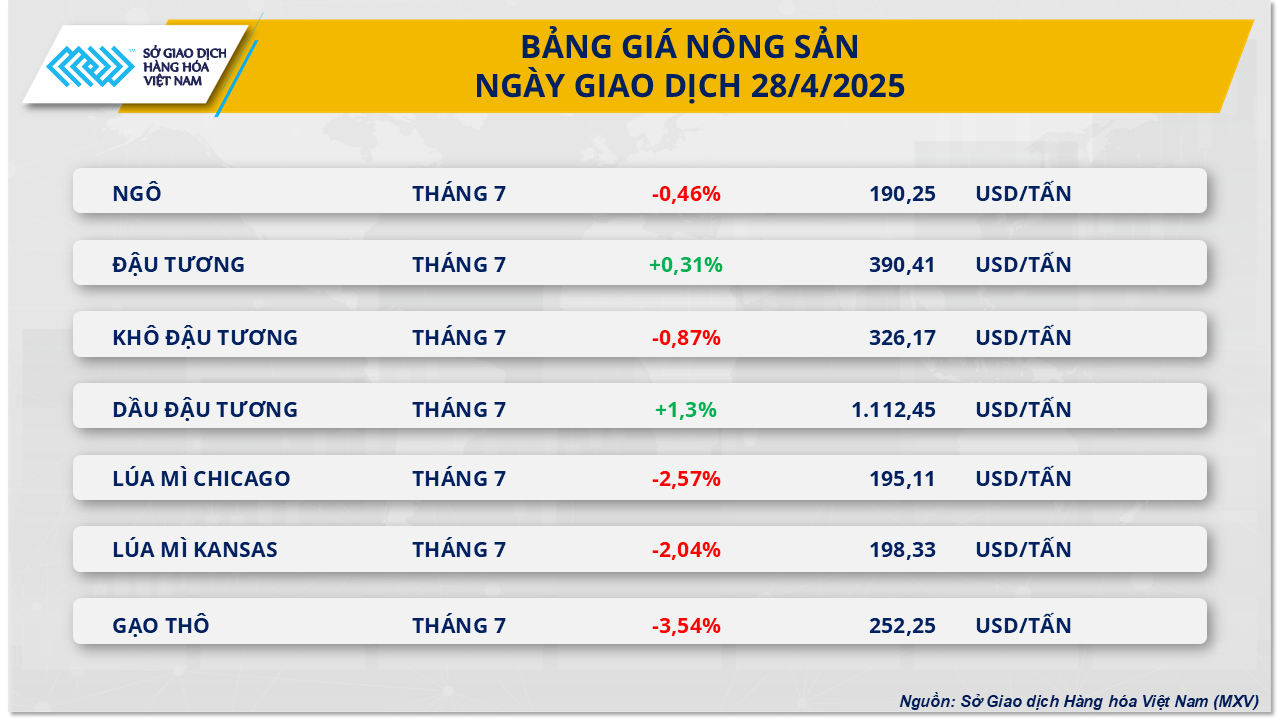

Agricultural commodity market is mixed with green and red. Source: MXV

According to MXV, going against the general trend of the agricultural market, soybeans just experienced the first trading session of the week with prices recovering thanks to the push from the increase in soybean oil, while market sentiment stabilized again due to positive signals about tariff policies.

At the end of the session, the price of soybean futures for July delivery recorded an increase of more than 0.3% to 390 USD/ton.

Meanwhile, soybean oil prices rose more than 1%, marking their highest close since December 2023. The recovery of Malaysian palm oil and expectations of a new biofuel support policy in the US continue to reinforce the positive outlook for the soybean oil market, thereby indirectly supporting soybean prices in the short term.

Source: https://hanoimoi.vn/thi-truong-hang-hoa-dien-bien-trai-chieu-700732.html

![[Photo] Prime Minister Pham Minh Chinh receives leaders of Excelerate Energy Group](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/29/c1fbe073230443d0a5aae0bc264d07fe)

![[Photo] Prime Minister Pham Minh Chinh attends the event "Digital transformation of the banking industry by 2025"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/29/0e34cc7261d74e26b7f87cadff763eae)

Comment (0)