Foreign exchange rates, USD/VND exchange rate today, September 2, recorded that the USD has recovered well, anchored at 101.73.

Foreign exchange rate update table - Vietcombank USD exchange rate today

| 1. VCB - Updated: September 2, 2024 09:25 - Website time of supply source | ||||

| Foreign currency | Buy | Sell | ||

| Name | Code | Cash | Transfer | |

| Australian Dollar | AUD | 16,476.93 | 16,643.36 | 17,191.71 |

| Canadian Dollar | CAD | 17,972.86 | 18,154.40 | 18,752.53 |

| SWISS FRANC | CHF | 28,552.73 | 28,841.14 | 29,791.36 |

| YUAN RENMINBI | CNY | 3,431.90 | 3,466.56 | 3,581.31 |

| DANISH KRONE | DKK | - | 3,624.00 | 3,765.93 |

| EURO | EUR | 26,832.82 | 27,103.86 | 28,327.84 |

| Sterling Pound | GBP | 31,917.54 | 32,239.94 | 33,302.15 |

| HONG KONG DOLLAR | HKD | 3,106.12 | 3,137.50 | 3,240.87 |

| INDIAN RUPEE | INR | - | 295.45 | 307.52 |

| YEN | JPY | 166.07 | 167.74 | 175.91 |

| Korean Won | KRW | November 16 | 17.90 | 19.55 |

| KUWAITIAN DINAR | KWD | - | 81,167.50 | 84,483.28 |

| MALAYSIAN RINGGIT | MYR | - | 5,690.78 | 5,819.77 |

| NORWEGIAN KRONER | NOK | - | 2,312.56 | 2,412.76 |

| Russian Ruble | RUB | - | 258.81 | 286.74 |

| SAUDI RIAL | SAR | - | 6,604.07 | 6,873.85 |

| SWEDISH KRONA | SEK | - | 2,377.63 | 2,480.66 |

| SINGAPORE DOLLAR | SGD | 18,595.23 | 18,783.06 | 19,401.90 |

| THAILAND BAHT | THB | 648.89 | 720.99 | 749.22 |

| US DOLLAR | USD | 24,660.00 | 24,690.00 | 25,030.00 |

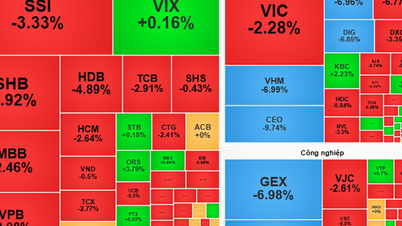

Exchange rate developments in the domestic market

In the domestic market, according to TG&VN at 7:30 a.m. on September 2, the State Bank announced the central exchange rate of the Vietnamese Dong to the USD at 24,224 VND.

The reference USD exchange rate at the State Bank's Transaction Office is listed at: 23,400 VND - 25,385 VND.

USD exchange rates at commercial banks buying and selling are as follows:

Vietcombank: 24,660 VND - 25,030 VND.

Vietinbank : 24,570 VND - 25,020 VND.

|

| Foreign exchange rates, USD/VND exchange rate today, September 2: USD has recovered. (Source: Vietnamnet) |

Exchange rate developments in the world market

The Dollar Index (DXY), which measures the USD against six major currencies (Euro, JPY, GBP, CAD, SEK, CHF), stopped at 101.73.

The DXY index recovered last week after falling sharply since early August. The index initially hit a low of 100.51 and then recovered well from there.

Data released on August 30 showed that the US Personal Consumption Expenditures (PCE) - the US Federal Reserve's (Fed) inflation measure - increased slightly in August.

The US PCE index rose 2.5% (year-on-year) in August, up from 2.47% in July. The US PCE data helped the 10-year Treasury yield rise nicely late last week.

The DXY index has resistance right at 101.75. If the current bullish momentum continues, a break above 101.75 could push the index up to the 102.50-102.70 zone this week. But if the DXY index declines from here, it could fall back to 100.50 again, possibly even to the 100-99.50 zone in the future.

The US 10-year bond yield has been stuck between 3.75% and 3.95%. The general view remains bearish. The 10-year bond yield is expected to break through 3.75% and fall to 3.5% in the coming weeks. This decline may not happen immediately, but may be gradual.

Moreover, given this decline, the current sideways move may continue for some time.

If yields break above 3.95%, a short-term rise to the 4-4.05% range is possible. The likelihood of a rise above 4.05% is low. If yields remain below 4.05%, the overall downtrend will remain intact.

On the other hand, the EUR/USD index fell more than 1% last week. The currency hit a high of 1.1202 and then fell sharply, breaking below the intermediate support level of 1.11.

Current support for the index is at 1.10, which could be tested this week. A bounce from 1.10 could send the euro back up to 1.11. But a break below 1.10 could drag it down to the 1.0930-1.09 zone.

Price action around the 1.10 mark will need to be closely watched this week.

Source: https://baoquocte.vn/ty-gia-ngoai-te-ty-gia-usdvnd-hom-nay-29-usd-da-phuc-hoi-284740.html

![[Photo] National Assembly Chairman Tran Thanh Man receives Chairman of the House of Representatives of Uzbekistan Nuriddin Ismoilov](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/27/1761542647910_bnd-2610-jpg.webp)

![[Photo] The 5th Patriotic Emulation Congress of the Central Inspection Commission](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/27/1761566862838_ndo_br_1-1858-jpg.webp)

![[Photo] Party Committees of Central Party agencies summarize the implementation of Resolution No. 18-NQ/TW and the direction of the Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/27/1761545645968_ndo_br_1-jpg.webp)

Comment (0)