Silver price today (November 5), world silver market and domestic silver market continue to decrease due to pressure from many factors.

Silver price today at Phu Quy Gold Investment Joint Stock Company, silver price is listed at 1,204,000 VND/tael (buy) and 1,241,000 VND/tael (sell) in Hanoi. In addition, according to a survey at other trading locations in Hanoi, silver price is currently listed at 1,003,000 VND/tael (buy) and 1,033,000 VND/tael (sell). In Ho Chi Minh City, silver price is listed higher, at 1,005,000 VND/tael (buy) and 1,035,000 VND/tael (sell). World silver price is at 828,000 VND/ounce (buy) and 833,000 VND/ounce (sell).

Specifically, the latest information on silver prices today in the two largest markets of Hanoi and Ho Chi Minh City on November 5, 2024:

Silver type | Unit | Hanoi | Ho Chi Minh City | ||

Buy | Sell out | Buy | Sell out | ||

99.9 silver | 1 amount | 1,003,000 | 1,033,000 | 1,005,000 | 1,035,000 |

| 1 kg | 26,746,000 | 27,544,000 | 26,798,000 | 27,595,000 | |

| Silver 99.99 | 1 amount | 1,007,000 | 1,037,000 | 1,009,000 | 1,039,000 |

| 1 kg | 26,842,000 | 27,656,000 | 26,894,000 | 27,707,000 | |

Update the latest silver price list of Phu Quy Gold Investment Joint Stock Company on November 5, 2024:

Silver type | Unit/VND | Hanoi | |

Buy | Sell out | ||

Silver bars, Phu Quy 999 silver bars | 1 amount | 1,204,000 | 1,241,000 |

| Phu Quy 999 Silver Bar | 1 kg | 32,106,586 | 33,093,251 |

Latest update on world silver price on November 5, 2024:

| Unit | World silver price today (VND) | |

Buy | Sell out | |

| 1 Ounce | 828,000 | 833,000 |

| 1 finger | 99,844 | 100,454 |

| 1 amount | 998,000 | 1,005,000 |

| 1 kg | 26,625,000 | 26,788,000 |

The metal market ended the past trading week with mixed performance. For the precious metals group, both silver and platinum prices adjusted down after two consecutive weeks of increase, closing the week at 32.68 USD/ounce and 1,002.9 USD/ounce, respectively.

The main reason is that the precious metal's safe-haven role has been weakened by the rising US bond yields and USD exchange rate. Specifically, the 10-year US government bond yield has increased to 4.36% - the highest level in the past 4 months, while the Dollar Index has climbed to 104.28 points, maintaining the three-month peak.

In addition, the expectation that the US Federal Reserve (FED) will lower interest rates in the coming time, after the personal consumption expenditure (PCE) price index increased more slowly than expected. Lower interest rates reduce the opportunity cost of holding non-yielding assets, leading investors to shift to higher-yielding channels such as stocks, which is also the reason for the weakening of silver prices.

Source: https://congthuong.vn/gia-bac-hom-nay-5112024-bac-dieu-u-chi-nh-gia-m-sau-2-tua-n-tang-lien-tiep-356670.html

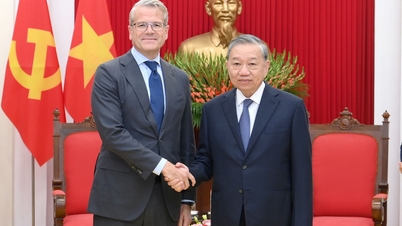

![[Photo] General Secretary To Lam receives Slovakian Deputy Prime Minister and Minister of Defense Robert Kalinak](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/18/1763467091441_a1-bnd-8261-6981-jpg.webp)

Comment (0)