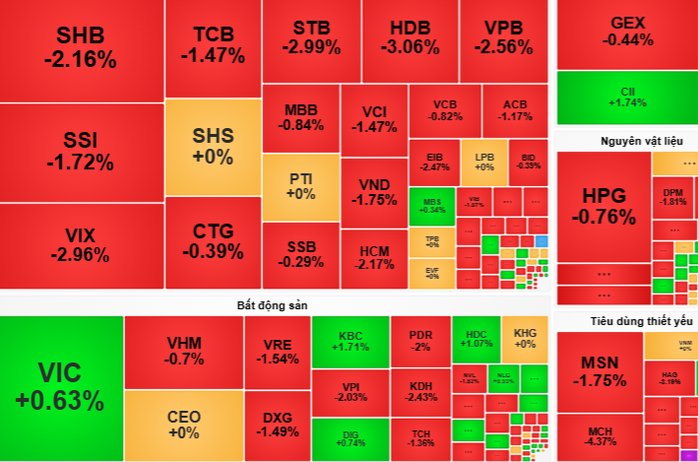

VN-Index on November 6 closed at 1,642 points, down 12 points (-0.74%)

The trading session on November 6 was full of drama. The opening morning, VN-Index increased slightly thanks to the push from bluechips such as VIC (Vingroup), GVR (Vietnam Rubber) and the industrial park duo BCM (Becamex IDC), VGC (Viglacera). However, the increase was quickly extinguished by the selling pressure in the banking, technology (FPT ), aviation (VJC) and retail (MWG) groups. The index hovered around 1,654 points before closing the morning session at 1,640 points, down 14 points.

In the afternoon session, the sudden return of demand in the banking group and the Vingroup ecosystem helped the index narrow the decline significantly, even turning green at times. However, the increased supply pressure towards the end of the session, especially in the banking and securities stocks, pulled the VN-Index to close at 1,642 points, down 12 points (-0.74%).

Notably, the sharp decline in liquidity reflects the prevailing cautious sentiment. Foreign investors net sold more than VND1,067 billion, focusing on selling STB, VPB and HPG - continuing to be a factor putting pressure on the index.

According to VCBS Securities Company, the adjustment session on November 6 with low liquidity shows that the market is in the phase of "re-testing" the accumulation zone. Investors should closely follow the fluctuations, promptly restructure the portfolio when stocks reach the stop-loss/take-profit threshold, and closely monitor the codes that maintain the support zone to prepare for disbursement when the VN-Index is balanced.

Dragon Capital Securities Company (VDSC) commented that cash flow is cautious after the recovery of 1,600 points. If the 1,620-1,640 point area attracts new demand, the market may bounce back. On the contrary, if demand is weak and supply overwhelms, the risk of support breaking and deeper correction will exist.

In the generally gloomy context, the oil and gas group (PVS, PVD, GAS...) and public investment (CTD, HBC, C4G...) emerged as relatively bright spots thanks to the ability to maintain prices and expectations from year-end budget disbursement, stable oil prices, and progress of key infrastructure projects.

Investors are advised to closely monitor the performance of each code, combining cash flow signals to disburse part of the investment. Patience and selection will be the key in the period when the market is testing the accumulation zone.

Source: https://nld.com.vn/chung-khoan-ngay-7-11-cho-tin-hieu-de-giai-ngan-co-phieu-dau-khi-196251106174029319.htm

![[Photo] Closing of the 14th Conference of the 13th Party Central Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/06/1762404919012_a1-bnd-5975-5183-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh receives the delegation of the Semiconductor Manufacturing International (SEMI)](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/06/1762434628831_dsc-0219-jpg.webp)

Comment (0)