VN -Index breaks its upward streak

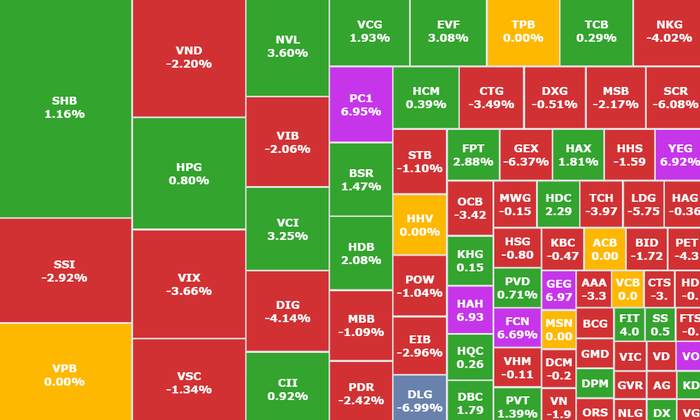

After nearly 4 months of continuous price increases and 6 weeks of strong gains, surpassing the historical peak since 2022, liquidity increased dramatically, VN-Index ended July with a decrease.

At the end of the week, the VN-Index decreased by -2.35% to 1,495.21 points after 5 trading sessions. The highlight of the week was the historic liquidity session, when the matched volume reached 2.7 billion shares, the transaction value was nearly 72,000 billion VND in the session on July 29, 2025.

On the contrary, at Hanoi Stock Exchange, the two indices HNX-Index and UPCoM-Index increased by 4.07% to end the week at 264.93 points and increased by 0.63% to reach 106.46 points, respectively.

VN-Index slightly decreased after 1 week of trading (Screenshot: SSI iBoard)

Market breadth is tilted towards the selling side, as short-term selling pressure increases sharply after the previous period of increase. Most familiar and market-oriented stock groups such as banks, securities, and real estate have slowed down their growth or adjusted, fluctuating according to the status of the VN-Index.

In terms of industry groups, there was strong downward pressure in the retail, telecommunications, seafood, agriculture , steel, real estate, etc. groups. Meanwhile, the securities and shipping groups continued to increase in price and only began to face strong selling pressure in the last session of the week.

The price increase effort mainly comes from individual stocks such asSHB (SHB, HOSE), PET (PETROSETCO, HOSE), KBC (Kinh Bac Urban Area, HOSE), HDC (HODECO, HOSE), HAH ), VSC (Vinconship, HOSE),…

Liquidity continued to explode when the average matched transaction value reached VND 46,322 billion/session, a sharp increase of +36.5% compared to last week and the highest level ever.

Last week was the second consecutive week of net selling by foreign investors in the market. Net selling value increased significantly, up to nearly VND 4,900 billion from VND 1,940 billion last week. The focus of net selling trend belonged to the codes: FPT (FPT, HOSE), HPG (Hoa Phat Steel, HOSE), SSI (SSI Securities, HOSE), CTG (VietinBank, HOSE),...

The market received a lot of important macro news last week. On August 1, US President Donald Trump announced that the US tax rate for Vietnam is 20% (adjusted from the previous rate of 46%). With the above tax rate, many experts believe that Vietnam can still maintain its competitive position with other countries in the supply chain.

Top most profitable businesses in the second quarter of 2025

The picture of the financial statements (FS) for the second quarter of 2025 has been revealed, the banking group once again affirmed its pivotal role when accounting for half of the list of 20 companies with the highest profits. Notably, VietinBank (CTG, HOSE) rose to the leading position, surpassing traditional competitors to record the highest profit in the period.

Accordingly, the "bank" reported pre-tax profit of VND12,097 billion in the second quarter of 2025, up 79% over the same period last year. This result came from a sharp reduction in credit risk provisioning costs, down 62% over the same period, while net revenue increased slightly by 3.3%, reaching VND15,842 billion.

The banking group accounts for 7 names in the top 10 leading the market in terms of business results in the second quarter of 2025. Illustrative photo

Next is Vietcombank (VCB, HOSE) in second place with pre-tax profit reaching VND 11,034 billion, up 9% compared to the second quarter of 2024.

Following is Vinhomes (VHM, HOSE), the only non-financial enterprise in the top, with pre-tax profit of VND9,106 billion, although it decreased by 26% due to the project handover schedule mainly falling in the second half of the year.

Ranked fourth is BIDV (BID, HOSE) with a profit of VND8,625 billion, up 6% over the same period. Ranked fifth is Techcombank (TCB, HOSE) closely following with VND7,899 billion.

Following this list in the top 10 is a series of other "banks", including: MB (MBB, HOSE); VPBank (VPB, HOSE), ACB (ACB, HOSE),...

In the Top 10 most profitable enterprises alone, there are 7 names coming from the banking industry, showing a clear recovery of this sector in the context of the economy starting to recover, reflecting the effectiveness in cost control, provisioning and credit expansion.

Data from FiinTrade shows that, as of the end of July, the total after-tax profit of nearly 1,000 listed companies, accounting for more than 97% of the total market capitalization, increased by 33.6% compared to the same period last year. Of which, the non-financial group increased by 53.8%, while the financial group, led by banks, increased by 17.9%.

With the State Bank of Vietnam setting a credit growth target of 16% this year, analysts expect listed banks' profits to continue to increase in the second half of the year, consolidating their leading position in the stock market.

August stock scenario

The Vietnamese stock market (TTCK) has just closed July 2025 with a strong impression: VN-Index closed at 1,502.5 points, up 127 points (+9.2%) compared to the end of June. However, the selling pressure suddenly increased in the afternoon of the same day, combined with the weakening demand, causing the index to drop sharply, closing below the 1,500 mark.

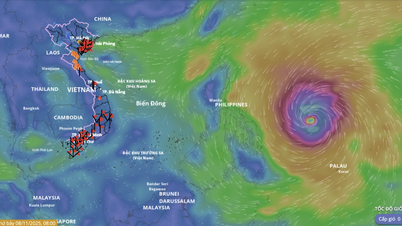

Entering August, after a series of hot increases and a correction at the end of July, the market is facing a clear state of shaking around the peak area.

Therefore, experts say that, entering the new month, investors are starting to worry about the possibility of a repeat of the rapid and deep decline of 12-14% that happened in 2021, the VN-Index could fall back to around 1,330 points, causing significant losses for investors. However, the market is now different: the economy is more stable, institutional and foreign cash flow is more positive, and listed companies also have a more solid foundation.

The current period of fluctuations is natural after a long period of increase. Instead of fearing a deep decline, investors should carefully observe the industry groups that benefit from economic growth, FDI capital flows and stick to long-term strategies. During this adjustment period, many groups are going up, such as public investment, seaports, shipping, oil and gas, mining, etc.

However, the factors supporting the market in August continued to be present. Cash flow remained in the market and tended to rotate between industry groups, instead of withdrawing completely after the adjustment sessions. Demand from the institutional sector remained stable, playing a supporting role in the psychology of individual investors during fluctuations. In addition, macro information on tariffs between the US and Vietnam, if resumed, would be an important lever to help the market recover.

To manage risks, investors should allocate their portfolios reasonably, avoiding the psychology of selling off or chasing noise signals. They should maintain the margin ratio at a safe level; continue to hold stocks that are recovering from the support zone, or consider increasing the proportion during short-term corrections. In addition, investors with a high proportion of cash can disburse part of their investment into the group of stocks that are attracting speculative cash flow, and still have room to increase compared to the nearest resistance zone.

Short term market fluctuations, opportunities with money-sucking stocks

According to analysis of Vietcombank Securities (VCBS), the market has experienced a week of strong fluctuations and is in the process of balancing and accumulating momentum. The plus point is that cash flow still shows signs of disbursement, although there has been differentiation between industry groups or individual stocks with their own stories or positive Q2 business results. However, the large-cap group has not yet reached a consensus, so the risk of fluctuations/adjustments still exists.

With the current situation, the analysis team recommends that investors should maintain a safe margin ratio, continue to hold stocks showing signs of recovery from the support zone, and consider increasing the proportion of these stocks during market fluctuations.

In addition, Asean Securities assessed that the stock market will likely continue to fluctuate in the short term. The index's near support zone is the 1,480 - 1,485 threshold while the near resistance is the 1,500 - 1,510 area.

Investors with a high proportion of stocks should only prioritize holding representatives with strong cash flow, maintaining a short-term uptrend and moving stronger than the general market. Investors with a large proportion of cash can disburse part of the capital during fluctuations, prioritizing leading sectors with support from macro policies: Banking, Securities, Real Estate ,...

With the medium-term buy-and-hold school, investors can allocate more weight to leading stocks, with prospects for profit growth in 2025 and are significantly discounted in price, while the stocks have returned to strong support levels on the technical chart.

Comments and recommendations

Ms. Nguyen Minh Chau, Consultant, Mirae Asset Securities (Vietnam) assessed that VN-Index had the most negative trading week since the collapse due to "tariffs" until now, foreign investors returned to sell off strongly, with a total net selling value of more than 4,600 billion in the whole week, which was also a significant pressure on the index. In general, with many of these warning signals, VN-Index is likely to confirm a short-term peak.

VN-Index continues to "struggle" with a downward trend this week

Regarding macro information, in addition to the positive signs of US tariffs on Vietnam, the US capital inflow trend over the past 6 months has been decreasing. The reasons for this are (1) Turbulent geopolitics (2) US businesses are affected by their own tariff policies. Emerging markets with stable geopolitics and high growth potential such as Vietnam are becoming destinations for foreign investment flows. This has been demonstrated by the net buying momentum in the Vietnamese market reaching 8,717 billion in July. This trend is expected to be further promoted at the end of the year because of the event of upgrading Vietnam's stock market.

However, in general, in the short term, speculative cash flow is scattered in individual stocks, no longer spreading to leading groups like in mid-July, showing that the internal market force is weakening, and investors need to be cautious. VN-Index may continue to struggle, even maintain a downward correction trend this week.

Investors need to keep a "cool head", turn on defense mode to preserve the achievements of the past 3 months, or at least not to "erode" their capital. Therefore, she recommends that at this time, investors need to analyze and select to find "super stocks" for the third quarter of 2025 from the published data of the second quarter, and prepare to buy when a good price range appears.

The industry groups for the end of the year will be the key industries for economic growth: Banking, Public Investment (construction materials), Consumption and Real Estate.

Phu Hung Securities believes that the VN-Index fell below 1,500 points, with matching orders lower than the 20-session average, showing hesitation from both buyers and sellers. This week, the index may continue to fluctuate to consolidate the price base, the recovery momentum will only be confirmed when the VN-Index breaks out and maintains above 1,525 points; if it continues below this mark, the correction pressure may pull it back to the 1,460 - 1,470 point range. For new buyers, it is necessary to observe the stock reaction when adjusting to the medium-term support zone. Priority groups include Banking, Real Estate, Securities, Steel and Utilities (Electricity).

Dividend payment schedule this week

According to statistics, there are 34 enterprises that have decided to pay dividends for the week of August 4 - August 8, of which 22 enterprises pay in cash, 7 enterprises pay in shares, 4 enterprises give bonus shares and 1 enterprise pays mixed dividends.

The highest rate is 100%, the lowest is 4.5%.

7 businesses pay by stock:

Metallurgical Engineering JSC (SDK, UPCoM), ex-right trading date is August 4, rate 20%.

Phat Dat Real Estate Development Corporation (PDR, UPCoM), ex-dividend date is August 4, rate 8%.

Quang Nam Mineral Industry JSC (MIC, HNX), ex-right trading date is August 4, rate 55%.

Dabaco Vietnam Group Corporation (DBC, HOSE), ex-right trading date is August 7, rate 15%.

Vietnam Airports Corporation (ACV, UPCoM), ex-right trading date is August 7, rate 65%.

CEO Group Corporation (CEO, HNX), ex-dividend date is August 7, rate 5%.

Tien Phong Technology Corporation (ITD, HOSE), ex-right trading date is August 7, rate 7%

4 companies award shares:

Advertising and Trade Fair Joint Stock Company (VNX, UPCoM), ex-right trading date is August 4, rate 70%.

Ho Chi Minh City Infrastructure Investment Corporation (CII, HOSE), ex-dividend date is August 5, rate 14%.

Bac Kan Minerals JSC (BKC, HNX), ex-right trading date is August 7, rate 100%.

Orient Commercial Joint Stock Bank (OCB, HOSE), ex-dividend date is August 8, rate 8%.

1 mixed enterprise:

In addition to cash payment , Hai An Transport and Stevedoring JSC (HAH, HOSE) also pays in shares with the ex-dividend date being August 7, at a rate of 30%.

Cash dividend payment schedule

*Ex-dividend date: is the transaction date on which the buyer, upon establishing ownership of shares, will not enjoy related rights such as the right to receive dividends, the right to buy additional issued shares, but will still enjoy the right to attend the shareholders' meeting.

| Code | Floor | Global Education Day | Day TH | Proportion |

|---|---|---|---|---|

| PWS | UPCOM | 4/8 | August 28 | 10% |

| KHW | UPCOM | 4/8 | August 29 | 17% |

| NTH | HNX | 4/8 | August 21 | 10% |

| NBC | HNX | 4/8 | August 15 | 5% |

| TNC | HOSE | 4/8 | September 25 | 16% |

| VID | HOSE | 4/8 | August 19 | 5% |

| VFG | HOSE | 4/8 | August 20 | 10% |

| BRC | HOSE | 5/8 | August 20 | 12% |

| IFS | UPCOM | 5/8 | 9/9 | 19.8% |

| PLE | UPCOM | 5/8 | August 28 | 9.5% |

| TSG | UPCOM | 6/8 | August 15 | 11% |

| THN | UPCOM | 6/8 | August 15 | 13.2% |

| GMX | HNX | 6/8 | August 28 | 12% |

| SSC | HOSE | 6/8 | August 29 | 20% |

| NNC | HOSE | 7/8 | August 29 | 10% |

| TIP | HOSE | 7/8 | August 15 | 16% |

| HAH | HOSE | 7/8 | August 28 | 10% |

| PNP | UPCOM | 7/8 | August 28 | 16% |

| MVC | UPCOM | 7/8 | August 29 | 4.5% |

| SBL | UPCOM | 7/8 | August 21 | 5% |

| TQW | UPCOM | 8/8 | August 29 | 6% |

| PTP | UPCOM | 8/8 | 3/9 | 9% |

| PNT | UPCOM | 8/8 | August 22 | 5% |

Source: https://phunuvietnam.vn/chung-khoan-tuan-4-8-8-8-vn-index-rung-lac-ngan-han-nha-dau-tu-can-giu-dau-lanh-20250804000943629.htm

![[Photo] Heavy damage after storm No. 13 in Song Cau ward, Dak Lak province](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/08/1762574759594_img-0541-7441-jpg.webp)

![[Photo] "Ship graveyard" on Xuan Dai Bay](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/08/1762577162805_ndo_br_tb5-jpg.webp)

![[Video] Hue Monuments reopen to welcome visitors](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/11/05/1762301089171_dung01-05-43-09still013-jpg.webp)

Comment (0)