In the first 10 months of this year, the technical systems of the Information Security Department ( Ministry of Information and Communications ) received more than 220,000 reports of fraud, with the majority of cases related to finance and banking.

The alarming figures mentioned above were shared by Mr. Le Van Tuan, Director of the Information Security Department (Ministry of Information and Communications), at the plenary session of the Smart Banking 2024 conference and exhibition, jointly organized by the Vietnam Banking Association and IEC on October 29th in Hanoi .

With the theme "Shaping the Digital Future for the Banking Industry: Safe and Sustainable Operational Strategies," this year's Smart Banking competition emphasizes the importance of safety measures and sustainable development strategies for the banking sector.

Recognizing that the theme of Smart Banking 2024 is very practical for banks, and highlighting some outstanding results in the industry's digital transformation, Deputy Governor of the State Bank of Vietnam Pham Tien Dung pointed out that connecting and integrating with many entities also brings significant risks to banks.

Specifically, in addition to the security risks if not handled carefully, another risk for banks is having to stop providing services when one element in the ecosystem encounters a problem.

According to Mr. Nguyen Quoc Hung, Vice President and General Secretary of the Vietnam Banking Association, the banking industry is undergoing a strong transformation, from the application of new technologies such as artificial intelligence (AI) and blockchain, to the development of digitized financial products and services.

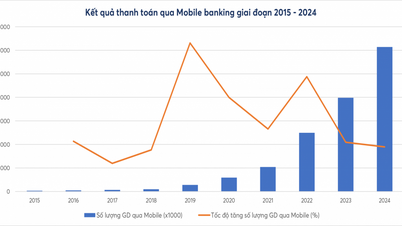

Statistics show that, to date, over 87% of adult Vietnamese people have a payment account at a bank; many banks have over 95% of their transactions processed digitally.

The positive developments in the banking industry not only help improve operational efficiency but also create many new opportunities for banks in serving customers and enhancing user experience.

"However, alongside the opportunities, the banking industry also faces numerous challenges. Competition is increasing, and the requirements for information security and compliance with legal regulations are becoming more stringent," said Mr. Nguyen Quoc Hung.

Speaking from the perspective of a state management agency in the field of cybersecurity, Director of the Cybersecurity Department Le Van Tuan stated: Online transaction systems are the lifeblood of the digital economy , and incidents and cyberattacks on the banking sector can change and disrupt the operation of the economy and social security and safety.

The finance and banking sector has two particularly important parallel responsibilities: ensuring cybersecurity for banking information systems, guaranteeing the safe and smooth operation of these systems and transactions; and ensuring information security for customers and users of banking services.

Ensuring cybersecurity is now a core, vital element for the survival, reputation, and competitiveness of banks.

"National digital transformation in general, and the digital transformation of the banking sector in particular, cannot develop or succeed if information systems are not secure, and if people do not feel safe using digital services and conducting online transactions," Mr. Le Van Tuan emphasized.

Speaking at the dialogue session, Colonel Trieu Manh Tung, Deputy Director of the Cyber Security and High-Tech Crime Prevention Department - A05 (Ministry of Public Security), shared that in recent years, many banks have proactively implemented measures to protect their customers, such as reviewing their customer base to identify cases and accounts that pose potential risks.

However, representatives from A05 also stated that inspections have revealed that some banks have not yet truly focused on reviewing, evaluating, and classifying their customers in order to proactively prevent risks and dangers for users of their services.

Experts agree that in the future, banking systems must further enhance their resilience, with comprehensive cybersecurity capabilities to withstand attacks from both inside and outside the system.

Simultaneously, banks are also advised to continue focusing on implementing solutions to ensure customer information security, protecting users from information security risks and online fraud.

Source: https://vietnamnet.vn/tiep-nhan-hon-220-000-luot-phan-anh-lua-dao-cua-nguoi-dung-viet-2336877.html

![[Live] 2025 Community Action Awards Gala](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F16%2F1765899631650_ndo_tr_z7334013144784-9f9fe10a6d63584c85aff40f2957c250-jpg.webp&w=3840&q=75)

![[Image] Leaked images ahead of the 2025 Community Action Awards gala.](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F16%2F1765882828720_ndo_br_thiet-ke-chua-co-ten-45-png.webp&w=3840&q=75)

![[Photo] Prime Minister Pham Minh Chinh receives the Governor of Tochigi Province (Japan)](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F16%2F1765892133176_dsc-8082-6425-jpg.webp&w=3840&q=75)

![[Photo] Prime Minister Pham Minh Chinh receives Lao Minister of Education and Sports Thongsalith Mangnormek](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F16%2F1765876834721_dsc-7519-jpg.webp&w=3840&q=75)

![[Photo] Prime Minister Pham Minh Chinh attends the Vietnam Economic Forum 2025](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/12/16/1765893035503_ndo_br_dsc-8043-jpg.webp)

Comment (0)