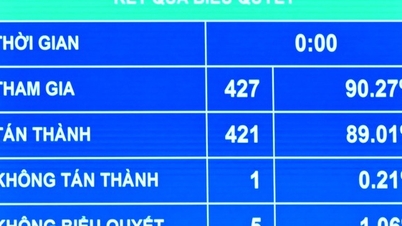

On the morning of December 10, the National Assembly passed the Law on Deposit Insurance (amended).

Previously, State Bank Governor Nguyen Thi Hong reported and explained, receiving opinions from National Assembly deputies.

Regarding special lending, some opinions suggest further review to ensure consistency with the Law on Credit Institutions, regulating the scale and scope of mass withdrawals in cases of early intervention and special control in sub-laws with regard to the provisions of point c, clause 1, article 35, ensuring that special lending is directed to the correct beneficiaries and preventing abuse of the policy.

State Bank Governor Nguyen Thi Hong reports to the National Assembly (Photo: National Assembly Media).

Regarding this matter, the Governor of the State Bank of Vietnam stated that the regulations on cases where deposit insurance organizations provide special loans in the draft law are basically consistent with the regulations in the Law on Credit Institutions.

According to regulations, credit institutions can borrow specially from the deposit insurance organization when experiencing mass withdrawals, without requiring the institution to be under early intervention or special supervision.

Ms. Hong stated that to ensure strict control, the draft law clearly stipulates that the deposit insurance organization provides special loans to participating deposit insurance institutions when they are subject to early intervention and mass withdrawals, or when they are placed under special control and experience mass withdrawals.

According to the Governor of the State Bank of Vietnam, credit institutions that receive early intervention and special control will be subject to stricter inspection and supervision than other credit institutions.

In addition, the criteria for determining "mass withdrawal," "early intervention," and "special control" have been stipulated in the Law on Credit Institutions and its implementing guidelines.

The draft law assigns the Governor of the State Bank to regulate the organization of special loan deposit insurance for credit institutions.

There have been suggestions to clarify the "principle of capital preservation in investment activities" regarding the sale of securities before maturity and the withdrawal of deposits before maturity, in order to avoid complications during implementation.

According to Ms. Hong, the drafting agency has added and clarified the regulation regarding the amount of money in the operational reserve fund that is insufficient to pay insurance claims. This is determined when the deposit insurance organization has used up all the money in the operational reserve fund but still does not have enough to fulfill its insurance payment obligations.

The government believes that the sale of securities that have not yet matured and the withdrawal of deposits that have not yet matured must ensure the principle of capital preservation in investment activities.

In addition, the principle of capital preservation in investment activities of deposit insurance organizations has also been stipulated in the draft law.

Accordingly, the specifics regarding the principle of capital preservation in the investment activities of the deposit insurance organization, and the special borrowing from the State Bank of Vietnam by the deposit insurance organization, will be regulated in the financial regime of the deposit insurance organization and guiding documents issued by the State Bank of Vietnam.

The Law on Deposit Insurance (amended) takes effect from May 1, 2026.

Article 38 of the Law on Deposit Insurance (amended) stipulates special loans from the State Bank of Vietnam :

1. The deposit insurance organization may borrow at a special interest rate of 0%, without collateral, from the State Bank of Vietnam in the cases stipulated in Article 21 of this law and when the amount in the operational reserve fund is insufficient to pay insurance claims.

The amount of money in the deposit insurance reserve fund that is insufficient to pay insurance claims is determined when the deposit insurance organization has exhausted all the funds in its reserve fund and still does not have enough to fulfill its insurance payment obligations.

The sale of securities that have not matured and the withdrawal of deposits that have not matured must ensure the principle of capital preservation in investment activities.

2. The Deposit Insurance Organization shall develop a plan to increase deposit insurance premiums to compensate for the special loans; using funds to repay special loans of credit institutions, revenue from the sale of securities held by the Deposit Insurance Organization, from the liquidation of assets of credit institutions that borrowed special loans, and deposit insurance premiums to prioritize the repayment of special loans to the State Bank of Vietnam.

3. The Governor of the State Bank provides guidance on the State Bank's provision of special loans to deposit insurance organizations.

Source: https://dantri.com.vn/thoi-su/quy-dinh-moi-ve-vay-dac-biet-lai-suat-0-20251210112844094.htm

![[Photo] Explore the US Navy's USS Robert Smalls warship](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F10%2F1765341533272_11212121-8303-jpg.webp&w=3840&q=75)

![[Photo] The captivating scenery of the fragrant maple forest in Quang Tri](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F10%2F1765353233198_lan09046-jpg.webp&w=3840&q=75)

![[Video] National Assembly passes Cybersecurity Law with 91.75% of delegates voting in favor](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/12/10/1765354445335_1-1521-png.webp)

![[Video] National Assembly passes the amended Personal Income Tax Law with many changes to tax rates and family deductions.](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/12/10/1765353535343_2-2763-png.webp)

![[Video] The craft of making Dong Ho folk paintings has been inscribed by UNESCO on the List of Crafts in Need of Urgent Safeguarding.](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/12/10/1765350246533_tranh-dong-ho-734-jpg.webp)

Comment (0)