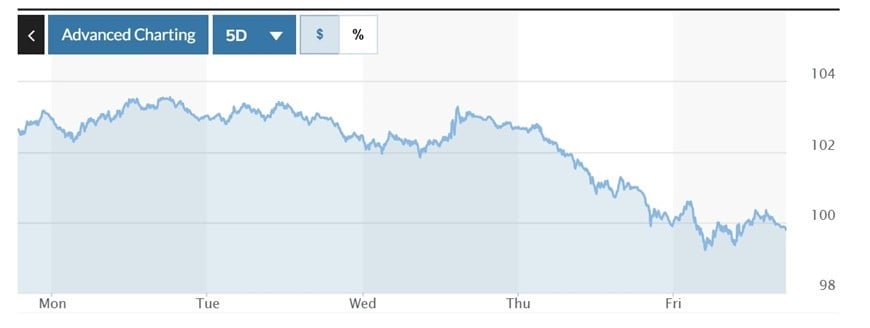

The USD Index (DXY), which measures the greenback's performance against six major currencies, stood at 99.78.

Forecast of USD trend this week

The DXY index fell sharply last week and broke through the psychological 100 level at the end of the week, hitting 99.01, its lowest level since July 2023. The ongoing tariff war and expectations of further rate cuts by the US Federal Reserve (Fed) are all putting pressure on the greenback.

Last week, US President Donald Trump issued a 90-day freeze on tariffs, but kept the overall 10% tariff rate for most countries. However, tariffs on imports from China were raised to 125%, effective immediately, after China retaliated against previous US tariffs with an 84% tariff. According to the White House, the total US tariffs on imports from China now stands at 145%.

The DXY index's drop below 100.50 was as expected. This week's price action will be crucial. The index needs a strong and sustained rise back above 100.50 to ease the downward pressure and create the premise for an increase to the 102-102.50 zone.

Conversely, a failure of the DXY to break above 100.50 could continue to put the index under negative pressure. In that case, it could continue to decline to 98.65, the next important support level. If the index fails to maintain that support level, it risks falling further to 96 in the coming weeks.

The yield on the 10-year US Treasury note saw a sharp increase last week. From a low of 3.87%, the yield jumped to a high of 4.59%. The yield has risen sharply above the resistance zone of 4.4-4.45%. That opens the way for a bullish outlook.

The 10-year yield is expected to rise to the 4.65-4.7% range. A break above 4.7% could send it higher, even to 4.85%.

Conversely, if the 10-year bond yield falls below 4.35, it will signal a return to a downward trend.

The EUR/USD index broke above the key resistance level of 1.12 last week. Strong support is currently in the 1.12-1.1150 zone. If the currency can hold above the 1.12-1.1150 support zone, the short-term trend will remain positive. Therefore, the EUR has the potential to rise to 1.16 and even 1.20 in the long-term.

The possibility of a rise to 1.20 for the EUR suggests that the DXY index could continue to decline in the coming period.

USD exchange rate in the country today

In the domestic market, at the beginning of the trading session on April 14, the State Bank announced the central exchange rate of the Vietnamese Dong against the USD at 24,923 VND.

* The reference exchange rate at the State Bank's transaction office has slightly decreased, currently at: 23,727 VND - 26,119 VND.

USD exchange rate at commercial banks buy and sell as follows:

USD exchange rate | Buy | Sell |

25,530 VND | 25,920 VND | |

25,410 VND | 25,990 VND | |

25,550 VND | 25,910 VND |

* The EUR exchange rate at the State Bank's buying and selling exchange center increased slightly, currently at: 26,743 VND - 29,558 VND.

EUR exchange rates at commercial banks are as follows:

EUR exchange rate | Buy | Sell |

Vietcombank | 28,228 VND | 29,775 VND |

Vietinbank | 28,419 VND | 29,919 VND |

BIDV | 28,940 VND | 28,964 VND |

* The Japanese Yen exchange rate at the State Bank's exchange office has increased slightly, currently at: 165 VND - 183 VND.

Japanese Yen Exchange Rate | Buy | Sell |

Vietcombank | 172.44 VND | 183.40 VND |

Vietinbank | 175.81 VND | 185.51 VND |

BIDV | 176.96 VND | 185.22 VND |

Source: https://baolangson.vn/ty-gia-usd-hom-nay-14-4-tuong-lai-am-dam-doi-voi-dong-usd-5043901.html

![[Photo] The Government Standing Committee works with ministries and branches on the real estate market situation.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/24/e9b5bc2313d14c9499b8c9b83226adba)

![[Photo] Ho Chi Minh City holds funeral for former President Tran Duc Luong](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/24/9c1858ebd3d04170b6cef2e6bcb2019e)

![[Photo] Party and State leaders visit former President Tran Duc Luong](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/24/960db9b19102400e8df68d5a6caadcf6)

Comment (0)