The market's strong and positive performance from the morning session helped the VN-Index reach a new record high of 1,585 points. In the afternoon session, the index continued to push up to 1,585 points. However, towards the end of the session, "shaking" movements began to appear from 2:00 p.m., the index dropped sharply by 50 points in just 30 minutes.

At the end of the session, VN-Index reached 1,547.15 points, up 19 points (+1.24%) with 118 codes increasing (of which, 5 codes "hit the ceiling"), 221 codes decreasing (of which 4 codes "hit the floor") and 40 codes remaining unchanged.

Thus, the index "shaken" strongly within the range of 70 points in just one trading session.

At the Hanoi Stock Exchange, the two indices HNX-Index and HNXUPCoM-Index had opposite movements, HNX-Index decreased slightly by 0.83%, reaching 266.12 points; HNXUPCoM-Index increased slightly by 0.32%, reaching 107.5 points.

VN-Index corrected strongly at the end of the afternoon session in a session with record liquidity (Screenshot)

In addition to the point index, VN-Index also set a new record with cash flow reaching 78,122 billion VND, surpassing the previous record of 72,000 billion VND (session 29/7).

The role of "pillar" in today's session came from the " VN30 basket " when it increased strongly by 37.21 points (+2.25%), reaching 1,690.43 points.

In particular, HPG ( Hoa Phat Steel, HOSE) stood out when it had the highest liquidity session in history with 216 million shares, equivalent to a value of VND 5,723 billion, of which foreign investors net bought VND 1,080 billion.

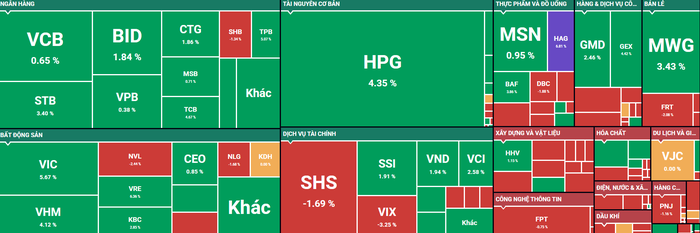

Regarding industry groups , all groups cooled down, Banking, Real Estate, and Securities continued to be the 3 "pillar" groups of the market.

Of which, Banks increased by 1.56% with MBB (MBBank, HOSE) at the "ceiling" level, TCB (Techcombank, HOSE) and TPB (TPBank, HOSE) increased by about 5%. Some other stocks decreased such asSHB (SHB, HOSE) decreased by 1.34%, NVB (NCB, HOSE) decreased by 5.6%.

Real estate maintained an increase of nearly 3% with two pillar stocks VIC (Vingroup, HOSE) increasing by 5.67%, VHM (Vinhomes, HOSE) increasing by 4.12%. The rest, most of them turned down: NLG (Nam Long, HOSE) decreased by 1.7%, DIG (DIC Group, HOSE) decreased by 1.16%. NVL (Novaland, HOSE) decreased by 2.44%,...

Meanwhile, the stock market moved sideways with clear differentiation when SSI (SSI Securities, HOSE), VND (VNDirect, HOSE) and VCI (Vietcap, HOSE) attracted cash flow, increasing by about 5%, while SHS (Saigon - Hanoi Securities, HOSE) and VIX (VIX Securities, HOSE) decreased.

For foreign investors, based on the order matching value, the "bright spot" comes from the signal of returning to net buying with today's purchase value of more than 670 billion (order matching) concentrated in the banking and steel groups. However, overall, net selling transactions are still strong with nearly 2,524 billion VND on the HOSE floor alone, the focus belongs to VIC (Vingroup, HOSE), SHB (SHB, HOSE), VPB (VPBank, HOSE), VHM (Vinhomes, HOSE), FPT (FPT, HOSE),...

VN-Index "shakes" on the way to the peak of 1,600 points

According to Mr. Bui Ngoc Trung, consultant, Mirae Asset Securities , today's trading session recorded a new record in liquidity, an unprecedented number in the 25 years of the Vietnamese stock market. Despite a strong increase in the morning session, this afternoon's move shows a short-term profit-taking mentality after a good recovery.

This development is somewhat similar to the session on July 29 (1 week before) when the selling force was strong with a synchronous decrease, and at the same time, it was also the session that set a record for liquidity before, reaching the mark of 72,000 billion VND. But in essence, today's session is somewhat different and more inclined towards buying although the selling force is also quite large.

Liquidity reached a new record of 78,122 billion VND, showing that cash flow is still maintained at a very high level in the market and helping the market quickly balance after one-way selling. However, the current price range may have more unexpected developments with the "shaking" momentum when VN-Index is approaching a new, larger peak such as 1,600 points.

The market shows clear differentiation (Screenshot)

It can be said that today's "shake" is an inevitable reaction after a series of hot increases, helping to cool down the margin and create opportunities to restructure the portfolio when the market approaches higher scores and the "profit-taking" psychology increases. However, the adjustment will be short-term because the market cash flow is still maintained at a high level and there are still good growth opportunities while Vietnam is still in the context of low interest rates, room for growth in credit and public investment is still being promoted, in addition to the prospect of upgrading the market is approaching.

Therefore, at this time, investors need to avoid the psychology of chasing stocks that are increasing strongly during the session.

In addition, some other experts believe that although VN-Index is continuing to increase, the number of stocks tending to increase is not as much as the previous peak. Therefore, this is not the time to integrate and disburse for short-term goals. Investors need to act cautiously, combining holding good positions and selectively looking for new opportunities.

Source: https://phunuvietnam.vn/vn-index-rung-lac-tren-duong-len-dinh-1600-diem-20250805171528939.htm

![[Photo] Cutting hills to make way for people to travel on route 14E that suffered landslides](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/08/1762599969318_ndo_br_thiet-ke-chua-co-ten-2025-11-08t154639923-png.webp)

![[Video] Hue Monuments reopen to welcome visitors](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/11/05/1762301089171_dung01-05-43-09still013-jpg.webp)

Comment (0)