The stock market on July 21 started positively and recorded a period of trading quite volatile around the 1,500 point mark. At one point, the VN-Index reached the 1,511 point mark. However, with great pressure and the unexpected reversal of Vingroup (VIC) shares, the VN-Index closed down 12.23 points, falling back to 1,485.05 points. Profit-taking pressure occurred widely, especially in the last 5 minutes of the session, causing the index to plummet. VIC shares once hit the floor from the reference point in just a few minutes. This was also the reason for taking away 6.3 points from the VN-Index.

Not only VIC, VHM shares of Vinhomes also took up more than 3.7 points of VN-Index. Some shares of "big" banks also contributed to the general index adjustment such as Techcombank, Vietcombank, BIDV, MBB... On the opposite side, shares of VPBank, LPBank,SHB , ACB and some large manufacturing enterprises such as Hoa Phat, Gelex, Vietnam Airlines actively contributed to help curb the decline.

In total, on all three floors, the whole market had 40 stocks hitting the ceiling price, 331 stocks increasing in price, while there were 435 stocks decreasing in price and 16 stocks hitting the floor price.

Red dominated most industry groups. Profit-taking pressure quickly appeared in the banking, securities and real estate groups. These are the groups that have increased sharply in the past two weeks. In the securities group, only a few stocks closed in green such as VIX, CTS, DSE... Many industry groups were differentiated when positive information from second-quarter business results and dividends helped some stocks perform positively.

Market liquidity remained high, with total trading value reaching nearly VND36,800 billion, only slightly down from the session at the end of last week. HoSE alone recorded liquidity of over VND35,400 billion. Up to 5 stocks reached liquidity of over a thousand billion VND, including SSI (VND1,722 billion), VPB (VND1,586 billion), HPG (VND1,476 billion), SHB (VND1,475 billion) and VIX (VND1,356 billion). These are all stocks that have attracted great attention from domestic and foreign cash flows in recent sessions.

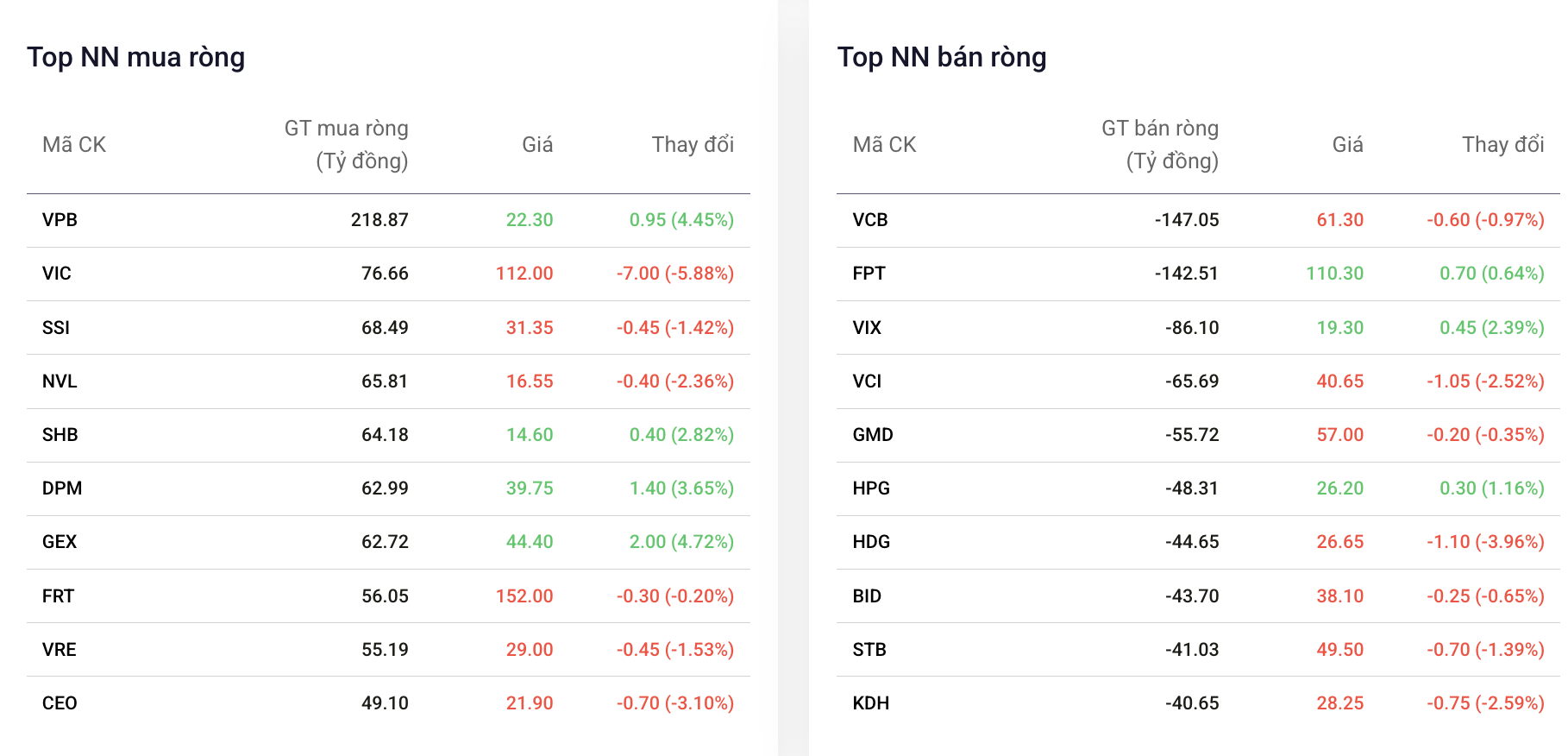

|

| Top stocks net bought/sold in the session. |

Foreign investors returned to net buying slightly, nearly 132 billion VND after 2 consecutive sessions of net selling. VPBank shares were the highlight of the session. In addition to contributing the largest increase in points and leading liquidity, this was also the stock that foreign investors net bought the most, VPB, with a net buying value of 218.87 billion VND. At the same time, foreign investors also strongly bought many other large stocks, respectively VIC (76.66 billion VND), SSI (68.49 billion VND), NVL (65.81 billion VND) and SHB (64.18 billion VND). On the other hand, VCB andFPT were net sold the most, 147 billion VND and 142.5 billion VND, respectively; followed by VIX, VCI, GMD and HPG.

Source: https://baodautu.vn/vn-index-tiep-tuc-chiu-ap-luc-lon-khi-tiep-can-moc-1500-diem-vic-giam-manh-cuoi-gio-d337147.html

![[Infographic] Vietnam's stock market exceeds 11 million trading accounts](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/11/09/1762677474332_chungkhoanhomnay0-17599399693831269195438.jpeg)

Comment (0)