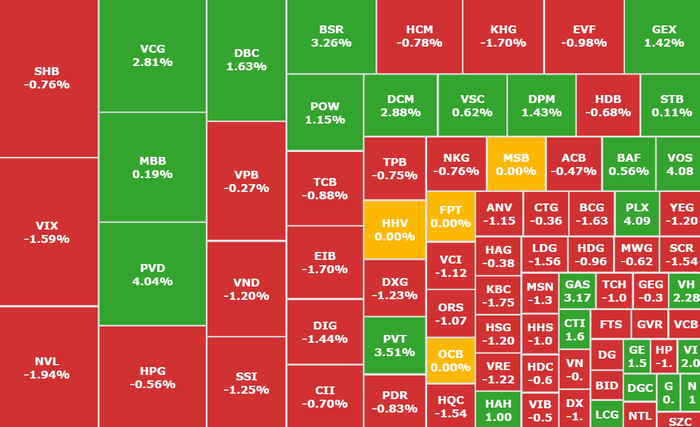

VN-Index accelerates

The trading week of June 16-20 recorded green returning to the board when the VN-Index broke through 33.86 points, equivalent to 2.57%, closing the week at 1,349.35 points.

Strong demand for large-cap stocks has pushed the VN-Index up sharply. Green spread across most of the "pillar stocks" of the VN30 group.

Regarding liquidity, the average matched value on HOSE last week reached VND20,687 billion, up 5.63% but the volume decreased 1.14% to 844 million units. This is the first week since the Lunar New Year that matched liquidity fell below the 20-week average, reflecting cautious sentiment despite the increase in the index.

In terms of industry groups, the most prominent contribution of the week continued to come from the banking group with MBB ( MBBank , HOSE), VCB (Vietcombank, HOSE), CTG (VietinBank, HOSE) all increasing.

By sector, the market was strongly differentiated. The utility - energy group led the decline when GAS lost 3.2% with selling pressure. On the contrary, the essential consumer group became an unexpected bright spot: ANV (NAVICO, HOSE), IDI (IDI Investment, HOSE) closed at the ceiling; VHC (Vinh Hoan, HOSE) increased by 6.67%; KDC (KIDO, HOSE) increased by 4.42%.

Foreign capital flows continued to withdraw slightly. Both exchanges recorded a net selling value of approximately VND 146 billion; HoSE alone was withdrawn VND 223 billion, with the focus on VIC (Vingroup, HOSE), VHM (Vinhomes, HOSE) and STB ( Sacombank , HOSE) continuing to be on the list of the strongest "dumping" stocks, with selling values of VND 983 billion, VND 523 billion and VND 378 billion respectively.

3 groups of stocks in the eye of the tariff storm

Sharing at the program series "The Fund Manager 2025" organized by AFA Capital, Ms. Duong Kim An, Director of Investment Division of Vietcombank Securities Investment Fund Management Company (VCBF), presented an overview of the investment strategy of the leading equity fund VCBF-BCF in the context of trade uncertainty.

According to her, banks are still one of the key choices of VCBF-BCF thanks to their ability to maintain a steady profit pace and transparent financial reporting. Especially, in the context of low interest rates and maintained credit promotion policies, the banking group has the ability to significantly improve profit margins.

Banking continues to be the leading industry group

By the end of May 2025, system-wide credit had increased by about 6.52%, while the annual credit growth target was 16%. There is still a lot of room for growth, creating a premise for banks' profitability. Investors should prioritize banks with large capitalization, sustainable business models and good risk management capacity.

Next is industrial park real estate , this is the industry group that benefits in the medium term from the requirement to tighten the rules of origin of goods, especially in the context of the US applying an import tax rate of 46%. FDI enterprises adjusting their supply chains to increase the rate of domestic production will stimulate demand for industrial park land rental.

Currently, the FDI sector contributes up to 70% of Vietnam’s total export turnover. Therefore, foreign enterprises will be forced to invest in domestic production instead of just processing or assembling, if they want to avoid tariff barriers.

However, she noted that this is a long-term transition process that cannot be completed in the short term. Therefore, the fund only selects industrial park enterprises with available clean land funds, good infrastructure connections and experienced operating teams. In addition, when residential real estate is still under pressure from liquidity and legal issues, industrial parks become an ideal shelter for medium-term capital flows.

Finally, retail has a positive outlook thanks to the policy of tightening taxes on business households and promoting traceability of goods. Moreover, Vietnam has a population of over 100 million people and living standards continue to improve. Real income has increased steadily for many years, while e-commerce is expanding strongly to tier II and tier III cities.

VCBF-BCF selects businesses that can effectively manage their supply chains, invest heavily in logistics and digital transformation to maintain profit margins in a fiercely competitive environment. Companies that can leverage customer data and expand their omnichannel model will be the winners in the race for market share.

Steel industry growth forecast for the second quarter of 2025

MB Securities (MBS) forecasts the steel industry's profit picture in the second quarter of 2025 and the whole year of 2025.

According to MBS, the domestic market in the second quarter of 2025 is forecast to record a growth in steel consumption output of about 22% over the same period to 7.1 million tons, of which 60% comes from construction steel and HRC.

Therefore, manufacturing enterprises such as Hoa Phat Steel (HPG, HOSE) are expected to benefit from the cooling of raw material prices and stable selling prices. In addition, for domestic galvanized steel enterprises such as Hoa Sen Steel (HSG, HOSE), stable HRC prices can help enterprises reverse provisions from previous quarters, thereby improving gross profit.

Accordingly, Hoa Phat's (HPG , HOES ) net profit could grow 19% year-on-year, driven by a 15% increase in output, contributed by Dung Quat 2.

In addition, gross profit margin improved by 0.4 percentage points compared to the same period (y/y) thanks to the cooling of raw material prices. Accordingly, the company's 6-month profit is estimated to increase by 17% y/y and complete 48% of the profit plan.

For Hoa Sen (HSG) , MBS forecasts a slight increase in net profit year-on-year in the second quarter thanks to the positive impact from the domestic market when output is expected to grow by 5%. Accordingly, after 9 months of fiscal year 2025, after-tax profit is estimated to decrease by 6% year-on-year and complete 131% of the yearly plan.

In addition, Nam Kim Steel (NKG) is forecast to reach VND150 billion and Ton Dong A (GDA) to reach VND60 billion, down 32% and 65% respectively. However, for the whole year 2025, Nam Kim's profit can still record a growth of 24% while Ton Dong A's profit will decrease by 12%.

Comments and recommendations

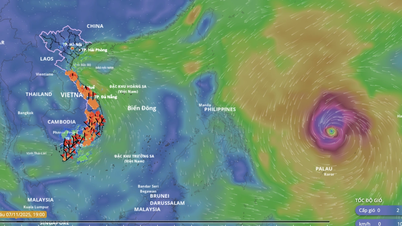

According to many opinions, the outlook for this week (June 23-27) depends largely on the development of world oil prices and Iran-Israel tensions. If the oil price scenario remains above the $80/barrel range, the oil and gas group is likely to play a leading role, supporting the VN-Index to challenge the resistance of 1,360 points. On the contrary, profit-taking pressure at the short-term peak could cause the index to fluctuate more strongly.

Grandfather Phan Van Trang , Consultant, Mirae Asset Securities (Vietnam) assessed, Despite escalating global geopolitical tensions, the Vietnamese stock market still recorded a volatile trading week.

Entering the new week, the market is expected to continue to face unpredictable variables from geopolitical risks between Iran and Israel, foreign capital flows have not shown signs of stopping net withdrawal from the market, and investors are cautious before the 90-day tax deferral policy expires.

The "tug of war" trend continues in the 1,330 - 1,340 point range.

With the above challenges, the "tug of war" trend may continue in the first sessions of the week, retesting the 1,330 - 1,340 point zone before determining a clear trend.

In terms of sectors and stocks, the market will continue to be strongly differentiated, requiring selective investment strategies. The banking group will continue to lead the wave thanks to key policy drivers such as the Resolution on handling bad debts being promoted.

Real estate and construction are expected to face adjustment pressure in the short term. Retail and Consumer groups benefit from recovering purchasing power, reinforced by expectations that the 2% VAT reduction policy will be extended until the end of 2026. Oil and gas and Fertilizer may continue to be "bright spots" in the short term as they directly benefit from escalating oil prices due to geopolitical tensions and concerns about supply disruptions.

The market is entering the second quarter and semi-annual financial reporting season. In the short term, the top priority strategy is risk management and proactively assessing and restructuring portfolio proportions, focusing on stocks with solid fundamentals, good liquidity and especially positive business results prospects for the second quarter of 2025.

Vietcap Securities According to the assessment, with short-term positive signals and improved demand in the banking, securities and consumer groups, VN-Index is expected to continue moving towards the high price zone of 1,360 points, with the support zone during the session at 1,340 points.

Phu Hung Securities Based on technical analysis, if the next sessions see more red candles that negate the 1,340 point area, the VN-Index will signal a risk of correction and possibly form a second downward peak. If the index remains above the 1,330 - 1,340 point threshold, it will consolidate the trend. The general strategy is to hold and maintain an average account weight. Notable stocks include banks, oil and gas, retail and utilities.

Dividend payment schedule this week

According to statistics, there are 35 enterprises that have decided to pay dividends in the week of June 16-20, of which 25 enterprises pay in cash, 5 enterprises pay in shares, 4 enterprises give bonus shares and 1 enterprise issues additional shares.

The highest rate is 50%, the lowest is 1%.

5 businesses pay by stock:

COTANA Group Corporation (CSC, HNX) , ex-right trading date is June 24, rate 10%.

Thua Thien Hue Construction Joint Stock Company (HUB, HOSE) , ex-right trading date is June 24, rate 15%.

Nagakawa Group Corporation (NAG, HNX) , ex-right trading date is June 25, rate 8%.

Hoa Phat Group Corporation (HPG, HOSE) , ex-right trading date is June 26, rate 20%.

Tien Phong Plastic Joint Stock Company (NTP, HNX) , ex-right trading date is June 27, rate 20%.

4 companies award shares:

Southern Cell and Storage Battery Joint Stock Company (PAC, HOSE), ex-dividend date is June 23, rate 50%.

Dong Nai Port Joint Stock Company (PDN, HOSE) , ex-right trading date is June 24, rate 50%.

Son Ha International Corporation (SHI, HOSE) , ex-right trading date is June 27, rate 5%.

Vietnam Thuong Tin Commercial Joint Stock Bank (VBB, UPCoM) , ex-right trading date is June 27, rate 15%.

1 additional issuer:

Ho Chi Minh City Securities Corporation (HCM, HOSE), ex-right trading date is June 24, rate 50%.

Cash dividend payment schedule

*Ex-dividend date: is the transaction date on which the buyer, upon establishing ownership of shares, will not enjoy related rights such as the right to receive dividends, the right to buy additional issued shares, but will still enjoy the right to attend the shareholders' meeting.

| Code | Floor | Global Education Day | Day TH | Proportion |

|---|---|---|---|---|

| SKV | UPCOM | June 23 | 7/7 | 18.3% |

| DKC | UPCOM | June 23 | July 14 | 11% |

| LAS | HNX | June 23 | May 19 | 12% |

| TMG | UPCOM | June 23 | 4/7 | 32% |

| SJ1 | HNX | June 23 | June 30 | 6.5% |

| TYA | HOSE | June 23 | 9/7 | 8.2% |

| PAC | HOSE | June 23 | July 15 | 10% |

| VPS | HOSE | June 23 | 24/7 | 5.5% |

| VND | HOSE | June 24 | July 15 | 5% |

| PHS | UPCOM | June 24 | July 22 | 1% |

| BLT | UPCOM | June 24 | July 11 | 8.2% |

| TVG | UPCOM | June 24 | July 10 | 24% |

| PDN | HOSE | June 24 | July 10 | 25% |

| TVT | HOSE | June 25 | July 16 | 6% |

| BT1 | UPCOM | June 25 | July 10 | 10% |

| CID | UPCOM | June 25 | July 29 | 15% |

| PGC | HOSE | June 25 | July 29 | 11% |

| CDN | HNX | June 26 | July 25 | 12% |

| DFC | UPCOM | June 26 | July 10 | 32% |

| SID | UPCOM | June 26 | July 28 | 3% |

| PBT | UPCOM | June 26 | 4/7 | 7% |

| DCM | HOSE | June 27 | July 15 | 20% |

| SPV | UPCOM | June 27 | 4/8 | 5% |

| BDB | HNX | June 27 | July 15 | 2% |

| PTB | HOSE | June 27 | July 18 | 15% |

| HTC | HNX | June 27 | July 15 | 3% |

| GDW | HNX | June 27 | July 10 | 19% |

Source: https://phunuvietnam.vn/chung-khoan-tuan-23-27-6-vn-index-giang-co-truoc-them-thoi-han-thue-quan-20250623100148684.htm

![[Photo] Da Nang: Hundreds of people join hands to clean up a vital tourist route after storm No. 13](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/07/1762491638903_image-3-1353-jpg.webp)

Comment (0)