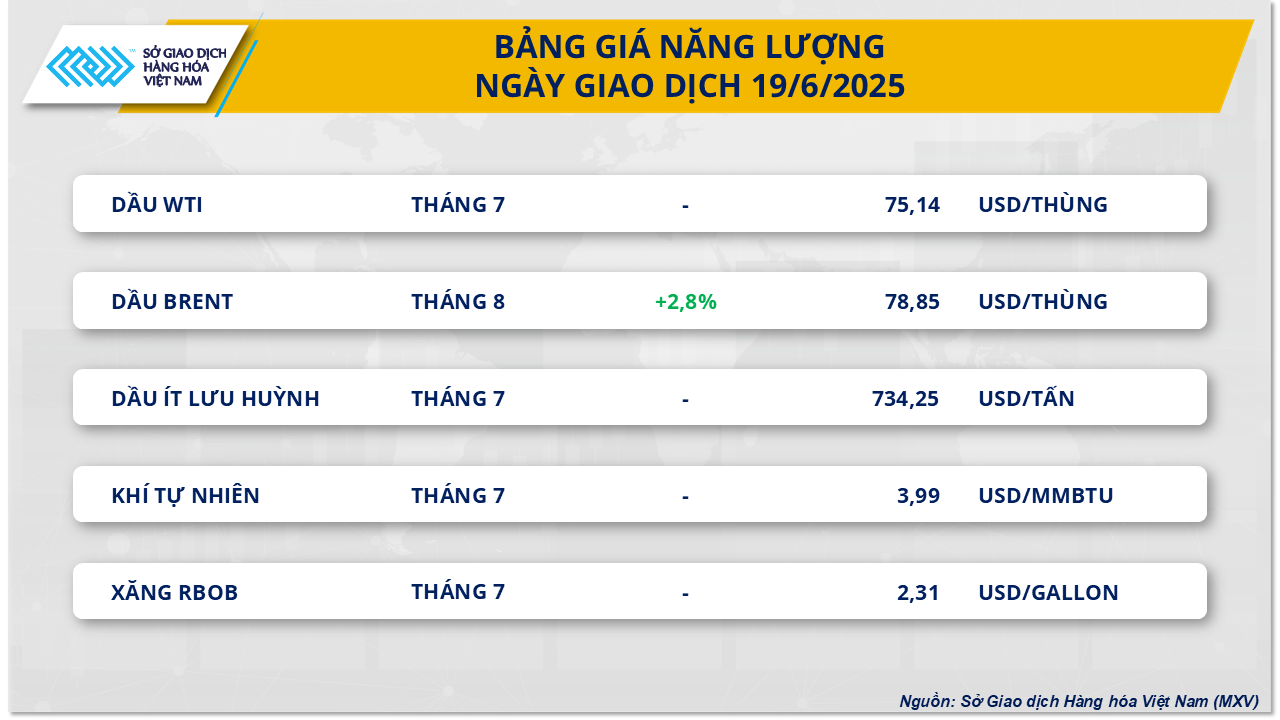

Last week, crude oil prices continued to rise, approaching the $80/barrel mark. Photo: MXV

On the first day of the week, June 16, the increase in oil prices from the previous weekend stopped after the first signs of cooling down in tensions between Israel and Iran appeared.

Accordingly, many international sources said that Iran has expressed its desire to move towards a ceasefire agreement with Israel, and proactively asked Qatar, Saudi Arabia and Oman to mediate, influence and support a ceasefire.

In return, Iran is willing to show flexibility in negotiations over its nuclear program. At the same time, the Kremlin also announced that Russia is ready to mediate the conflict between Israel and Iran.

If the disagreements between the US and Iran are resolved, there is a possibility that Washington will lift sanctions on Iran, thereby allowing Iranian crude oil to return to the international market, contributing to stabilizing global energy supplies.

With this information, at the end of the first trading session of the week, Brent oil price turned down 1.35% to 73.23 USD/barrel, while WTI oil also lost 1.66%, closing at 71.77 USD/barrel.

However, in the remaining days of the week, oil prices continued to increase to their highest level since January, in which Brent oil prices approached the mark of 80 USD/barrel.

Specifically, on Tuesday (June 17), Brent oil price returned to above 76.45 USD/barrel, equivalent to an increase of 4.4% while WTI oil price increased sharply by 4.28%, to 74.84 USD/barrel.

On Wednesday (June 18), WTI oil prices closed up 0.4% to $75.14/barrel - the highest level since January 2025. Meanwhile, Brent oil prices also recorded a slight increase of 0.33% to $76.7/barrel.

Brent oil price on June 19 increased to 78.85 USD/barrel. Source: MXV

Not stopping there, at the end of the trading session on Thursday (June 19), Brent oil price climbed to 78.9 USD/barrel, corresponding to an increase of 2.8% compared to the previous day, approaching the 80 USD/barrel mark.

WTI oil traded on the NYMEX floor was quite quiet due to the floor closing early. At the closing time, WTI oil price stopped at 75.8 USD/barrel, corresponding to an increase of about 0.88%.

These increases are all linked to hot developments in the Middle East.

According to the Vietnam Commodity Exchange, tensions between Israel and Iran have shown no signs of cooling down, making the risk of disruption of energy supplies from Iran and many areas in the Persian Gulf increasingly present.

There have been no new reports of major disruptions to Iran’s oil exports or shipping through the Strait of Hormuz, a vital artery for the global oil industry. But concerns that the strategic trade route could be shut down at any time remain a key driver of higher energy prices.

Experts say that if the prospect of the Strait of Hormuz being blocked becomes a reality, global energy prices will face the risk of skyrocketing.

According to data from Vortexa Consulting Company, on average, about 20 million barrels of crude oil and related energy products are transported from Gulf countries via this route to the world market every day, accounting for nearly 20% of the total global crude oil flow.

In that context, on Thursday (June 19), US President Donald Trump announced that he has not yet decided whether the US will participate in the Israel-Iran conflict and will consider and evaluate the situation within the next two weeks.

This statement has somewhat helped stabilize the market temporarily, especially when Mr. D. Trump still left open the possibility of resolving tensions through diplomatic negotiations.

Also on June 19, many forecasts were made with new updates on the scenario of high oil prices due to supply disruptions from the Middle East.

Goldman Sachs has set a geopolitical risk premium of $10 a barrel and believes oil prices could climb above $90 a barrel depending on the extent of damage caused by the conflict.

In addition, JP Morgan Bank also warned of a worst-case scenario where oil prices could spike to more than $120 per barrel.

On the other hand, credit rating firm Morningstar DBRS said any sudden price increase would be temporary, adding that higher oil prices would exacerbate uncertainties in the global economy and oil demand.

Source: https://hanoimoi.vn/gia-dau-han-thu-bieu-cho-xung-dot-o-trung-dong-706309.html

![[Photo] Da Nang: Hundreds of people join hands to clean up a vital tourist route after storm No. 13](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/07/1762491638903_image-3-1353-jpg.webp)

![[Photo series] Bu Gia Map National Park "tells stories" of changing seasons](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/11/08/1762556754197_ttttttttttttttttt_20251107112659.jpeg)

Comment (0)