Domestic gold price today April 14, 2025

At the time of survey at 4:30 a.m. on April 14, 2025, the domestic gold price increased to an all-time high of VND 106.5 million/tael. Specifically:

The price of SJC gold bars is listed by DOJI Group at 103-106.5 million VND/tael (buy - sell). Compared to the closing price of the previous week, the price of SJC gold bars at DOJI increased by 5.9 million VND/tael for buying and 6.4 million VND/tael for selling. The difference between the buying and selling price of SJC gold at DOJI Group is at 3.5 million VND/tael.

At the same time, the price of SJC gold bars was listed at 103-106.5 million VND/tael (buy - sell). Compared to the closing price of the previous week, the price of SJC gold bars at Saigon Jewelry Company SJC increased by 5.9 million VND/tael for buying and increased by 6.4 million VND/tael for selling. The difference between the buying and selling price of SJC gold at Saigon Jewelry Company SJC was at 3.5 million VND/tael.

SJC gold price at Bao Tin Minh Chau Company Limited listed SJC gold bar price at 103-106.5 million VND/tael (buying - selling, unchanged in both buying and selling directions compared to yesterday. Compared to last week, gold price increased by 5.7 million VND/tael for buying - increased by 6.4 million VND/tael for selling. The difference between buying and selling price is at 3.5 million VND/tael.

As of 4:30 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 101.2-104.8 million VND/tael (buy - sell); an increase of 4.5 million VND/tael for buying and an increase of 4.7 million VND/tael for selling compared to the closing price of last week's trading session. The difference between buying and selling is at 3.6 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 101.6-105.1 million VND/tael (buy - sell); an increase of 4.1 million VND/tael for buying and 4.6 million VND/tael for selling compared to the closing price of the previous week. The difference between buying and selling is at 3.5 million VND/tael.

The latest gold price list today, April 14, 2025 is as follows:

| Today (April 14, 2025) | Yesterday (April 13, 2025) | |||

| Purchase price | Selling price | Purchase price | Selling price | |

| SJC | 103,000 | 106,500 | 103,000 | 106,500 |

| DOJI Hanoi | 103,000 | 106,500 | 103,000 | 106,500 |

| DOJI SG | 103,000 | 106,500 | 103,000 | 106,500 |

| BTMC SJC | 103,000 | 106,500 | 103,000 | 106,500 |

| Phu Quy SJC | 102,500 | 106,500 | 102,500 | 106,500 |

| PNJ HCMC | 101,200 | 104,900 | 101,200 | 104,900 |

| PNJ Hanoi | 101,200 | 104,900 | 101,200 | 104,900 |

| 1. DOJI - Updated: April 14, 2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Domestic gold price | Buy | Sell |

| AVPL/SJC HN | 103,000 | 106,500 |

| AVPL/SJC HCM | 103,000 | 106,500 |

| AVPL/SJC DN | 103,000 | 106,500 |

| Raw material 9999 - HN | 101,000 | 103,900 |

| Raw materials 999 - HN | 100,900 | 103,800 |

| 2. PNJ - Updated: April 14, 2025 04:30 - Website supply time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| HCMC - PNJ | 101,200 | 104,900 |

| HCMC - SJC | 103,000 | 106,500 |

| Hanoi - PNJ | 101,200 | 104,900 |

| Hanoi - SJC | 103,000 | 106,500 |

| Da Nang - PNJ | 101,200 | 104,900 |

| Da Nang - SJC | 103,000 | 106,500 |

| Western Region - PNJ | 101,200 | 104,900 |

| Western Region - SJC | 103,000 | 106,500 |

| Jewelry gold price - PNJ | 101,200 | 104,900 |

| Jewelry gold price - SJC | 103,000 | 106,500 |

| Jewelry gold price - Southeast | PNJ | 101,200 |

| Jewelry gold price - SJC | 103,000 | 106,500 |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 101,200 |

| Jewelry gold price - Kim Bao Gold 999.9 | 101,200 | 104,900 |

| Jewelry gold price - Phuc Loc Tai Gold 999.9 | 101,200 | 104,900 |

| Jewelry gold price - Jewelry gold 999.9 | 101,200 | 103,700 |

| Jewelry gold price - 999 jewelry gold | 101,100 | 103,600 |

| Jewelry gold price - 9920 jewelry gold | 100,470 | 102,970 |

| Jewelry gold price - 99 jewelry gold | 100,260 | 102,760 |

| Jewelry gold price - 750 gold (18K) | 75,430 | 77,930 |

| Jewelry gold price - 585 gold (14K) | 58,320 | 60,820 |

| Jewelry gold price - 416 gold (10K) | 40,790 | 43,290 |

| Jewelry gold price - 916 gold (22K) | 92,590 | 95,090 |

| Jewelry gold price - 610 gold (14.6K) | 60,910 | 63,410 |

| Jewelry gold price - 650 gold (15.6K) | 65,060 | 67,560 |

| Jewelry gold price - 680 gold (16.3K) | 68,170 | 70,670 |

| Jewelry gold price - 375 gold (9K) | 36,540 | 39,040 |

| Jewelry gold price - 333 gold (8K) | 31,870 | 34,370 |

| 3. SJC - Updated: April 14, 2025 04:30 - Website time of supply - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 103,000 | 106,500 |

| SJC gold 5 chi | 103,000 | 106,520 |

| SJC gold 0.5 chi, 1 chi, 2 chi | 103,000 | 106,530 |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 101,400 | 104,900 |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 101,400 | 105,000 |

| 99.99% jewelry | 101,400 | 104,400 |

| 99% Jewelry | 99,566 | 103,366 |

| Jewelry 68% | 67,349 | 71,149 |

| Jewelry 41.7% | 39,889 | 43,689 |

World gold price today April 14, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 6:00 p.m. today, Vietnam time, was 3,235.91 USD/ounce. Today's gold price is unchanged from yesterday and increased by 205.19 USD/ounce compared to last week. Converted according to the USD exchange rate at Vietcombank (25,920 VND/USD), the world gold price is about 102.17 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 4.33 million VND/tael higher than the international gold price.

The world gold price continues to affirm its role as the leading safe haven in the context of a volatile and unpredictable week for the global financial market. The wave of increasing risk aversion has pushed money into gold, causing the price of this precious metal to continuously reach new peaks.

Gold has had little respite since breaking above $3,100 on Wednesday evening. When North American markets opened on Thursday, the metal quickly surged above $3,140. In Asian trading, it continued to break above $3,200 and hit a weekly high of $3,245.48 an ounce.

Adrian Day, Chairman of Adrian Day Asset Management, commented that any current correction in gold prices is only short-term. He said that the upward trend is still maintained strongly thanks to the huge potential demand from investors. Sharing the same view, experts such as Darin Newsom and James Stanley also said that in the current unstable global political situation, gold is the most reasonable choice to protect assets.

According to Daniel Pavilonis of RJO Futures, the bond market has recently become an important factor driving gold prices. After April 2, when the retaliatory tariffs between the US and China officially took effect, widespread concerns made gold even more attractive. He warned that if long-term bond yields fall sharply, gold prices may face a correction in the short term, but in the long term, the upward momentum is still very sustainable.

Pavilonis also believes that rising inflation will continue to be a factor supporting gold. He said that the European governments' sell-off of US bonds is not politically motivated but due to the urgent need for finance to support the weakened economies after the Covid-19 pandemic.

Despite the strengthening of the bullish trend, he still recommends that investors actively hedge their risks with derivatives. He stressed that the world is entering the early stages of major changes, and factors such as trade wars and global monetary policy will continue to act as catalysts for the gold market.

Next week, attention will be on central banks, especially Federal Reserve Chairman Jerome Powell's speech at the Economic Club of Chicago on Wednesday. There will also be a number of important economic data releases, including the Empire State manufacturing survey on Tuesday, and on Thursday, jobless claims, housing starts and building permits in the US.

Gold price forecast

Analysts are showing high optimism about the near-term price trend for gold, according to the latest Kitco News weekly gold survey. Retail investors are also becoming more active as other investment avenues become less attractive.

Of the 16 experts surveyed, 15, or 94%, predicted gold prices would continue to rise next week. No one expected prices to fall, and only one predicted gold would move sideways around the current high price range.

On the individual investor side, the online survey attracted 275 participants, of which 69% believe that gold prices will increase, 18% believe that it will decrease and 13% believe that the price will remain the same. This sentiment shows great confidence in gold in the context of volatile global financial markets.

Colin Cieszynski, an expert from SIA Wealth Management, said that the weakening US dollar and the uncertainties will continue to support gold prices in the coming time. He expressed optimism about the price trend of precious metals in the coming week.

While there may be some short-term profit-taking after gold’s strong rally, it does not change the overall trend, said Rich Checkan, president and COO of Asset Strategies International. He said gold has a clear momentum advantage.

Michael Moor, founder of Moor Analytics, also believes that gold prices have room to rise as long as they do not fall below $3,224.50 an ounce. He had predicted that gold could rise between $151 and $954 from $2,148.40, and the price has actually risen more than $1,100 – exceeding his highest target.

Jim Wyckoff, senior analyst at Kitco, predicts that gold prices will continue to rise next week. According to him, the increasing demand for safe havens, along with positive technical signals, is reinforcing the upward trend of gold.

Source: https://baoquangnam.vn/gia-vang-hom-nay-14-4-2025-gia-vang-trong-nuoc-va-the-gioi-tang-lien-tuc-lap-dinh-moi-3152695.html

![[Photo] Nhan Dan Newspaper displays and solicits comments on the Draft Documents of the 14th National Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/26/1761470328996_ndo_br_bao-long-171-8916-jpg.webp)

![[Photo] Enjoy the Liuyang Fireworks Festival in Hunan, China](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/26/1761463428882_ndo_br_02-1-my-1-jpg.webp)

![[Photo] General Secretary To Lam received the delegation attending the international conference on Vietnam studies](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/26/1761456527874_a1-bnd-5260-7947-jpg.webp)

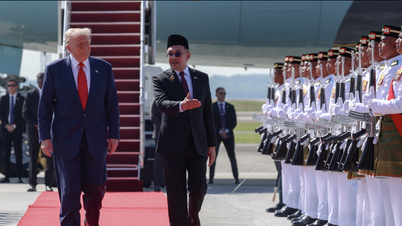

![[Photo] Prime Minister Pham Minh Chinh attends the opening of the 47th ASEAN Summit](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/26/1761452925332_c2a-jpg.webp)

Comment (0)