VN-Index continued its tug-of-war trend in the 24/7 session with green spreading and quite overwhelming. Although it turned down at the opening of the afternoon session, the strong uptrend returned at the end of the session. The whole market was at times negatively affected by information about border tensions between Thailand and Cambodia, especially the correction in the early afternoon session due to pressure from Vingroup stocks. However, the market unexpectedly recovered strongly thanks to the pulling force from VIC, VHM and the banking group.

VN-Index closed at 1,521 points, up nearly 9 points compared to yesterday. On the Hanoi Stock Exchange, HNX-Index increased 1.34 points to 250.67 points, UPCoM-Index increased 0.36 points to 105.16 points.

The entire market recorded 32 stocks hitting the ceiling price, 443 stocks increasing in price, while only 326 stocks decreased and 5 stocks hit the floor price. The dominance of green on the floor shows that demand is still dominant. The oil and gas group led the increase with support from world oil prices. In the session on July 24, MBB stock contributed most positively to the increase of VN-Index when it increased by 3.65% and contributed 1.47 points to the increase, followed by VNM (+1.0 point), HDB (+0.93 points) and VIC (+0.91 points). These large stocks helped VN-Index maintain its upward momentum against the pressure of correction from a number of stocks, led by HPG, MSN and HVN. In particular, HPG took away 0.7 points from VN-Index when the stock of the "big guy" in the steel industry decreased by 0.52%.

Although market liquidity decreased slightly compared to the previous session, it was still at a very high level, with total trading value continuing to exceed VND40,000 billion. Of which, HOSE recorded a trading value of more than VND36,800 billion, with 184 stocks increasing, 131 stocks decreasing and 59 stocks remaining unchanged. Up to 7 stocks reached liquidity of over VND1,000 billion and were all large-cap stocks on HOSE, including HDB, SHB, SSI, HPG, MSN, MBB and VPB. Stocks of two banks, HDB and SHB, both recorded an impressive increase of more than 4%.

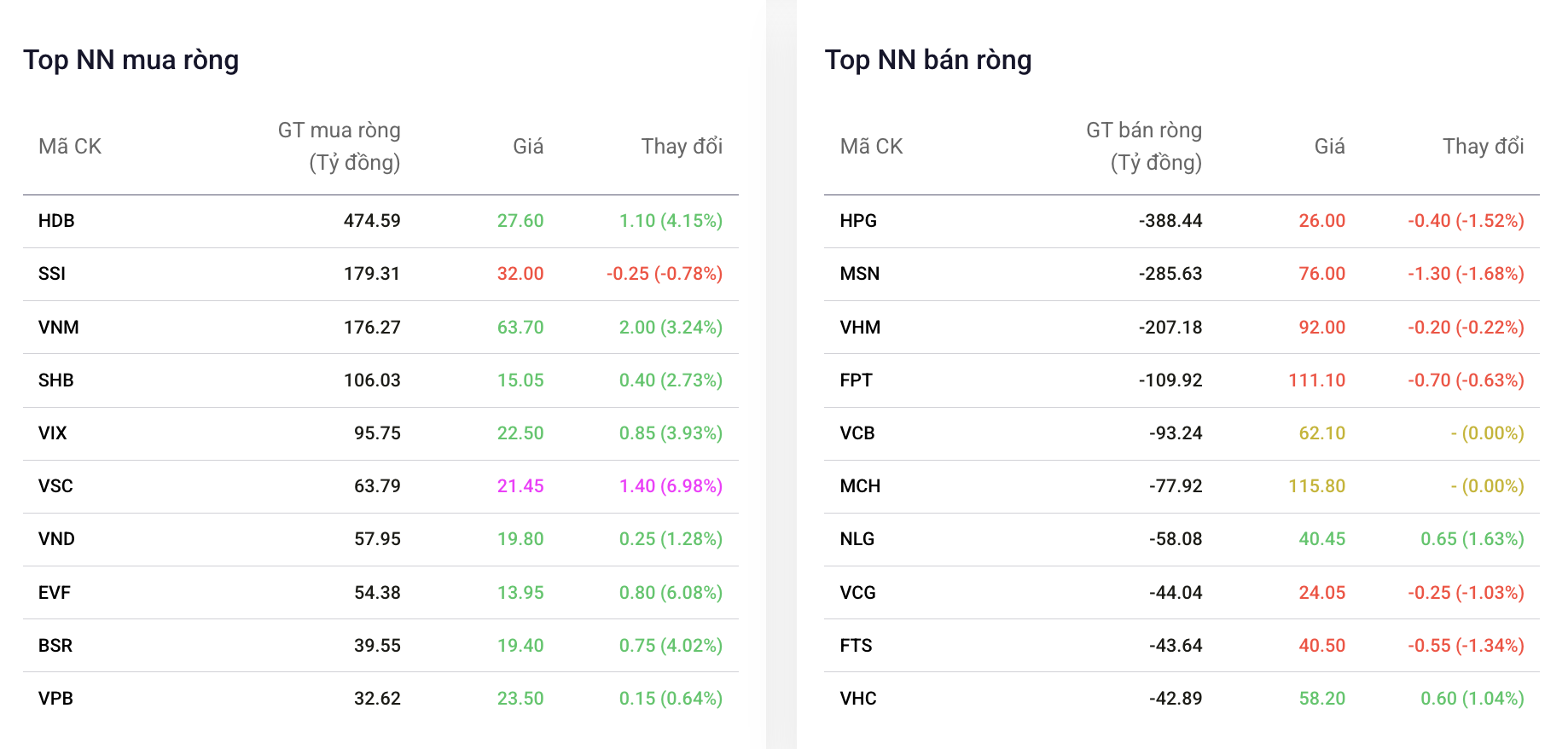

Foreign investors net sold about VND350 billion in the whole market. Selling pressure focused on large stocks such as HPG (-VND388 billion), MSN (-VND286 billion), VHM (-VND207 billion) and FPT (-VND110 billion). Not only HPG, all 4 stocks that were net sold the most by foreign investors closed in red. On the other hand, foreign investors net bought the most at HDB (VND474 billion), SSI (VND179 billion), VNM (VND176 billion), SHB (VND106 billion) and VIX, VSC. Except for SSI's adjustment, other stocks remained green until the end of the session.

|

| Top stocks with the most net buying and selling by foreign investors in the session |

According to BIDV Securities Company (BSC), the market is still heading towards the old peak of 1,530-1,540 points, despite strong fluctuations. Bottom-fishing demand is still working well and supporting the index's upward trend. Experts from VCBS Securities Company believe that after weeks of strong gains, the market's upward momentum is showing signs of slowing down as the VN-Index accumulates to consolidate momentum at the 1,500-point level. Large-cap stocks are still the mainstay, while cash flow has not shown signs of resting as it continuously rotates between industry groups.

VCBS recommends that investors continue to hold stocks in the current uptrend, and can disburse part of their investment into stocks that show signs of long-term accumulation or have successfully overcome resistance. Some notable industry groups include electricity, oil and gas, transportation - seaports, real estate and banking.

Source: https://baodautu.vn/giao-dich-soi-dong-vn-index-tang-len-hon-1521-diem-d340311.html

![[Photo] Cutting hills to make way for people to travel on route 14E that suffered landslides](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/08/1762599969318_ndo_br_thiet-ke-chua-co-ten-2025-11-08t154639923-png.webp)

![[Video] Hue Monuments reopen to welcome visitors](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/11/05/1762301089171_dung01-05-43-09still013-jpg.webp)

Comment (0)