ANTD.VN - The State Bank said there are still difficulties and obstacles in detecting, preventing and handling cross-ownership and ownership of manipulative and dominant nature in credit institutions.

Cross-ownership and ownership exceeding the limit have decreased.

In a report recently sent to National Assembly delegates, regarding the issue of preventing cross-ownership and ownership with manipulative and dominating nature in credit institutions (CIs), the State Bank said that in recent years, this agency has continued to improve the legal basis and resolutely implemented solutions to prevent and handle ownership of shares exceeding the prescribed limit, cross-ownership, lending, and investment in violation of regulations, along with the restructuring process of CIs.

In particular, the Law on Credit Institutions 2024 has added regulations to help prevent cross-investment, cross-ownership and ownership of manipulative and dominant nature in credit institutions.

The State Bank also continues to direct the prevention and handling of shareholding exceeding the prescribed limit, cross-ownership, lending, and investment in violation of regulations. Accordingly, shareholding exceeding the prescribed limit, cross-ownership in the credit institution system has been gradually handled, and the situation of large shareholders/shareholder groups manipulating and dominating banks has been limited.

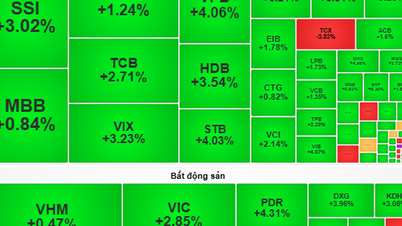

The situation of excessive share ownership and cross-ownership between credit institutions, credit institutions and enterprises, as reported by credit institutions after processing, has decreased significantly compared to previous periods. Shareholders, shareholders and related persons owning shares exceeding the prescribed limit are mainly in corporations and state-owned enterprises.

|

The situation of excessive share ownership and cross-ownership has decreased significantly. |

However, the State Bank noted that the issue of credit institutions and their related persons contributing capital and buying shares at other credit institutions is still a matter of concern that may potentially pose risks.

Currently, this ownership situation has decreased significantly, overcoming the situation of a commercial bank's ownership of shares at another credit institution exceeding the prescribed rate of over 5% of the voting capital of another credit institution, and the ownership of shares at another credit institution (one-way) has decreased.

However, handling the issue of ownership exceeding the prescribed limit and cross-ownership is still difficult in cases where major shareholders and related persons of major shareholders conceal their ownership, ask other individuals/organizations to stand in their names to own shares to circumvent regulations, leading to the credit institution being controlled by these shareholders, potentially posing a risk of lack of publicity and transparency.

Some credit institutions have a concentration of share ownership among a number of shareholders and related persons. Although this does not violate the provisions of the law, attention should be paid to prevent potential risks that may occur...

Strengthening inspection, preventing takeover and domination of credit institutions

The State Bank also pointed out a number of difficulties and obstacles in detecting, preventing and handling cross-ownership and manipulative and dominant ownership in credit institutions.

In particular, cross-ownership involves many entities under the management of ministries/sectors. However, the State Bank's management entities are only credit institutions, so the State Bank does not have information or tools to control ownership between companies in other fields.

At the same time, controlling cross-ownership between non-industry companies and banks is very difficult in cases where major shareholders and related persons of major shareholders deliberately conceal or ask other individuals/organizations to stand in their names to own shares to circumvent legal regulations on cross-ownership/ownership exceeding prescribed levels or circumvent regulations on credit limits for related customer groups and share ownership ratios of shareholders and related persons.

This leads to the potential risk of the credit institution's operations lacking transparency and openness. At the same time, this can only be detected and identified through investigation and verification by the investigative agency according to the provisions of law.

Detecting the relationship between enterprises is still limited because information to determine the ownership relationship of enterprises, especially enterprises that are not public companies, is very difficult. The State Bank cannot proactively look up information as well as determine the accuracy and reliability of information sources; especially in the context of the current rapidly developing stock market and technology.

In the coming time, the State Bank said it will continue to monitor the safety of credit institutions' operations and through inspections of capital, share ownership of credit institutions, lending, investment, and capital contribution activities... In case of detecting risks and violations, the State Bank will direct credit institutions to handle existing problems to prevent risks. In cases where signs of crime are detected, the State Bank will consider transferring to the police to investigate and clarify the violations of the law (if any) for handling to prevent risks.

In addition, implementing the 2023 Inspection Plan of the State Bank of Vietnam, the inspection teams of the Banking Inspection Agency focused on inspecting the contents of share ownership ratio; purchase and transfer of bank shares; credit granting to large customers/customer groups (loans, guarantees, L/Cs, corporate bond investments).

The State Bank of Vietnam continues to include the inspection of transfer and ownership activities of shares and stocks that may lead to the acquisition and domination of credit institutions in the 2024 Inspection Plan.

Source: https://www.anninhthudo.vn/so-huu-cheo-so-huu-co-tinh-chat-thao-tung-tai-cac-ngan-hang-van-kho-nhan-dien-post593287.antd

![[Photo] Flooding on the right side of the gate, entrance to Hue Citadel](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/28/1761660788143_ndo_br_gen-h-z7165069467254-74c71c36d0cb396744b678cec80552f0-2-jpg.webp)

![[Photo] Draft documents of the 14th Party Congress reach people at the Commune Cultural Post Offices](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/28/1761642182616_du-thao-tai-tinh-hung-yen-4070-5235-jpg.webp)

![[Photo] National Assembly Chairman Tran Thanh Man received a delegation of the Social Democratic Party of Germany](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/28/1761652150406_ndo_br_cover-3345-jpg.webp)

![[Photo] President Luong Cuong attends the 80th Anniversary of the Traditional Day of the Armed Forces of Military Region 3](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/28/1761635584312_ndo_br_1-jpg.webp)

Comment (0)