Illustration photo

This morning, the National Assembly did personnel work.

Today (November 10), the National Assembly began the 4th working week of the 10th session (from November 10 to 14). This morning, the National Assembly held a separate meeting on personnel work.

Previously, at the 14th Conference, the Party Central Committee gave opinions on personnel for the Politburo to decide to introduce at the 10th Session of the 15th National Assembly to elect the positions of Vice President (permanent) of the 15th National Assembly and Chief Justice of the Supreme People's Court for the 2021-2026 term.

Accordingly, Mr. Do Van Chien was assigned and appointed to hold the position of Permanent Deputy Secretary of the National Assembly Party Committee, and at the same time introduced to the National Assembly to elect to hold the position of Permanent Vice Chairman of the National Assembly.

Mr. Nguyen Van Quang was mobilized, assigned, and appointed as Secretary of the Party Committee of the Supreme People's Court and introduced to the National Assembly to elect to hold the position of Chief Justice of the Supreme People's Court.

In the afternoon, the National Assembly will discuss the Population Law and the Disease Prevention Law in the hall. At the end of the discussion, Minister of Health Dao Hong Lan will explain the opinions raised by the delegates.

HNX floor capitalization approaches half a million billion VND mark

According to news from HNX, the stock market listed on this floor in October 2025 had many strong fluctuations, the price index tended to decrease and market liquidity also decreased.

The HNX Index closed the last trading session of the month at 265.85 points, down 2.68% compared to the previous month.

The highest score of this index reached 277.08 points on October 16, 2025.

GOLD PRICE UPDATE

Meanwhile, the average stock trading volume reached 107.9 million shares/session, down 9.59% and the trading value decreased 7.85% to VND2,496 billion/session.

Foreign investors trading listed stocks on HNX increased by 22% compared to the previous month. Of which, the purchase value was over VND2,101 billion and the sale value was over VND4,014 billion, with a net selling value of over VND1,913 billion.

Meanwhile, the self-trading activities of listed stocks at HNX of member securities companies decreased by 20.5% compared to the previous month, with a transaction value of more than VND535 billion (accounting for more than 2% of the total market), of which this group net sold more than VND152 billion.

By the end of October 2025, the stock market listed on HNX had 306 listed enterprises with a total listed value of more than VND 173,000 billion. The market capitalization value at the end of the month's trading session reached more than VND 447,900 billion, up 2.2% compared to September.

Banks increase lending for real estate and securities

A recently published report by SSI Securities said that joint stock commercial banks continued to record higher credit growth than the state-owned bank group in the third quarter of 2025, reaching +4.5% and +4% respectively compared to the previous quarter.

However, this gap narrowed as VCB regained growth momentum and CTG maintained a good growth trend. Banks with high credit growth in the quarter included VPB (+8.3% compared to the previous quarter), TCB (+6.1%), ACB (+5.6%) and MBB (+5.5%).

Illustration photo

In contrast, HDB recorded a surprise decrease (-3.3%) due to the sale of VND10,500 billion worth of debt to Vikki Bank in Q3-2025. If excluding this transaction, HDB's credit growth in Q3 only decreased slightly by -1.3%.

Except for HDB, the main credit growth drivers of the commercial banking group in the third quarter continued to focus on real estate and construction (+6.84%) and home loans (+6.65%).

Lending to securities companies also recorded a strong increase, especially at VPB, MBB and TCB, thanks to favorable developments in the stock market during the period.

Meanwhile, ACB remains steadfast in its focus on working capital loans for production, business households and FDI enterprises - in line with the bank's strategic orientation.

Regarding asset quality and credit costs, the report showed that total non-performing loans (NPL) in the third quarter increased slightly by +1.5%. According to SSI, asset quality has generally stabilized.

However, the performance remained mixed among banks. ACB, VIB, VPB, CTG and BID recorded improvements, while STB, OCB, MBB and HDB recorded a decline in asset quality; the rest remained relatively stable.

MBB surprised with a 23% increase in bad debt, mainly from restructured loans of renewable energy customers in the process of renegotiating power purchase agreements (PPA) with EVN. These loans are expected to be reclassified to group 1 in the fourth quarter of 2025.

'Rain' of cash dividends flowing to ministries and branches

According to the announcement from Vietnam Engine and Agricultural Machinery Corporation - VEAM (VEA), on November 19, the company will close the shareholder list to pay 2024 cash dividends at a rate of 46.58%. Accordingly, shareholders owning 1 share will receive 4,658.8 VND.

It is estimated that with nearly 1.33 billion shares in circulation, the total amount VEAM will pay is nearly 6,200 billion VND. Of which, the largest shareholder, the Ministry of Industry and Trade, holding 88.47% of the capital, will receive about more than 5,400 billion VND.

Illustration

In addition, Viglacera (VGC) will also close the right to pay dividends in 2024 at a rate of 22%, equivalent to VND 2,200/share. Accordingly, the ex-right date is November 11, expected to be paid on December 5.

VGC's largest shareholder at the end of September was Gelex Infrastructure JSC with a 50.21% ownership ratio, which could receive nearly VND500 billion in dividends. Another major shareholder is the Ministry of Construction, which holds 38.58% of the capital, and will receive nearly VND381 billion.

Main news on Tuoi Tre daily today 10-11. To read Tuoi Tre print newspaper E-paper version, please register for Tuoi Tre Sao HERE

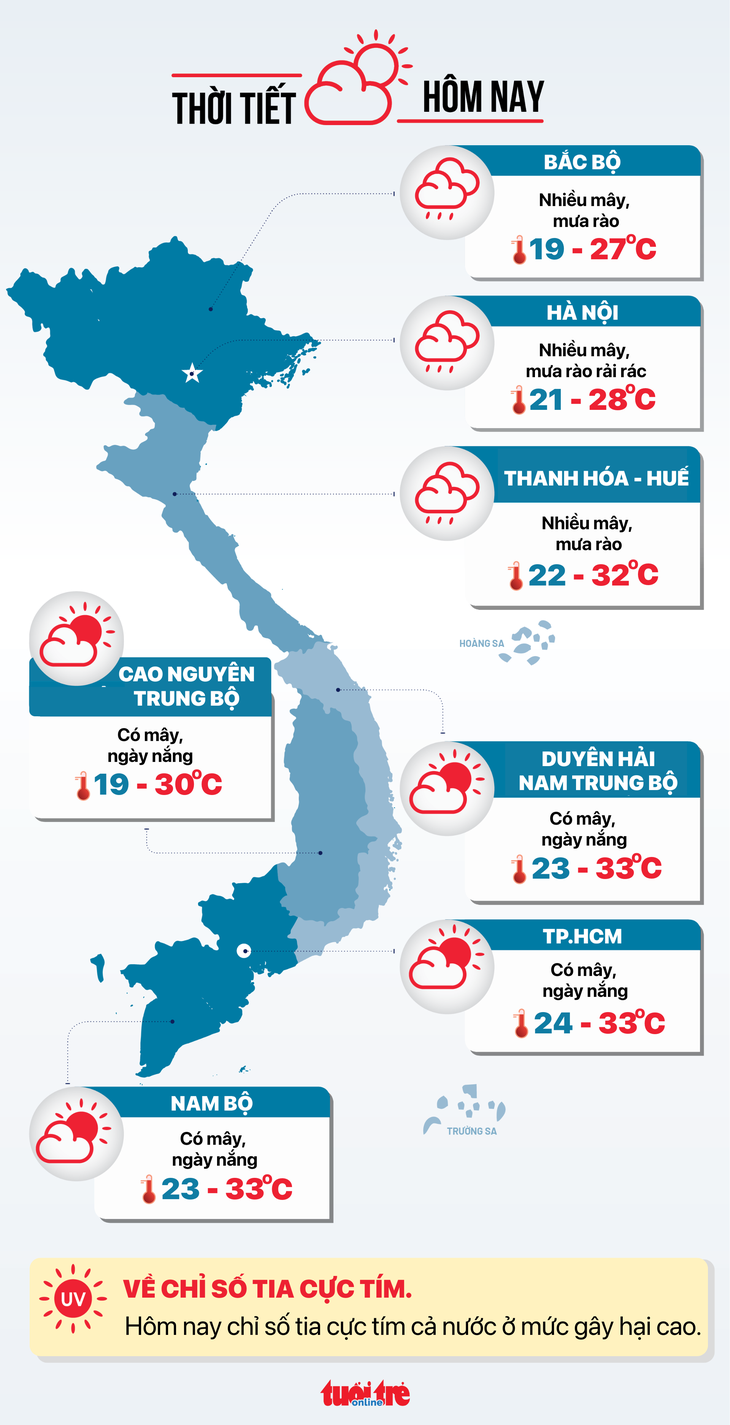

Weather news today 10-11

Nung people's hat weaving profession - Photo: THI THO

Back to topic

BINH KHANH - THANH CHUNG

Source: https://tuoitre.vn/tin-tuc-sang-10-11-sang-nay-quoc-hoi-lam-cong-tac-nhan-su-2025110919581208.htm

![[Photo] Opening of the 14th Conference of the 13th Party Central Committee](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/11/05/1762310995216_a5-bnd-5742-5255-jpg.webp)

![Dong Nai OCOP transition: [Article 3] Linking tourism with OCOP product consumption](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/11/10/1762739199309_1324-2740-7_n-162543_981.jpeg)

Comment (0)