|

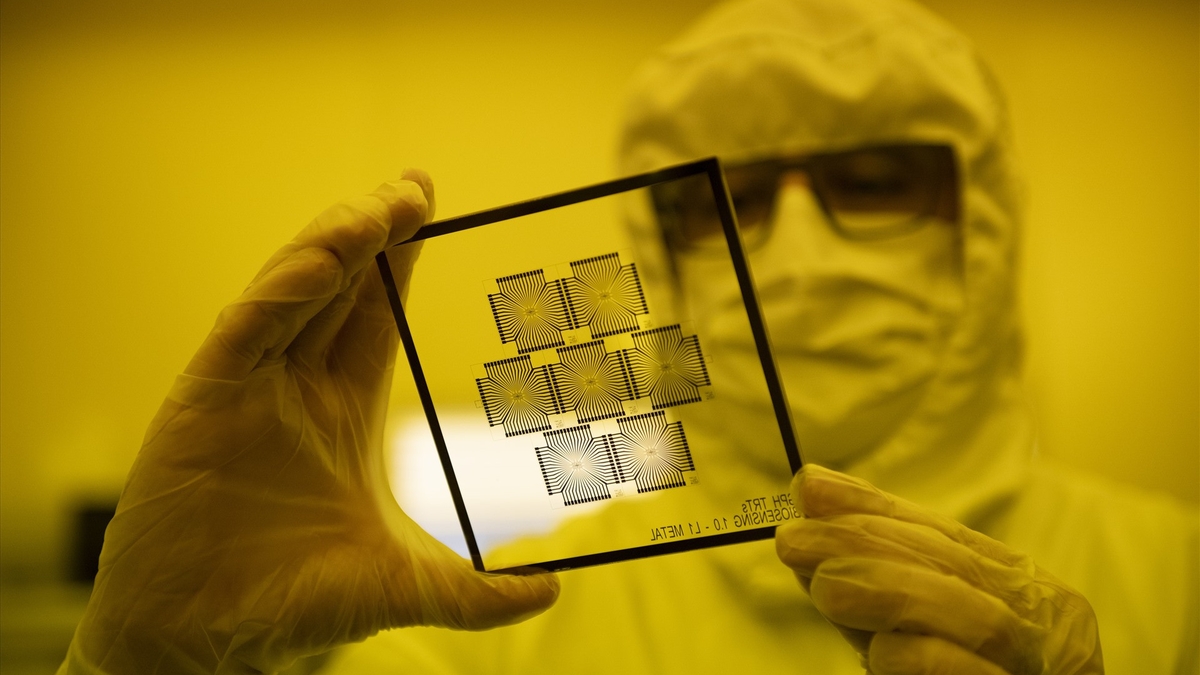

| Despite drastic staff cuts, LPBank still spends generously on employees. Photo: Duc Thanh |

Human resources and salaries fluctuate greatly.

Financial reports of many banks show that the human resource picture in the first half of this year has fluctuated strongly. Accordingly, the trend of cutting staff in previous years continues to take place at some banks, most notably LPBank.

LPBank's financial report shows that as of June 30, 2025, the bank only had 9,203 officers and employees, a decrease of 2,909 people (down 31.6%) compared to the same period last year and a decrease of nearly 2,000 people compared to the end of 2024. Thus, in the second quarter of 2025, LPBank reduced 367 employees after cutting up to 1,619 employees in the first quarter of 2025.

Despite the drastic reduction in staff, LPBank has been generous in spending on employees. The total cost of salaries and allowances of the Bank in the first half of this year was 1,400 billion VND, an increase of 11.8% over the same period last year. This helped the average salary in the first 6 months of the year of officers and employees here increase to 24.24 million VND/person/month (an increase of 31.8%). Currently, the average income of officers and employees of this bank is 26.94 million VND/person/month, an increase of 27.1% over the same period.

Among the banks that have announced their financial reports for the second quarter of 2025, only LPBank has announced a sharp reduction in staff. Previously, a series of banks such as Sacombank , TPBank, VIB... also announced staff reductions in the first quarter, but have not yet announced their financial reports for the second quarter.

On the contrary, many banks still increased their staff significantly compared to last year. According to VPBank 's separate financial report for the second quarter of 2025, as of the end of June 2025, the total number of employees of VPBank's parent bank was 15,680, an increase of 677 compared to the end of last year (up 4.5%).

Although the average number of employees increased by only 13.4% compared to the same period last year, the cost of salaries and allowances for VPBank employees increased by nearly 42%. Thanks to that, the average income of this bank's employees in the first 6 months of this year reached 40.85 million VND/person/month (an increase of 23.6% compared to the same period last year).

In the second quarter of 2025, VPBank recorded net profit equivalent to the same period last year, but due to a 39% decrease in risk provisions, profit in the second quarter of 2025 increased by 61% compared to the same period last year.

PGBank also recorded a slight increase in staff (up 127 people) compared to the same period last year, while the average income of staff increased to 26.7 million VND/person/month (up 8.8% compared to the same period last year).

Contrary to the trend of increasing income, in the first half of this year, some banks have sharply cut the income of their staff, such as Techcombank and KienLongBank.

As of June 30, 2025, Techcombank recorded 11,306 employees, an increase of nearly 8.1% over the same period last year. During the period, the Bank reduced salary and related costs for employees by up to 5%. Accordingly, the average salary of this bank's employees decreased by 28.2%, while income decreased by 18.8%. The average income of Techcombank employees in the first half of this year was VND43 million/person/month compared to VND53 million in the same period last year.

Similarly, KienLongBank reduced salary and allowance costs for employees by more than 10%, causing total employee income to decrease to VND23 million/person/month in the first 6 months of the year, instead of VND25 million in the same period last year.

Bank employee salaries have strong differentiation.

According to Ms. Ngo Lan, Director of Navigos Search North, this year, although banks are profitable, they still lay off a lot of people, mainly due to the impact of technology. Currently, artificial intelligence (AI) can replace many tasks of bank employees. Therefore, many banks, on the one hand, want to lay off many employees doing simple, manual work, while on the other hand, they increase recruitment in some groups, especially technology and sales groups.

- Associate Professor, Dr. Pham Thi Hoang Anh, Deputy Director of Banking Academy

The demand for digital human resources in the banking industry is increasing rapidly, but the supply is currently not enough to meet the demand. The banking industry lacks human resources with both deep expertise in the banking sector and knowledge of information technology. This is a human resource that determines the competitiveness of banks. The demand for human resources in this field is increasing rapidly. If in 2018, the banking industry needed 320,000 technology human resources, then by 2026, it will need 750,000 people.

The demand for digital human resources in the banking industry is increasing rapidly, but the supply is currently not enough to meet the demand. The banking industry lacks human resources with both deep expertise in the banking sector and knowledge of information technology. This is a human resource that determines the competitiveness of banks. The demand for human resources in this field is increasing rapidly. If in 2018, the banking industry needed 320,000 technology human resources, then by 2026, it will need 750,000 people.

Regarding salary, according to experts, the average salary of commercial banks is quite high, but there is a strong differentiation. There are employees who receive a salary of 15-20 million VND/month, but there are positions where banks have to pay hundreds of millions of VND/month, especially technology employees.

Mr. Luu Danh Duc, Deputy General Director of LPBank, said that the reason LPBank drastically cut its staff in the first half of this year was because the Bank had reorganized and streamlined its apparatus from 18 blocks to 8 blocks. The desire of bank owners is extremely large, the investment capital is not small, but recruiting high-level technology personnel is not easy. The reason is that the labor market lacks workers who are both highly skilled in technology and knowledgeable in the fields of finance and banking.

Ms. Ngo Lan also said that many banks are willing to pay up to 700-800 million VND/month for experts and technology candidates from abroad, but recruiting people is not easy.

According to economic experts, in the next 5 years, 85 million banking jobs will disappear worldwide, but 97 million new jobs will be created. This shows that the demand for jobs in the banking sector continues to increase, but not all employees can meet it.

Mr. Phan Duc Trung, Chairman of the Vietnam Blockchain Association, said that up to 60% of banking staff will need to be retrained in the next 5 years. This shows that banking staff are facing great opportunities, but also great challenges.

Source: https://baodautu.vn/trai-chieu-bien-dong-nhan-su-thu-nhap-tai-ngan-hang-d340148.html

![[Photo] Da Nang: Hundreds of people join hands to clean up a vital tourist route after storm No. 13](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/07/1762491638903_image-3-1353-jpg.webp)

Comment (0)