Positive growth, maintaining a strong and secure balance sheet.

As of September 30th,VIB 's total assets reached over VND 543,000 billion, a 10% increase compared to the beginning of the year. Outstanding loans reached nearly VND 373,000 billion, a 15% increase compared to the beginning of the year, with contributions evenly distributed across its three main business segments: individual customers, corporate customers, and financial institutions.

VIB announced its business results for the first nine months of the year with a profit of over VND 7,040 billion, an increase of 7% compared to the same period last year (Photo: VIB).

Customer deposits recorded growth of over 11%, reaching nearly VND 308,000 billion. CASA balances and Super Yield accounts increased by 39% year-on-year, demonstrating the effectiveness of the strategy to optimize idle cash flow. VIB also launched a combined solution of Super Yield accounts and Smart Card cashback payment cards with the goal of "Leading the trend in profitability".

The VIB duo offers combined benefits that can reach up to 9.3% (Photo: VIB).

Asset quality continued to improve significantly in the third quarter, with the non-performing loan ratio decreasing to 2.45%, a reduction of 0.23 percentage points compared to the end of the first quarter. VIB's loan portfolio maintained a balanced proportion, with over 73% of outstanding loans in the Retail and SME segments, of which over 90% of retail loans were secured by fully legal real estate assets, concentrated in major urban areas.

Meanwhile, 27% of the credit portfolio is allocated to corporate and financial institution clients, primarily focused on industry leaders within the FDI, state-owned, and private sectors.

In the third quarter, the bank issued a 14% bonus share issue and completed the payment of a total of 21% in cash and stock dividends. The bank's safety management indicators remained at optimal levels, with a Basel II capital adequacy ratio (CAR) of 12.4%, a loan-to-deposit ratio (LDR) of 79%, a short-term to medium- and long-term loan ratio of 27%, and a Basel III net stable capital ratio (NSFR) of 107%.

Profits for the first nine months increased by 7%, boosting diversification of revenue sources.

At the end of the first nine months of 2025, VIB recorded total operating income of over VND 14,700 billion, pre-tax profit of over VND 7,040 billion, an increase of 7% compared to the same period. Net interest income reached nearly VND 11,900 billion, continuing to be the main contributor as the bank boosted lending across all customer segments.

In response to the Government's directive on credit support, VIB's lending interest rates have been maintained at a reasonable level, contributing to promoting economic recovery. The net interest margin (NIM) reached 3.2%, ensuring a balance between profitability and asset quality.

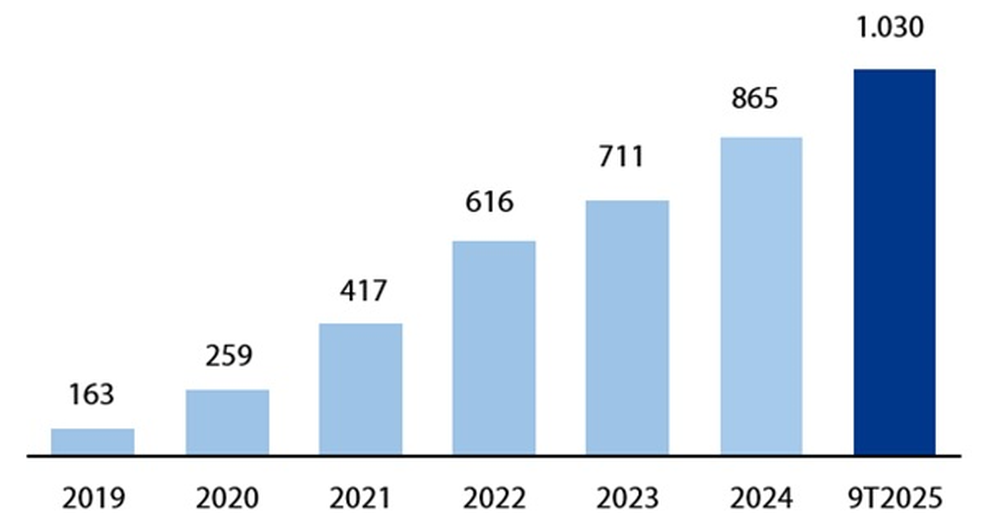

Non-interest income contributed significantly, accounting for over 19% of total operating income, mainly from fees and service activities. As of September 30th, VIB's credit cards exceeded one million in circulation, with total spending after nine months reaching over VND 104,000 billion, a 15% increase compared to the same period last year.

Number of credit cards in circulation at VIB from 2019 to September 2025 (Unit: Thousand cards)

Completing a comprehensive financial ecosystem and enhancing the customer experience.

Responding to the trend of customers seeking comprehensive financial solutions rather than individual products, Vietnam International Bank (VIB) launched Privilege Banking with the positioning that "Value is measured not only by assets, but by experience." Privilege Banking opens up a comprehensive ecosystem of privileges, combining financial benefits, lifestyle, and premium services, affirming VIB's pioneering position in the priority banking segment in Vietnam.

Financial privileges from the comprehensive VIB Privilege Banking ecosystem (Photo: VIB).

Also in the third quarter, VIB was honored by Visa International with 3 awards at the Visa Vietnam Customer Conference 2025, including Digital Pioneer - pioneering the deployment of new digital solutions in Vietnam; Payment Volume Growth - outstanding growth in card transaction volume; and Supply Chain Payment & Commercial Card Innovation 2025 - pioneering in supply chain payments and corporate card innovation with VIB Business Card.

Outstanding growth in card spending, pioneering technology and innovation, VIB receives 3 awards from Visa (Photo: VIB).

The positive results in the first nine months of the year further affirm VIB's correct direction in improving operational efficiency, controlling risks, and promoting digitalization. With a solid financial foundation, high credit quality, and an increasingly complete digital ecosystem, VIB is ready to accelerate in the fourth quarter, continuing to create sustainable value for customers, shareholders, and the Vietnamese economy.

Source: https://dantri.com.vn/kinh-doanh/vib-cong-bo-loi-nhuan-9-thang-hon-7040-ty-dong-chi-tra-21-co-tuc-2025-20251028201535342.htm

![[Image] Vietnam's colorful journey of innovation](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F14%2F1765703036409_image-1.jpeg&w=3840&q=75)

![[Image] Vietnam's colorful journey of innovation](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/12/14/1765703036409_image-1.jpeg)

![[Infographic] Portrait of the Standing Committee of the Dong Nai Provincial Farmers' Association for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/12/14/1765708210139_thumbnail_ban_thuong_vu_sua_20251214164836.jpeg)

Comment (0)