Specifically, MSCI added 6 new Vietnamese stocks to the MSCI Frontier Markets Index portfolio, including CEO, EVF, KOS, SIP, VPB and CTR. On the other hand, the index basket did not exclude any Vietnamese stocks.

In addition to adding 6 new Vietnamese stocks, the MSCI Frontier Markets Index basket also added 4 new Sri Lankan stocks, 2 Omani stocks, 1 Moroccan stock and 1 Tunisian stock. On the other hand, this index basket removed 2 stocks from Sri Lanka. Thus, after this restructuring, the number of stocks in the MSCI Frontier Markets Index basket will increase to 211 stocks.

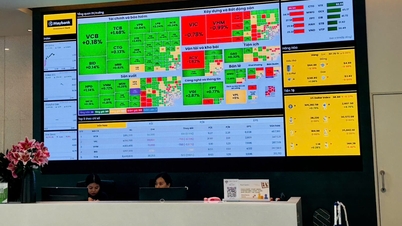

Vietnam is currently the largest market in the MSCI Frontier Markets Index. As of October 31, the proportion of the Vietnamese market in the MSCI Frontier Markets Index was 25.76%, followed by Romania (11.11%), Morocco (10.88%)... Currently, there are many large funds, with hundreds of millions of USD in scale, being allocated to frontier markets (including Vietnam) based on the MSCI Frontier Markets Index.

The top 10 largest stocks in the MSCI Frontier Markets Index basket as of October 31 included 4 Vietnamese stocks, including HPG (2.71%), VNM (2.06%), VCB (2.01%) and VIC (1.92%).

Meanwhile, with the MSCI Frontier Markets Smallcaps Index, this index has added 7 new Vietnamese stocks including LHC, TVS, VFS, VIP, VNS, IDV and YEG. On the other hand, the index basket excludes CEO and EVF (to add to the MSCI Frontier Markets Index basket).

Vietnam currently has the largest weighting in the MSCI Frontier Markets Smallcaps Index at 29.04%. However, no notable funds are currently investing in frontier markets in this index.

According to Mr. Tran Hoang Son - VPBankS Market Strategy Director, if the KRX system goes into operation in 2023, Vietnam can be included in MSCI's upgrade watchlist in the annual review in June 2024. It can then be announced to be upgraded to emerging market status in the review in June 2025 and officially included in the basket in June 2026.

At that time, it is expected that 6 stocks will benefit, including HPG, VNM, VIC, MSN, VHM, VCB (when meeting the requirements on capitalization, free-float capitalization and liquidity of emerging markets).

Source

![[Photo] Opening of the 14th Conference of the 13th Party Central Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/05/1762310995216_a5-bnd-5742-5255-jpg.webp)

![[Photo] Panorama of the Patriotic Emulation Congress of Nhan Dan Newspaper for the period 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/04/1762252775462_ndo_br_dhthiduayeuncbaond-6125-jpg.webp)

Comment (0)