At the 9th session of the 15th National Assembly, contributing comments to the draft Law on Corporate Income Tax (amended), delegate Thach Phuoc Binh - National Assembly Delegation of Tra Vinh province said that the regulation at Point v, Clause 2, Article 12 of the Draft Law has included the press, including newspaper advertising, in the list of subjects eligible for corporate income tax incentives. This is an important step forward, providing strategic support to the Vietnamese press industry in the context of innovation, digital transformation and facing market challenges.

According to the delegate, the press industry is currently facing a serious decline in revenue, especially traditional advertising due to fierce competition from digital platforms such as Google and Facebook. Adding newspapers to the tax incentives will help reduce financial pressure, creating conditions for press agencies to continue to maintain their political and social tasks.

Delegate Thach Phuoc Binh - National Assembly Delegation of Tra Vinh province

Journalism is not simply a business but also performs the function of information andeducation , orienting public opinion to criticize policies, playing an important role in political stability and cultural development.

Tax incentives are a form of indirect support from the State for public service activities in line with the nature of revolutionary journalism. Financial resources from tax reduction can be reinvested by press agencies in technology infrastructure, upgrading content management systems, digitizing content, and training staff. Thereby, promoting the improvement of content quality, competitiveness with social media and cross-border platforms.

"This regulation reflects the serious acceptance of the opinions of National Assembly deputies, the Vietnam Journalists Association, and press agencies that have repeatedly made recommendations in recent sessions. In particular, during the Law's consultation sessions, many press agencies proposed to be treated more fairly in terms of taxes when performing socio-political tasks but still have to bear the burden of tax obligations like commercial enterprises," the delegate expressed.

In addition, to optimize regulations, delegate Thach Phuoc Binh proposed some contents:

Firstly, it is necessary to review the definition of preferential press. It is necessary to clearly stipulate that the scope of application only applies to press agencies licensed to operate under the Press Law, to avoid being exploited by disguised media organizations. Clearly determine whether advertising content on electronic newspapers also enjoys this preferential treatment.

Second, linking incentives to social performance requires setting out control criteria such as the proportion of official information content, the quality of press products, or compliance with professional ethics.

Third, it is necessary to combine tax incentives with direct support policies in addition to tax exemptions and reductions.

"In my opinion, there should be a Fund to support innovation in journalism, support journalism in technology training and digital transformation for small local agencies," the delegate suggested.

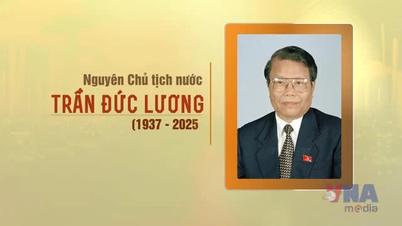

Chairman of the Economic and Financial Committee of the National Assembly Phan Van Mai

Previously, presenting the Report on explanation, acceptance and revision of the draft Law on Corporate Income Tax (amended), Chairman of the National Assembly's Economic and Financial Committee Phan Van Mai said that the Law on Corporate Income Tax (amended) after acceptance and revision consists of 4 chapters and 21 articles.

Regarding additional tax incentives for the press, according to the drafting agency, under current law, the income of press agencies from print newspaper activities, including advertising on print newspapers as prescribed by the Press Law, is subject to a tax rate of 10% throughout the entire period of operation; for other press activities, the general tax rate is 20%.

According to Chairman of the National Assembly's Economic and Financial Committee Phan Van Mai, in the context that press agencies are having to reorganize and rearrange according to the Party and State's policies and are public service units that are not yet fully autonomous, press revenue mainly relies on advertising, but with the development of technology, especially social media, press revenue from advertising tends to decrease.

Therefore, in order to demonstrate the support of the Party and State for the activities of press agencies, on the basis of agreeing with the proposal of the Drafting Agency, the National Assembly Standing Committee has accepted and revised the draft Law in the direction of uniformly applying the preferential tax rate of 10% to all types of press, similar to the preferential policy currently applied to printed newspapers.

Source: https://bvhttdl.gov.vn/dbqh-uu-dai-thue-la-buoc-tien-quan-trong-co-tinh-ho-tro-chien-luoc-voi-nganh-bao-chi-viet-nam-20250513125024468.htm

![[Photo] Top players gather at the 2025 Nhan Dan Newspaper National Table Tennis Championship](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/23/9ad5f6f4faf146b08335e5c446edb107)

![[Photo] Anh Hoang - Dinh Duc successfully defended the men's doubles championship of the National Table Tennis Championship of Nhan Dan Newspaper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/23/d6ab3bcac02c49928b38c729d795cac6)

Comment (0)