Domestic gold price today

Domestic gold bar prices increased. At the end of May 24, gold brands were buying at 119 million VND/tael and selling at 121 million VND/tael. Phu Quy SJC gold was buying at 1 million VND lower than other brands.

Similarly, the price of gold rings of most brands has also been adjusted up both buying and selling prices. Specifically, the price of SJC 9999 gold rings increased by 1 million VND for buying and 500,000 VND for selling, up to 113.5 million VND/tael and 116 million VND/tael, respectively.

|

| Domestic gold bar prices increase. Photo: thanhnien.vn |

DOJI in Hanoi and Ho Chi Minh City markets also adjusted the buying price up by 1 million VND and the selling price up by 500,000 VND to 113.5 million VND/tael and 116 million VND/tael.

The price of Bao Tin Minh Chau brand gold rings is listed at 115.5 million VND/tael for buying and 118.5 million VND/tael for selling, an increase of 1 million VND in both directions.

Phu Quy SJC is buying gold rings at 113 million VND/tael and selling at 116 million VND/tael, an increase of 500,000 VND in both directions.

PNJ brand gold ring price is listed at 113 million VND/tael for buying and 116 million VND/tael for selling, an increase of 500,000 VND for both buying and selling.

Domestic gold bar prices updated at 5:30 a.m. on May 25 as follows:

Yellow | Area | Early morning 24-5 | Early morning 25-5 | Difference | ||||||

Buy | Sell | Buy | Sell | Buy | Sell | |||||

Unit of measure: Million VND/tael | Unit of measure: Thousand dong/tael | |||||||||

DOJI | 118.5 | 121 | 119 | 121 | +500 | +500 | ||||

Ho Chi Minh City | 118.5 | 121 | 119 | 121 | +500 | +500 | ||||

SJC | Ho Chi Minh City | 118.5 | 121 | 119 | 121 | +500 | +500 | |||

Hanoi | 118.5 | 121 | 119 | 121 | +500 | +500 | ||||

Danang | 118.5 | 121 | 119 | 121 | +500 | +500 | ||||

PNJ | Ho Chi Minh City | 118.5 | 121 | 119 | 121 | +500 | +500 | |||

Hanoi | 118.5 | 121 | 119 | 121 | +500 | +500 | ||||

Bao Tin Minh Chau | Nationwide | 118.5 | 121 | 119 | 121 | +500 | +500 | |||

Phu Quy SJC | Nationwide | 117.8 | 121 | 118 | 121 | +500 | +500 | |||

World gold price today

Increased safe-haven demand has helped gold rally solidly this week. The turmoil began late Friday after Moody's downgraded the U.S. sovereign credit rating, citing concerns about the country's growing debt of $36 trillion. The precious metal broke through initial resistance at $3,200 an ounce and ended the week above $3,300 an ounce.

Analysts note that gold continues to assert its role as a global safe-haven currency. However, others say that this also poses short-term risks.

Gold prices are likely to remain subdued as long as US government bond yields do not rise too sharply and the 30-year bond yield remains below around 5%, according to FXTM market analyst Han Tan.

In addition to trade and geopolitical developments, gold traders will also look to potential signals from the US central bank’s policy meeting minutes and personal consumption expenditures price index data to adjust expectations for a rate cut from the US Federal Reserve in the coming week, he said. Gold could break out of the $3,000–$3,500/ounce range if the Fed signals it is ready to continue its rate-cutting cycle, he added.

|

| World gold price anchored above 3,300 USD/ounce. Photo: Kitco |

A move above $3,355 an ounce could signal the end of a short-term correction, said Ole Hansen, head of commodity strategy at Saxo Bank, but he warned that bond market sentiment could be too negative.

“My only concern is that we have reached peak bond pessimism and that could trigger a risk-on move,” he said.

Some bond market analysts said next week's auction could attract more participants as investor demand for shorter-dated bond yields remains strong.

Hansen also noted that gold could also attract safe-haven demand after US President Donald Trump threatened to raise tariffs on imports from Europe to 50% on June 1.

In this context, experts are also paying attention to the USD as this currency continues to lose momentum.

A weaker US dollar will continue to benefit gold, said David Morrison, senior market analyst at Trade Nation, but he urged investors to be cautious as momentum is currently neutral and prices could move in either direction.

With the domestic gold bar price increasing and the world gold price listed at Kitco at 3,358.9 USD/ounce (equivalent to about 105.8 million VND/tael converted according to Vietcombank exchange rate, excluding taxes and fees), the difference between domestic and world gold prices is about 15.2 million VND/tael.

TRAN HO HOAI

* Please visit the Economics section to see related news and articles .

Source: https://baodaknong.vn/gia-vang-hom-nay-25-5-vang-nhan-tang-manh-253558.html

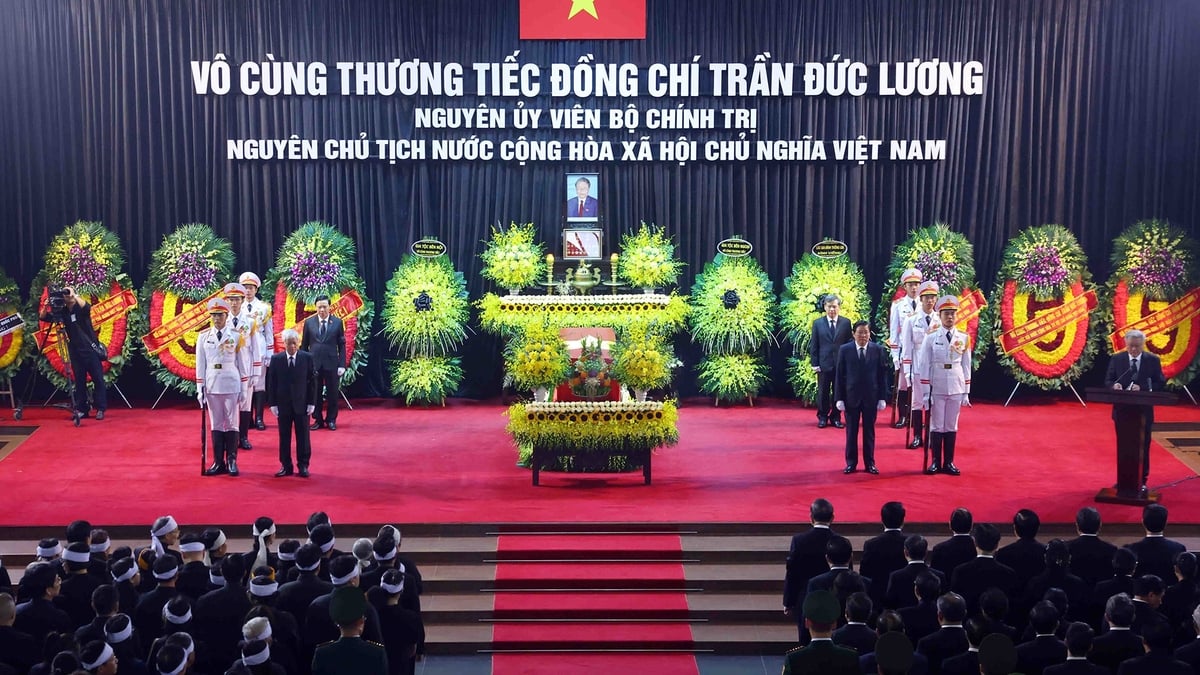

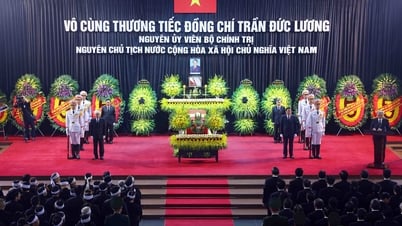

![[Photo] Panorama of the memorial service for former President Tran Duc Luong](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/25/d33968481f21434fa9ed0df48b9ecfa9)

![[Photo] Prime Minister Pham Minh Chinh meets the Vietnamese community in Malaysia](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/25/1f11d1256d7745a2a22cc65781f53fdc)

Comment (0)