Domestic gold price today April 30, 2025

At the time of survey at 2:30 p.m. on April 30, 2025, the domestic gold price was anchored at a high level of over 121 million VND. The gold market is on holiday from April 30 to May 1, so the price will not change until the end of this week. Specifically:

The price of SJC gold bars listed by DOJI Group is at 119.3-121.3 million VND/tael (buy - sell), the price remains unchanged in both buying and selling directions compared to yesterday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 119.3-121.3 million VND/tael (buy - sell), the price remained unchanged in both buying and selling directions compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 119.5-121 million VND/tael for buying and selling. Compared to yesterday, the gold price increased by 300 thousand VND/tael for buying - unchanged for selling.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by businesses at 119.3-121.3 million VND/tael (buying - selling), unchanged in both buying and selling directions compared to yesterday.

SJC gold price at Phu Quy is traded by businesses at 118.3-121.3 million VND/tael (buy - sell), gold price remains unchanged in both buying and selling directions compared to yesterday.

As of 2:30 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 114-116.5 million VND/tael (buy - sell); unchanged in both buying and selling directions compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 117.1-120.1 million VND/tael (buy - sell); unchanged in both buying and selling directions compared to yesterday.

The latest gold price list today, April 30, 2025 is as follows:

| Gold price today | April 30, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 119.3 | 121.3 | - | - |

| DOJI Group | 119.3 | 121.3 | - | - |

| Red Eyelashes | 119.8 | 121 | +300 | - |

| PNJ | 119.3 | 121.3 | - | - |

| Vietinbank Gold | 121.3 | - | ||

| Bao Tin Minh Chau | 119.3 | 121.3 | - | - |

| Phu Quy | 118.3 | 121.3 | - | - |

| 1. DOJI - Updated: April 30, 2025 14:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Domestic gold price | Buy | Sell |

| AVPL/SJC HN | 119,300 | 121,300 |

| AVPL/SJC HCM | 119,300 | 121,300 |

| AVPL/SJC DN | 119,300 | 121,300 |

| Raw material 9999 - HN | 113,800 | 115,600 |

| Raw material 999 - HN | 113,700 | 115,500 |

| 2. PNJ - Updated: April 30, 2025 14:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| SJC 999.9 gold bar | 11,930 | 12,130 |

| PNJ 999.9 Plain Ring | 11,400 | 11,700 |

| Kim Bao Gold 999.9 | 11,400 | 11,700 |

| Gold Phuc Loc Tai 999.9 | 11,400 | 11,700 |

| 999.9 gold jewelry | 11,400 | 11,650 |

| 999 gold jewelry | 11,388 | 11,638 |

| 9920 jewelry gold | 11,317 | 11,567 |

| 99 gold jewelry | 11,294 | 11,544 |

| 750 Gold (18K) | 8.003 | 8,753 |

| 585 Gold (14K) | 6,080 | 6,830 |

| 416 Gold (10K) | 4.111 | 4,861 |

| PNJ Gold - Phoenix | 11,400 | 11,700 |

| 916 Gold (22K) | 10,431 | 10,681 |

| 610 Gold (14.6K) | 6,372 | 7.122 |

| 650 Gold (15.6K) | 6,838 | 7,588 |

| 680 Gold (16.3K) | 7,187 | 7,937 |

| 375 Gold (9K) | 3,634 | 4,384 |

| 333 Gold (8K) | 3.110 | 3,860 |

| 3. SJC - Updated: April 30, 2025 14:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 119,300 | 121,300 |

| SJC gold 5 chi | 119,300 | 121,300 |

| SJC gold 0.5 chi, 1 chi, 2 chi | 119,300 | 121,300 |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 114,000 | 116,500 |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 114,000 | 116,600 |

| Jewelry 99.99% | 114,000 | 115,900 |

| Jewelry 99% | 110,752 | 114,752 |

| Jewelry 68% | 72,969 | 78,969 |

| Jewelry 41.7% | 42,485 | 48,485 |

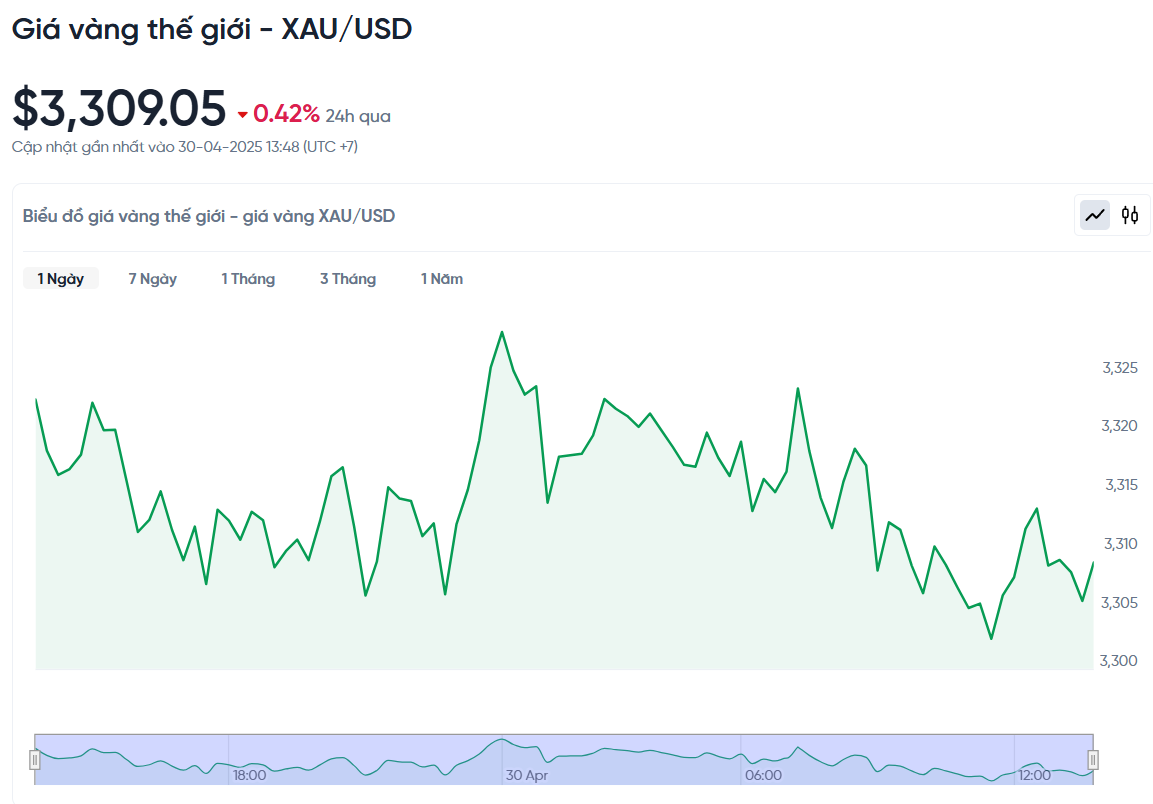

World gold price today April 30, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 2:30 p.m. today, Vietnam time, was 3,309.05 USD/ounce. Today's gold price decreased by 13.89 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,180 VND/USD), the world gold price is about 105.51 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 15.79 million VND/tael higher than the international gold price.

World gold prices fell slightly after the latest data showed that US consumer confidence in April fell more than expected. The downward pressure also came from the rising US dollar and falling crude oil prices, two factors that are usually not favorable for gold prices.

According to Nicholas Frappell, an expert from ABC Refinery, the slight increase in the USD is the main reason for the decrease in gold prices. In addition, trade tensions also showed signs of easing after US President Donald Trump signed an executive order to reduce import tariffs on cars. However, experts said that the current tax rate is still quite high and confidence in the US financial market may have been affected in the long term.

Asian and European stock markets were mixed overnight. US markets are expected to open mixed today as investors focus on upcoming quarterly earnings reports.

According to a report from The Conference Board, the Consumer Confidence Index fell to 86 points, lower than the forecast of 87.5 points and also lower than the upwardly revised 93.9 points in March.

The Present Situation Index, which measures current business and labor market conditions, fell 0.9 points to 133.5. The Expectations Index, which measures consumers' expectations for future income, business and employment, fell sharply by 12.5 points to 54.4, its lowest level since October 2011 and well below the 80-point threshold that typically signals a recession.

Tariffs are now a top concern among consumers, with a record number of mentions, many expressing concern about tariffs raising prices and negatively impacting the economy.

The share of consumers expecting a recession next year has risen to a two-year high. At the same time, more are expecting interest rates to continue falling. Investors now expect the Fed to cut rates by about 0.95% this year.

US gold futures also fell 0.7% to $3,310.70. The dollar rose 0.1% against a basket of major currencies, making gold more expensive for foreign investors. Meanwhile, other precious metals such as silver, platinum and palladium also fell.

Gold Price Forecast

In the coming days, markets will pay close attention to key US economic data, including the consumer spending index (PCE) and the non-farm payrolls report, which will help gauge the impact of tariffs on the Fed's monetary policy.

If the PCE shows continued weakness in inflation, the Fed could continue to cut interest rates, which would support gold prices. Conversely, if the data is better than expected, expectations of interest rate cuts could decline, putting further pressure on gold.

Gold prices are currently under pressure due to optimism in financial markets. Expectations of a possible easing of trade tensions between the US and China, along with a slight recovery in the US dollar, are weakening demand for gold, said Ricardo Evangelista, senior analyst at brokerage firm ActivTrades.

In its latest commodity outlook report, the World Bank forecasts that gold prices will average around $3,250 an ounce this year. That is 36% higher than last year’s average, and a major revision from its November forecast, when experts said gold prices would remain flat.

Moving into 2026, the average gold price is forecast to decline slightly to around $3,200/ounce, down about 1.5% from this year. However, in the broader context, gold is still considered the most prominent asset in the commodity group over the next two years.

Gold will continue to receive strong support from safe-haven demand, according to a World Bank report. Factors such as political uncertainty, geopolitical conflicts and concerns about global financial volatility are keeping gold at high levels.

Gold prices are now expected to be up to 155% higher than the 2015–2019 average. If global tensions continue to escalate, gold prices could even surpass current forecasts.

Technically, the June gold contract still has the near-term advantage. The buyers are aiming to close above the resistance level of $3,509.90 per ounce. Meanwhile, the sellers are aiming to push the price below the support level of $3,200 per ounce, which could trigger a deeper decline if this scenario occurs.

Source: https://baonghean.vn/gia-vang-ngay-30-4-2025-gia-vang-giam-sau-bao-cao-chi-so-niem-tin-tieu-dung-thap-hon-du-kien-10296284.html

Comment (0)