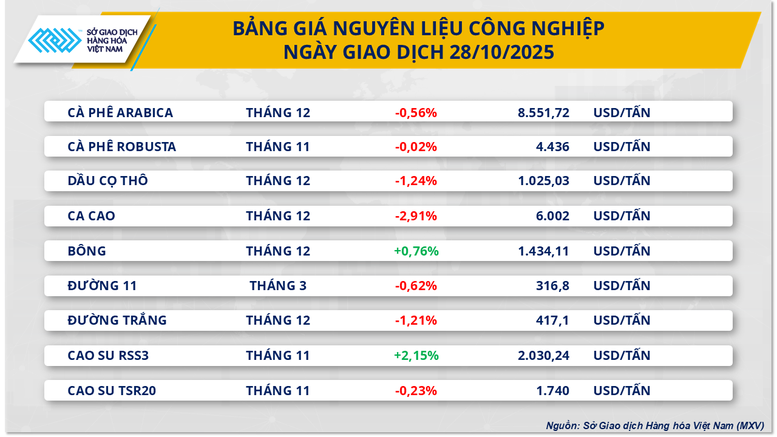

Supply pressure continues to push palm oil prices down

At the end of yesterday's trading session, the industrial raw material market was deep in red. In particular, Malaysian palm oil prices continued to extend their decline to the third consecutive session. Specifically, the price of Malaysian palm oil futures for December delivery continued to lose another 1.24% to 1,022 USD/ton.

According to the Vietnam Commodity Exchange (MXV), the sharp increase in supply amid somewhat weakened demand has become a factor putting pressure on palm oil prices in yesterday's session.

In Indonesia - the world's largest palm oil producer, production is forecast to increase by up to 10% in 2025, reaching around 56-57 million tonnes, far exceeding previous estimates. According to the Indonesian Palm Oil Association (GAPKI), this increase is supported by favorable weather conditions and attractive selling prices, encouraging farmers to invest in better care and management of their plantations. GAPKI Secretary General said that the period 2024-2025 will hardly see prolonged rains, bringing expectations of a harvest that is superior to last year.

In Malaysia, the latest figures from the Malaysian Palm Oil Association (MPOA) showed that production during the period from October 1-20 increased by 10.77% compared to the same period in September. This increase indicates that supply is recovering rapidly, leading to the possibility of further inventory accumulation and putting downward pressure on spot prices in the commodity market.

Against this backdrop, import demand from the EU and China has seen significant declines. European Union (EU) data shows that, as of October 19, the region’s palm oil import volume in 2025-2026 is down 20% year-on-year. This decline is partly due to the long-term impact of the Renewable Energy Directive (RED II), which restricts the use of palm oil in biofuels.

In China, the world's second-largest palm oil importer, imports for the food processing industry in September reached only 150,000 tons, down 32.2% year-on-year. Year-to-date, China's total palm oil imports reached 1.74 million tons, down 15.7% year-on-year.

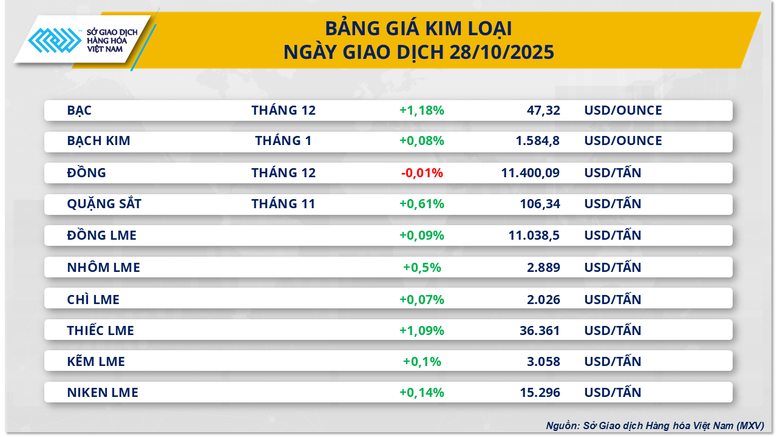

Silver prices rebound after two consecutive sessions of weakness

On the other hand, the metal market yesterday witnessed overwhelming buying power when 9 out of 10 items increased in price. Notably, after falling for 2 consecutive sessions to the lowest level in nearly 1 month, the silver price in yesterday's session suddenly reversed and recovered strongly. Specifically, the price of silver futures contracts for December turned up to increase by 1.18%, to 47.32 USD/ounce.

According to MXV, the main driver for this recovery comes from the weakening of the USD and growing expectations that the US Federal Reserve (Fed) will continue to lower interest rates at its policy meeting tomorrow. The Dollar Index (DXY) fell another 0.12% to 98.67 points, marking the second consecutive decline in the context of the 10-year US Treasury bond yield remaining below the 4% threshold for more than a week. The weaker greenback makes silver and other precious metals, which are priced in USD, more attractive to investors holding other currencies, thereby triggering technical buying in the market.

The probability of a further 25 basis point cut by the Fed has risen to 99.5%, according to the CME FedWatch tool. Recent data shows that the US labor market is cooling, with non -farm payrolls falling to their lowest level since the pandemic in May-August and the unemployment rate rising to 4.3% - a four-year high. Together with the Conference Board's October consumer confidence index continuing to decline, these signals reinforce the view that the Fed will maintain flexible monetary policy to support growth.

However, silver’s recovery was limited by weakening defensive demand. The global trade outlook improved after the US and China reached a preliminary framework agreement in Malaysia last weekend, reducing the risk of Washington imposing 100% import tariffs on Chinese goods. This positive development somewhat reduced the precious metal’s role as a haven.

Source: https://baochinhphu.vn/thi-truong-hang-hoa-ap-luc-ban-van-bao-trum-102251029100518377.htm

![[Photo] Prime Minister Pham Minh Chinh chaired a meeting to evaluate the operation of the two-level local government model.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/29/1761751710674_dsc-7999-jpg.webp)

![[Photo] Fall Fair 2025 - An attractive experience](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/30/1761791564603_1761738410688-jpg.webp)

![[Photo] New-era Party members in the "Green Industrial Park"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/30/1761789456888_1-dsc-5556-jpg.webp)

Comment (0)