At the conference to review tax work in the first 6 months of 2025 held on July 10, the Department of Taxation - Ministry of Finance announced that by the end of June 2025, up to 238,942 businesses had registered to apply electronic invoices generated from cash registers. This demonstrates a positive trend in the transition to digital technology in tax management. Businesses applying electronic invoices will help save time, costs and improve business efficiency. This development not only benefits businesses but also contributes to the transparency and efficiency of the national economy.

In the first 6 months of 2025 alone, 145,929 business establishments have registered to use, of which 45,247 business households using the contract method with revenue of 1 billion VND/year or more have applied, basically completing according to the provisions of Decree 70/2025/ND-CP.

Regarding budget revenue, total revenue in the first 6 months of the year is estimated at over VND 1,180 trillion, equal to 68.7% of the ordinance estimate, up 38.1% over the same period last year. Notably, tax revenue from e-commerce and digital economy activities reached VND 98,000 billion, up 58% over the same period in 2024.

Tightening the declaration process, strengthening tax management for e-commerce activities on digital platforms, improving tax refund procedures and implementing anti-revenue loss topics have significantly contributed to improving management efficiency and minimizing state budget loss.

At the conference, Mr. Phan Thanh Hoa, Deputy Director of the Hanoi Tax Department, said that in the city, many households and business individuals who are famous on social networks have proactively declared and paid over 40 billion VND to the budget. In addition, households and business individuals have also proactively paid taxes through the e-commerce portal of about 1,020 billion VND, accounting for 55% of the total amount paid nationwide.

"People have gradually become aware of their responsibilities and legal consequences when they do not pay or deliberately avoid paying taxes," Mr. Hoa commented.

Source: https://nld.com.vn/hon-45000-ho-kinh-doanh-da-ap-dung-hoa-don-dien-tu-196250710211748669.htm

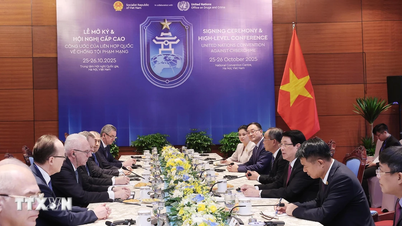

![[Photo] President Luong Cuong receives heads of delegations attending the signing ceremony of the Hanoi Convention](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/25/1761377309951_ndo_br_1-7006-jpg.webp)

![[Photo] General Secretary To Lam receives United Nations Secretary-General Antonio Guterres](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/25/1761379090768_image.jpeg)

![[Photo] President Luong Cuong and United Nations Secretary-General Antonio Guterres chaired the signing ceremony of the Hanoi Convention.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/25/1761370409249_ndo_br_1-1794-jpg.webp)

Comment (0)