Danang Housing Development Investment Joint Stock Company (stock code: NDN) has just announced its financial report for the third quarter of 2023 with positive business results. Specifically, net revenue in the last quarter reached 56.2 billion VND, 51 times higher than the same period last year. Accumulated net revenue for the first 9 months reached 368.7 billion VND, nearly 154 times higher than the figure for 2022.

In addition to the sharp increase in core business revenue, financial revenue in the third quarter also reached VND27.3 billion, double that of last year. Meanwhile, financial expenses decreased by 49.7% to VND20.8 billion in the last quarter.

Accumulated in 9 months, financial revenue of this real estate company reached 50.4 billion VND, up 11.5% over the same period last year.

Selling expenses in the third quarter were VND2.3 billion, while last year there was no such expense. Administrative expenses remained almost unchanged in the third quarter, at VND1.5 billion. Accumulated for the first 9 months, administrative expenses were VND4.1 billion, down 54.4%.

Strong revenue growth and reduced costs resulted in a post-tax profit of VND27.6 billion in the third quarter compared to a loss of VND28.8 billion. In the first 9 months, the company recorded a post-tax profit of VND230.4 billion, an increase of VND354.4 billion compared to a loss of VND124 billion last year.

The company explained that its third-quarter profit increased sharply due to continued revenue from the transfer of apartments at the Monarchy B project.

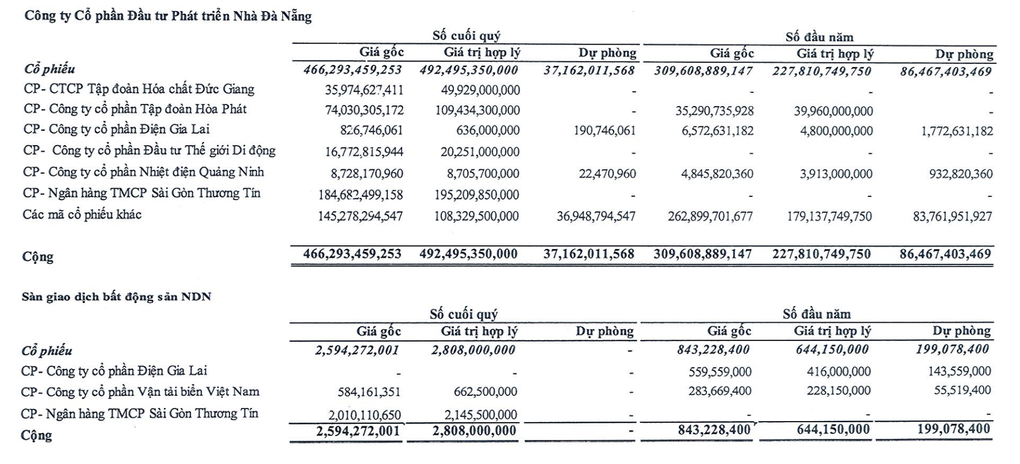

It is noteworthy that by the end of the third quarter, the real estate company's securities investment item recorded VND468.9 billion, an increase of 51% compared to the beginning of the year, equal to 33.9% of total assets.

Danang Housing Development Investment Joint Stock Company earned up to 47.8% profit when investing in HPG shares of Hoa Phat Group (Source: Business report).

Since the beginning of the year, the company has invested in Duc Giang Chemical Group Joint Stock Company (stock code: DGC), Mobile World Investment Joint Stock Company (stock code: MWG), and Saigon Thuong Tin Commercial Joint Stock Bank (stock code: STB).

As of September 30, the original price of the securities investment portfolio included VND186.7 billion in STB shares (accounting for 39.8%); VND74 billion in HPG shares (accounting for 15.4%), VND36 billion in DGC shares (accounting for 7.7%), and VND16.8 billion in MWG shares (accounting for 3.6%).

The investment in HPG recorded a fair value of VND 109.4 billion, a profit of 47.8% compared to the original price. The investment in DGC made a profit of 38.8%, MWG made a profit of up to 20.7%, STB made a profit of 5.7%.

Source

![[Photo] Prime Minister Pham Minh Chinh attends the opening of the 47th ASEAN Summit](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/26/1761452925332_c2a-jpg.webp)

![[Photo] General Secretary To Lam received the delegation attending the international conference on Vietnam studies](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/26/1761456527874_a1-bnd-5260-7947-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh and United Nations Secretary-General Antonio Guterres attend the Press Conference of the Hanoi Convention Signing Ceremony](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/25/1761391413866_conguoctt-jpg.webp)

![[Photo] National Assembly Chairman Tran Thanh Man receives United Nations Secretary-General Antonio Guterres](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/25/1761390815792_ctqh-jpg.webp)

Comment (0)