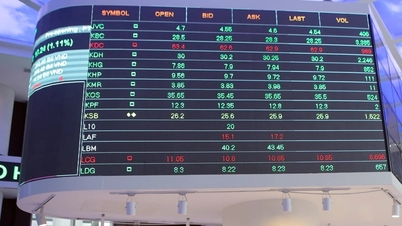

At the close of trading on April 8th, the Vietnamese stock market witnessed its third sharpest decline in history, with the VN-Index losing nearly 78 points, falling to close to 1,130 points, or 6.43%. Thus, over the last three trading sessions, the index has fallen by 185 points.

According to experts, the continuous sharp decline in stock prices is due to pressure from the US's retaliatory tax policy, in which Vietnam is subject to a 46% rate. In addition, the forced selling of shares by many investors has also contributed to the market downturn.

Linh (25 years old), an office worker in Hanoi, has been trading stocks for over a year. This is the first time she's experienced the feeling of her account being almost completely wiped out in just a few trading sessions. "I'm confused and don't know what to do, whether to cut my losses or hold on," Linh shared.

Linh's case is not unique in the market right now, as investors are wondering whether to cut their losses or continue holding when stocks experience a deep correction.

"Investors should not cut their losses at this time," advised Mr. Nguyen The Minh, Director of Research and Development for Individual Clients at Yuanta Securities Vietnam.

This expert believes the market may continue to decline on April 9th; however, this is very close to the time when Trump's retaliatory tariffs on major trading partners, including Vietnam, will take effect. Therefore, investors need to observe further and make buying and selling decisions after the final ruling.

"When the market declines, all sectors go down. Whether a stock is good or not, if it's heavily sold at the floor price, it's the same; it's difficult to cut losses," Mr. Minh commented.

Experts from Yuanta Securities Vietnam shared lessons learned from the sharp market downturn in 2020. At that time, the VN-Index fell from around 1,000 points to just over 600 points in the first three months of the year due to sell-offs by investors fearing an economic recession caused by the pandemic. However, the market rebounded from the beginning of April, surpassing 850 points after two months thanks to people's "accustomed to living with the pandemic" mindset.

Given these developments, Mr. Minh expects the market to bottom out in the next few sessions. "Investors are not under pressure to sell off their holdings; those currently at a loss should temporarily hold onto their stocks and not panic sell," he said, adding that investors should restructure their portfolios or buy more stocks to mitigate losses during market rallies.

Forced sale of shares is when a securities company sells off a portion of an investor's shares to reduce the debt ratio to a safe level as required by regulations. This usually happens when an investor uses margin trading and the share price falls below the securities company's allowed threshold, but the investor has not yet deposited additional funds.

Sharing the same view, Mr. Nguyen Trong Dinh Tam, Deputy Director of Investment Strategy at the Analysis Center of Thien Viet Securities (TVS), said, "It's not advisable to sell now."

This expert stated that the optimal selling point would be during the first decline, while investors should currently wait for information on the progress of negotiations and the official reciprocal tariffs between the US and Vietnam before making a decision. According to Mr. Tam, if the information is positive, investors should hold onto their stock portfolios to optimize their strategy during the recovery.

However, these experts note that the possibility of large, shocking US tariffs on Vietnam could lead to a further market decline. If this scenario occurs, investors will be forced to sell off their holdings, as they will have clearer reasons to make such decisions.

"If the information is cautious, investors should sell decisively. Repurchasing shares after selling will only be done when the market stabilizes with low volume," said Mr. Nguyen Trong Dinh Tam.

Experts from TVS also recommend that investors should not use margin yet, and if they do invest, it should only be for exploratory purposes with a low proportion, while prioritizing stocks of companies with a high domestic business volume.

Commenting on short-term market fluctuations , Mr. Tam suggested that investors should focus on the outcome of Vietnam's negotiations with the US, as well as the official reciprocal tariffs that will be applied from April 9th.

"Currently, the Vietnamese stock market reflects the scenario of Vietnamese exports facing a 46% tariff from the US. Therefore, any information suggesting a postponement or reduction of the reciprocal tariff will likely lead to a short-term market recovery," Mr. Tam said.

Meanwhile, Mr. Nguyen The Minh hopes that Donald Trump will delay imposing retaliatory tariffs on other countries, thereby allowing the Vietnamese stock market to bottom out and potentially rebound.

Besides Donald Trump's new tariff policies, Ms. Do Minh Trang, Director of the Analysis Center at ACBS Securities Company, believes that the actions of the US Federal Reserve (Fed) are also worth noting.

"If the risk of recession and deflation makes the Fed confident enough to cut interest rates sooner and more extensively, that would be a calming measure for the market," Ms. Trang said.

This expert emphasized that "it is very difficult to accurately predict whether the stock market will recover soon or continue to correct," because the macroeconomic situation has many unpredictable variables.

In the less favorable scenario where President Trump does not extend the tariffs, the VN-Index may continue to correct, but not too deeply. The index representing the Ho Chi Minh City stock exchange is expected to soon find equilibrium at an attractive valuation level. Important support levels in the near future include 1,160, 1,130, and 1,080 points.

VN (according to VnExpress)Source: https://baohaiduong.vn/nha-dau-tu-chung-khoan-co-nen-cat-lo-thoi-diem-nay-408998.html

![[Photo] Prime Minister Pham Minh Chinh holds a phone call with the CEO of Russia's Rosatom Corporation.](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F11%2F1765464552365_dsc-5295-jpg.webp&w=3840&q=75)

Comment (0)