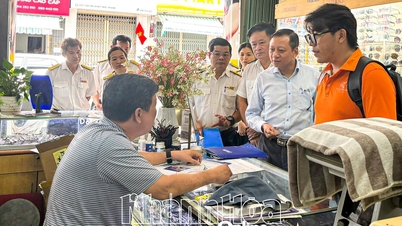

Today's silver price is listed at 912,000 VND/tael for buying and 957,000 VND/tael for selling in Hanoi. The silver price in Ho Chi Minh City is listed higher at 913,000 VND/tael for buying and 958,000 VND/tael for selling. The world silver price is at 755,000 VND/ounce for buying and 760,000 VND/ounce for selling.

Specifically, the latest information on silver prices today in the two largest markets of Hanoi and Ho Chi Minh City on September 17, 2024:

Silver type | Unit | Hanoi | Ho Chi Minh City | ||

Buy | Sell out | Buy | Sell out | ||

99.9 silver | 1 amount | 912,000 | 957,000 | 913,000 | 958,000 |

| 1 kg | 24,310,000 | 25,508,000 | 24,348,000 | 25,554,000 | |

| Silver 99.99 | 1 amount | 917,000 | 957,000 | 918,000 | 962,000 |

| 1 kg | 24,458,000 | 25,520,000 | 24,478,000 | 25,657,000 | |

Latest update on world silver prices on September 17, 2024

| Unit | World silver price today (VND) | |

Buy | Sell out | |

| 1 Ounce | 755,000 | 760,000 |

| 1 finger | 90,983 | 91,575 |

| 1 amount | 910,000 | 916,000 |

| 1 kg | 24,262,000 | 24,420,000 |

For precious metals, silver jumped 10.26% to $31.07 an ounce, its highest level in nearly two months. This was also the biggest weekly increase for silver since early April this year. Platinum reclaimed the $1,000 an ounce mark thanks to a 9.59% increase, closing the week at $1,006.8 an ounce, its highest level since mid-July.

The strong cash flow into precious metals last week was mainly due to clearer signals about the US Federal Reserve’s interest rate cut scenario. Besides the safe haven investment channel of precious metals, green also covered the US stock market, reflecting the general optimistic sentiment in the world financial market.

Specifically, according to data from the US Bureau of Labor Statistics, in August, the country's producer price index (PPI) increased 1.7% compared to the same period last year, a deceleration from the 2.1% increase in July and 0.1 percentage point lower than forecast. The consumer price index (CPI) also cooled to 2.5% in August, in line with market forecasts.

These data continue to confirm that inflation in the US is still on track to cool down to the Fed's 2% target, thereby strengthening the belief that the Fed will cut interest rates at the meeting on September 17-18. The FedWatch interest rate monitoring tool shows that investors are currently betting on a 55% chance of the Fed cutting by 25 basis points and a 45% chance of cutting by 50 basis points.

Source: https://congthuong.vn/gia-bac-hom-nay-1792024-gia-bac-nhay-vot-1026-cao-nhat-trong-gan-hai-thang-qua-346299.html

![[Photo] General Secretary To Lam and National Assembly Chairman Tran Thanh Man attend the 80th Anniversary of the Traditional Day of the Vietnamese Inspection Sector](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/17/1763356362984_a2-bnd-7940-3561-jpg.webp)

Comment (0)